Wheat starts strong, cools quickly

Afternoon report: Corn and soybean prices make modest inroads in Wednesday’s session.

March 30, 2023

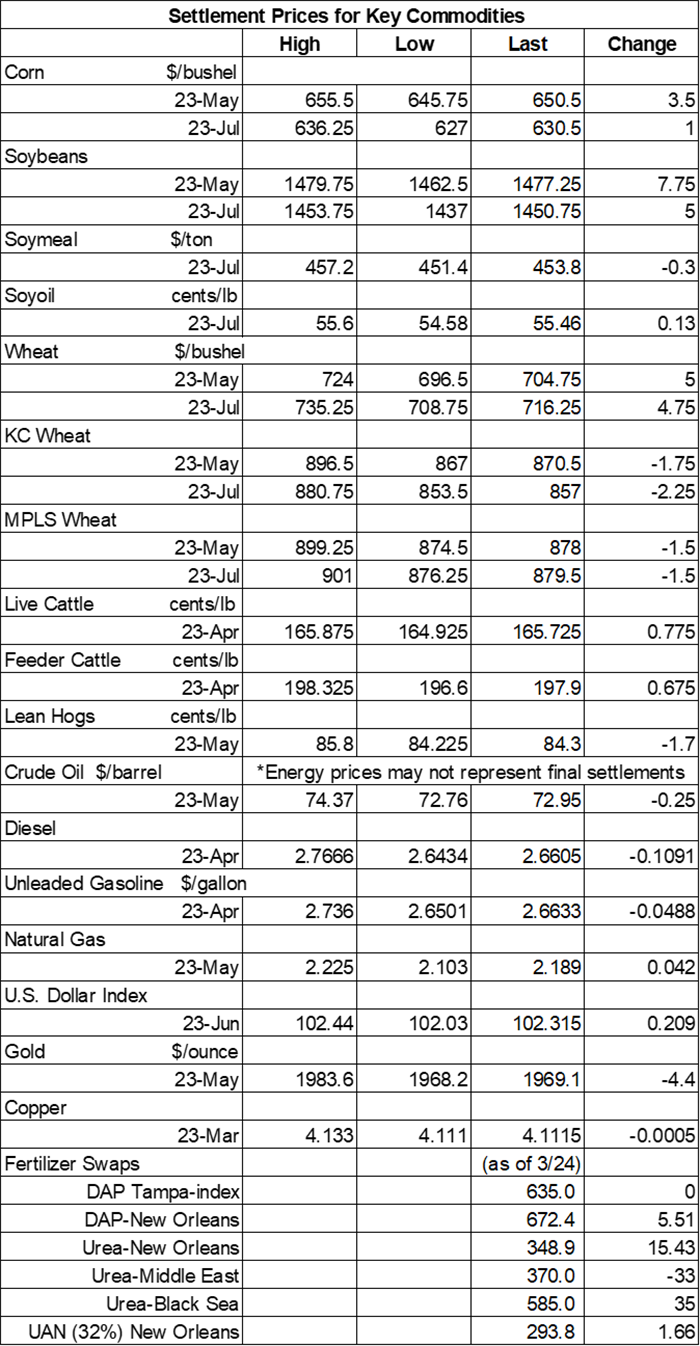

Grain prices started Wednesday’s session with variable overnight gains – particularly for wheat, which surged higher on news that Cargill is no longer going to export Russian grain starting in July. But those gains largely fizzled by the close today. CBOT wheat contracts managed moderate gains, while Kansas City HRW and MGEX spring wheat contracts spilled back into the red. Corn and soybeans continued to move higher on Wednesday, with each commodity capturing gains of around 0.5%.

The Ohio River Valley and Great Lakes region could see plenty of additional rain and/or snow fall between Thursday and Sunday, per the latest 72-hour cumulative precipitation map from NOAA. Some areas could gather 1.5” or more during this time. NOAA’s new 8-to-14-day outlook predicts widespread seasonally wet weather across the central U.S. between April 5 and April 11, with warmer-than-normal temperatures likely for most areas east of the Mississippi River.

On Wall St., the Dow moved another 212 points higher to 32,606 in afternoon trading, anchored by strong performances in the tech sector. Easing worries about the banking sector lent additional support today. Energy futures were in the red today. Crude oil slid 0.5% lower to $72 per barrel on a round of profit-taking. Diesel tumbled more than 4$ lower, while gasoline fell more than 1.5%. The U.S. Dollar firmed moderately.

On Tuesday, commodity funds were once again net buyers of all major grain contracts, including corn (+500), soybeans (+12,000), soymeal (+6,000), soyoil (+1,500) and CBOT wheat (+2,000).

Corn

Corn prices tested even larger gains Wednesday morning following a flash sale to China but cooled somewhat by the close. May futures added 3.5 cents to $6.5075, with July futures firming a penny to $6.3050.

