Futures mixed after USDA reports

Smaller corn and soybean crops offset by soft demand.

Due to a lapse in federal funding last month, USDA did not release its January World Agricultural Supply and Demand Estimates (WASDE) reports. But traders anxiously awaited the agency’s February release, which finally came out Friday morning.

The latest supply and demand report had plenty of data for traders to chew on after USDA reports that showed smaller corn and soybean crops but held few big surprises. Markets were mixed immediately following the report.

“After what seemed like an endless wait, USDA’s big reports produced few major surprises and overall mixed results, leaving markets pretty much where they started,” according to Farm Futures senior grain market analyst Bryce Knorr. “That could change by the close, or perhaps next week, when U.S. and Chinese negotiators renew trade talks and the government faces potential for another shutdown.”

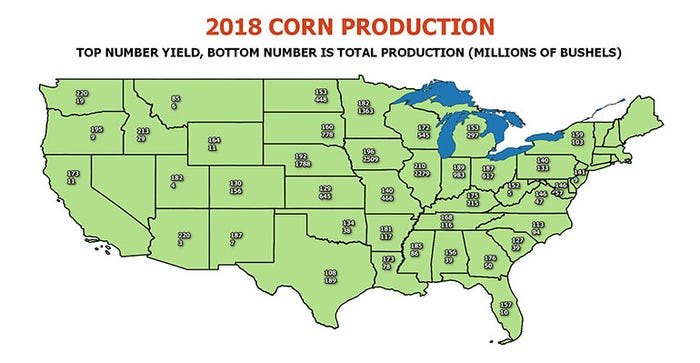

Corn

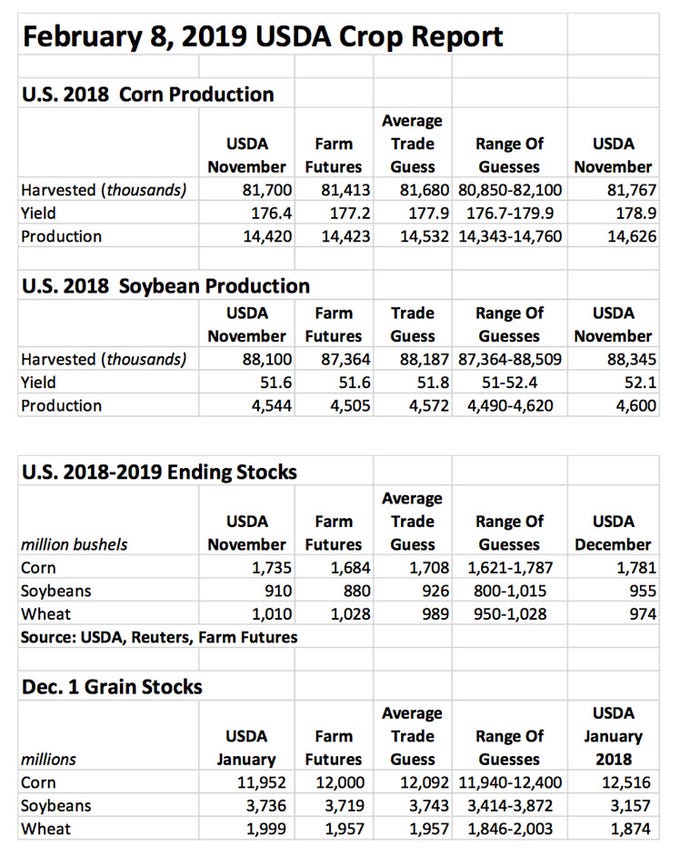

USDA says 2018 U.S. corn production reached 14.420 billion bushels, with average yields of 176.4 bushels per acre. That number comes in 206 million bushels lower than the agency’s November estimates. Production estimates also fell below trade estimates, which averaged 14.532 billion bushels. Farm Futures, which regularly participates in these surveys, included a nearly on-the-nose guess of 14.423 billion bushels.

