Afternoon report: Corn and soybeans also in the red amid a broad commodity selloff on Thursday.

Grain prices slumped significantly lower amid a broad commodity selloff on Thursday. Wheat prices were hit the hardest, tumbling to an 18-month low after most contracts incurred losses ranging between 2.75% to 3.5%. Corn prices faced double-digit cuts with losses of around 2.5%. Soybeans were relatively spared thanks to a flash sale reported this morning but still trended 0.5% lower by the close.

Ample rain and/or snow is on its way to large portions of the Midwest and Plains between Friday and Monday, per the latest 72-hour cumulative precipitation map from NOAA. The Ohio River Valley is expected to gather the largest totals during this time. NOAA’s new 8-to-14-day outlook predicts seasonally wet weather for the southern half of the United States between March 16 and March 22, with colder-than-normal conditions likely for nearly the entire country.

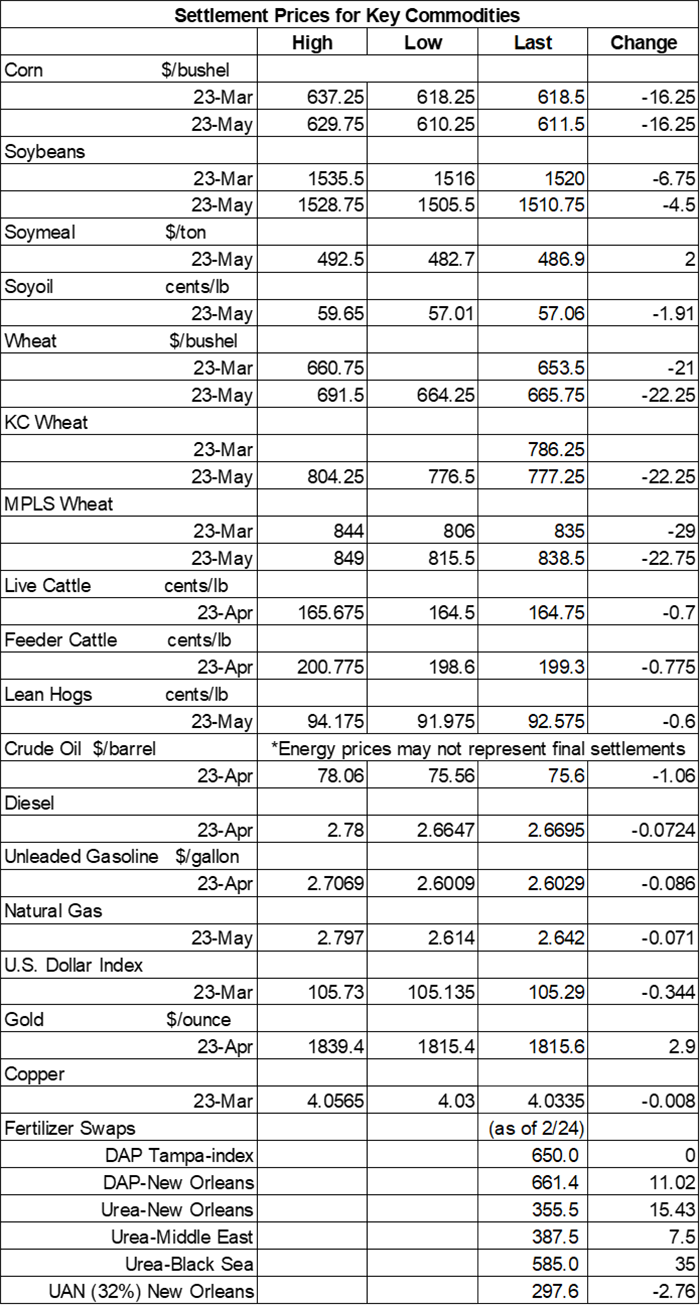

On Wall St., the Dow softened another 317 points in afternoon trading, falling to 32,480. Bank stocks took the biggest hit as investors remain concerned that the Federal Reserve will continue its aggressive stance on interest rates. Energy futures also saw significant cuts today. Crude oil spilled 1% lower to $75 per barrel on general recession worries. Diesel and gasoline each lost around 2.75%. The U.S. Dollar softened moderately.

On Wednesday, commodity funds were net buyers of soybeans (+1,000) and soyoil (+1,500) contracts but were net sellers of corn (-6,000), soymeal (-2,000) and CBOT wheat (-4,000).

Corn

Corn prices were slashed more than 2% lower as traders shrugged off a bullish round of export data from USDA this morning, focusing instead on the broad commodity selloff that left stocks, energy futures and other agricultural commodities lower on Thursday. Expectations that a potential shift to El Niño conditions this summer (which would help U.S. producers grow bigger crops) also appeared to be in the mix today. March futures lost 16.25 cents to $6.1825, with May futures down 13.25 cents to $6.1225.

Corn basis bids were largely steady across the central U.S. on Thursday but did slide a penny lower at an Illinois river terminal today.