Corn basis bids were steady to mixed across the central U.S. after firming a penny at an Ohio elevator while fading 2 to 5 cents lower at two other Midwestern locations on Wednesday.

Private exporters announced to USDA the sale of 8.0 million bushels of corn for delivery to China during the 2022/23 marketing year, which began September 1.

Ethanol production reached a daily average of 1.003 million barrels for the week ending March 24, per the latest data from the U.S. Energy Information Administration, out earlier today. Stocks moved 3% lower last week.

Prior to Thursday morning’s export report from USDA, analysts expect the agency to show corn sales ranging between 25.6 million and 82.7 million bushels for the week ending March 23.

All eyes are on Friday’s USDA Prospective Plantings report, but the agency will also release updated data on quarterly grain stocks. For corn, analysts predict USDA will show corn stocks at 7.470 billion bushels through March 1, down from 10.809 billion bushels as of December 1. That would also be slightly lower year-over-year, if realized.

Grain traveling the nation’s railways saw another 19,889 carloads on the move last week. That brings cumulative totals for 2023 to 262,111 carloads, which is tracking 6.9% below last year’s pace so far.

Preliminary volume estimates were for 314,327 contracts, which was moderately above Tuesday’s final count of 270,663.

Soybeans

Soybean prices continued to push higher following another round of technical buying on Wednesday and have captured solid gains over the past three sessions. Today, May futures added 7.75 cents to $14.7550, with July futures up 5 cents to $14.4950.

The rest of the soy complex was lightly mixed today. Soymeal futures faced fractional losses, while soyoil futures shifted 0.25% higher.

Soybean basis bids firmed 8 cents at an Ohio elevator and jumped 12 cents higher at an Ohio river terminal while holding steady elsewhere across the central U.S. on Wednesday.

Ahead of tomorrow morning’s export report from USDA, analysts think the agency will show soybean sales ranging between 5.5 million and 33.1 million bushels for the week ending March 23. Analysts also expect to see soymeal sales ranging between 75,000 and 300,000 metric tons, plus up to 30,000 MT of soyoil sales.

Prior to Friday’s quarterly grain stocks report, analysts expect USDA to show soybean stocks at 1.742 billion bushels through March 1, down from 3.022 billion bushels as of December 1. It would also be moderately below year-ago totals of 1.932 billion bushels, if realized.

Preliminary volume estimates were for 194,952 contracts, sliding slightly below Tuesday’s final count of 220,027.

Wheat

Wheat prices were red-hot overnight but cooled considerably as Wednesday’s session wore on. May CBOT contracts reached a four-week high at one point this morning, staying up 5 cents by the close to $7.0475. In contrast, May Kansas City HRW futures eased 1.75 cents to $8.7075, with May MGEX spring wheat futures down 1.5 cents to $8.81.

Prior to Thursday morning’s export report from USDA, analysts expect the agency to show wheat sales ranging between 4.6 million and 16.5 million bushels for the week ending March 23.

Ahead of Friday’s quarterly grain stocks report from USDA, analysts think USDA will show wheat stocks at 934 million bushels through March 1, versus 1.290 billion bushels through December 1. It would also be modestly below year-ago totals of 1.029 billion bushels, if realized.

Cargill informed Russia’s agriculture ministry that it will no longer export grain starting on July 1, which marks the start of the 2023/24 marketing year. Moscow asserts that although Cargill exports a significant amount of Russian wheat, the company’s decision shouldn’t adversely affect overall Russian grain shipments. “[Russia] is ready to work with all foreign companies whose activities contribute to the development of both the domestic food market of Russia and its export potential,” according to a ministry spokesperson.

Ukraine’s total grain exports in March should come in around 5.1 million metric tons, according to the country’s agriculture ministry. That’s sharply above March 2022 totals of 1.4 million metric tons, when the Russian invasion had just begun. A deal that allows for safe passage of shipping vessels through the Black Sea was later implemented and has currently been extended through at least mid-May. Ukraine is among the world’s top exporters of wheat, corn and barley.

Meantime, Poland wants the European Union to take measures to limit the amount of Ukrainian grain entering those markets because the influx is suppressing prices for Polish farmers – it’s essentially an appeal to the ruling nationalist party’s largely rural voter base. Poland is also encouraging Slovakia, Romania, Hungary and Bulgaria to join the effort.

China will hold an auction on April 6 to sell another 5.1 million bushels of its imported wheat reserves. (The volume was previously incorrectly reported as 33.1 million bushels, which was actually for a rice auction.) China has served up similarly sized auctions in recent months in an attempt to boost local supplies and cool high prices.

Preliminary volume estimates were for 132,592 CBOT contracts, moving moderately above Tuesday’s final count of 84,703.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)