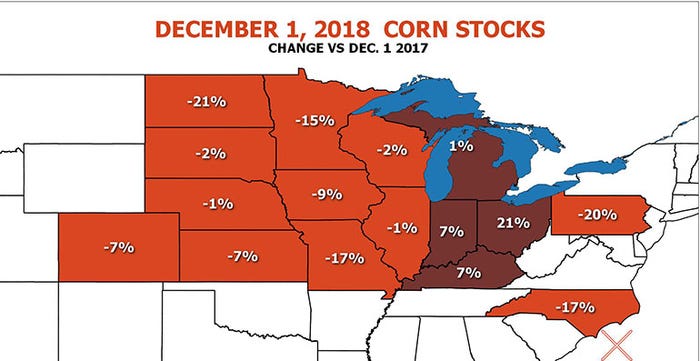

Corn usage fell 165 million bushels to reach 14.865 billion bushels, according to USDA – largely attributing the drop to lower ethanol and industrial uses. Supply fell more steeply than demand, however. All told, U.S. 2018/19 ending stocks dropped 46 million bushels to 1.735 billion bushels. Trade analysts expected a larger decline to 1.708 billion bushels.

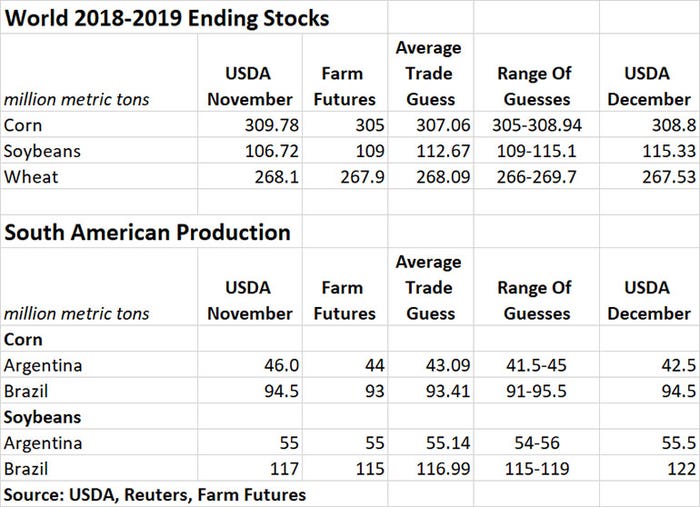

In South America, Argentina’s corn production this year is expected to climb to 1.811 billion bushels, with Brazilian production holding steady at 3.720 billion bushels.

World ending stocks for 2018/19 moved slightly higher, from 308.8 million metric tons in December to 309.78 MMT. Analyst expected a decline to 307.06 MMT, in contrast. Even so, USDA lowered its estimates for global corn production by 1.5 MMT to 1.372 BMT.

USDA’s projections for season-average corn prices remained unchanged, with a midpoint of $3.60 per bushel.

“Total production of 2018 crop corn was just 3 million bushels less than we forecast based on our recent survey of growers,” Knorr says. “But weaker demand offset most of the reduction. The drop in feed usage was more than I expected, and the agency’s minor cut to usage for ethanol – just 25 million bushels – seems too low based on ethanol production over the last five months.”

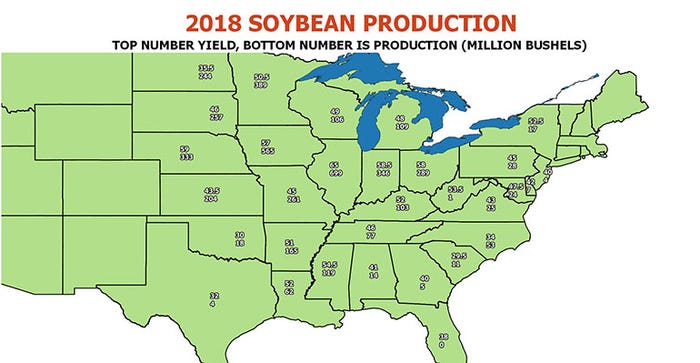

Soybeans

For soybeans, USDA pegged the 2018 U.S. crop at 4.544 billion bushels on average yields of 51.6 bpa, which is a bit lower than its prior projection of 4.600 billion bushels. Analysts expected the agency to report a smaller drop to 4.572 billion bushels, including a Farm Futures estimate of 4.505 billion bushels.