Corn sales posted a combined 60.0 million bushels in old and new crop sales for the week ending March 2. Old crop sales climbed 57% above the prior four-week average. Total sales were higher than the entire range of trade guesses, which came in between 23.6 million and 55.1 million bushels. Cumulative sales for the 2022/23 marketing year remain substantially below last year’s pace, however, with 633.1 million bushels.

Corn export shipments reached a marketing-year high of 41.4 million bushels after besting the prior four-week average by 74%. Mexico, Colombia, Japan, South Korea and Guatemala were the top five destinations.

With the March WASDE report now in the rearview mirror, the trade is wondering “what’s next” in terms of market-moving news, notes Naomi Blohm, senior market adviser with Stewart Peterson. “USDA estimated Brazil 2022/23 corn crop at 125.0 mmt, nearly in line with expectations of 124.8 mmt and unchanged from the February report,” she points out. “While I didn’t expect USDA to make any adjustments to the Brazil corn crop on this report, it is something that must be monitored in the weeks and months ahead.” Blohm adds that the market is assuming a record corn crop, but that could be jeopardized by a sluggish start to planting this season. Click here to learn more in today’s Ag Marketing IQ blog.

Brazil’s Conab estimates that the country’s total corn production during the 2022/23 season will reach 4.908 billion bushels, which is 0.8% above its prior forecast from a month ago. Conab also estimates that Brazilian exports could reach 1.890 billion bushels in the current marketing year.

Preliminary volume estimates were for 409,308 contracts, moving moderately ahead of Wednesday’s final count of 333,986.

Soybeans

Soybean prices suffered a moderate setback following spillover weakness from a broad set of other commodities that triggered some moderate technical selling on Thursday. March futures dropped 6.75 cents to $15.20, with May futures down 4.5 cents to $15.1325.

The rest of the soy complex mixed. Soyoil futures tumbled more than 3.25% lower, while soymeal futures managed modest gains today.

Soybean basis bids were steady to weak on Thursday after eroding 2 to 15 cents lower across five Midwestern locations today.

Private exporters announced to USDA the sale of 6.8 million bushels of soybeans for delivery to unknown destinations during the 2022/23 marketing year, which began September 1.

Soybean old crop sales eroded to a marketing-year low after posting net reductions of around 850,000 bushels. New crop sales lifted the total volume to a net positive of 5.5 million bushels. That was below the entire range of trade estimates, which came in between 7.3 million and 34.9 million bushels. Cumulative totals for the 2022/23 marketing year are still slightly above last year’s pace, with 1.548 billion bushels.

Soybean export shipments fell 62% below the prior four-week average, with 21.3 million bushels. China, Mexico, Japan, Indonesia and Vietnam were the top five destinations.

Argentina’s Rosario Grains exchange is the latest group to make severe cuts to the country’s estimated 2022/23 soybean production, slashing its latest projection by 22% to 992.1 million bushels amid widespread drought problems throughout the season. The exchange also made major cuts to its 2022/23 corn production estimates, which fell to 1.378 billion bushels.

Preliminary volume estimates were for 195,804 contracts, trending slightly higher than Wednesday’s final count of 187,191.

Wheat

Wheat prices suffered another major blow on Thursday after a round of technical selling pushed prices another 2.75% to 3.5% lower. May Chicago SRW futures lost 22.25 cents to $6.6525, May Kansas City HRW futures lost 22.25 cents to $7.78, and May MGEX spring wheat futures lost 22.75 cents to $8.1575.

Wheat exports saw 12.4 million bushels in total sales last week. Old crop sales firmed 11% above the prior four-week average. Sales were near the middle of analyst estimates, which ranged between 5.5 million and 22.0 million bushels. Cumulative totals for the 2022/23 marketing year are running slightly below last year’s pace, with 525.0 million bushels.

Wheat export shipments were down 24% from the prior four-week average, with 13.9 million bushels. China, Mexico, the Philippines, South Korea and Tunisia were the top five destinations.

Recent Russian comments have cast fresh doubts on whether a deal that allows safe passage of shipping vessels in the Black Sea will be granted a 120-day extension. “There are still a lot of questions about the final recipients, questions about where most of the grain is going,” according to Kremlin spokesperson Dmitry Peskov. The deal will automatically renew on March 18 if there are no formal objections lodged.

Saudi Arabia issued a large tender to purchase as much as 17.6 million bushels of wheat, which will be for shipment in July and August. Additional details were not immediately available.

Algeria purchased up to 9.2 million bushels of durum wheat from optional origins in an international tender that closed yesterday. The grain is for shipment in April.

Japan purchased 3.0 million bushels of food-quality wheat from the United States and Canada in a regular tender that closed earlier today. Around 63% of the total was sourced from the U.S. The grain is for shipment starting in April.

China will hold an auction on March 15 to sell up to 5.1 million bushels of its state imported wheat reserves. The country has offered a series of similarly sized auctions in recent months to boost local supplies and push down high prices.

Preliminary volume estimates were for 120,825 CBOT contracts, which was moderately higher than Wednesday’s final count of 99,449.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)