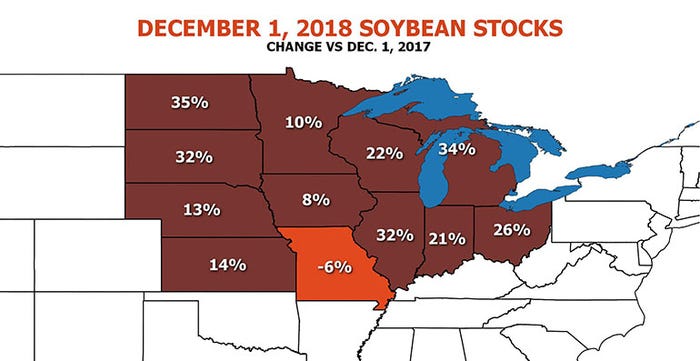

Soybean ending stocks for 2018/19 moved slightly lower, from prior estimates of 955 million bushels up to 910 million bushels. Analysts had provided an average guess of 926 million bushels ahead of the report.

In South America, USDA left soybean production estimates for Argentina and Brazil unchanged, at 2.021 billion bushels and 4.299 billion bushels, respectively.

Worldwide, soybean ending stocks for 2018/19 moved slightly lower, from 115.33 MMT to 106.72 MMT, a move largely predicted by analysts earlier this week.

USDA did not change its season-average price estimates for soybeans, with a range of $8.10 to $9.10 per bushel.

“USDA’s estimate of soybean production was higher than we found, but their cut in demand was close to our guess,” Knorr says. “The reduction in carryout isn’t enough to move the market much but the cut to Brazil’s crop could grow. CONAB puts out its next estimate Tuesday.”

Wheat

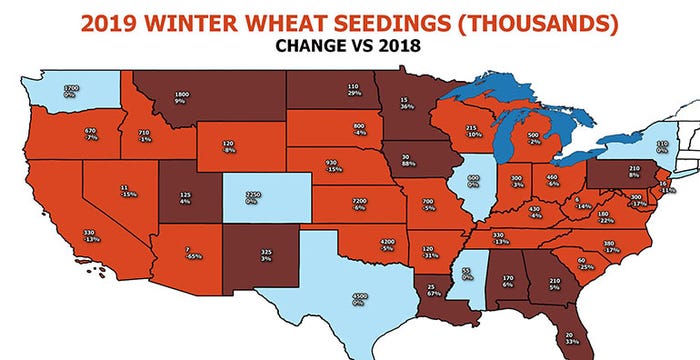

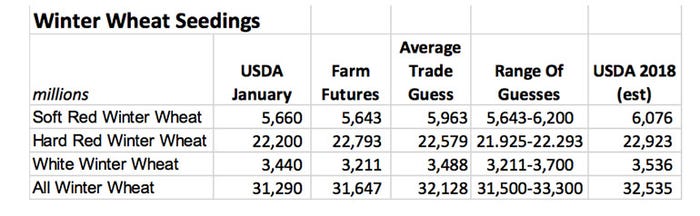

USDA also released estimates for 2018/19 U.S. winter wheat seedings, which total 31.290 million acres, down from prior estimates of 32.595 million acres. Analysts had expected a modest drop in acres this coming season, with an average guess of 32.128 million acres, including a Farm Futures projection of 31.647 million acres. Lower soft red winter wheat, hard red winter wheat and white winter wheat acres all contributed to the overall decline.

U.S. wheat ending stocks for 2018/19 are on the rise, moving from prior estimates of 974 million bushels up to 1.010 billion bushels. Analysts predicted a more modest increase to 989 million bushels.

Worldwide, USDA estimates 2018/19 wheat ending stocks at 268.1 MMT, up slightly from its prior projection of 267.53 MMT. That’s due in part to production increases expected in Russia, Brazil and Paraguay. Analysts provided a nearly spot-on estimate of 268.09 MMT earlier this week.

USDA did not change its season-average price estimates for wheat.

“The only surprise for wheat was USDA’s decision to leave its forecast for exports unchanged,” Knorr says. “The U.S. did capture part of a tender to Egypt, but still faces an uphill battle after a slow start in the first half of the marketing year.”

The market’s attention may now shift to the upcoming crop, where seeding estimates fell more than expected, Knorr adds. Watch for flooding and winterkill events that could trigger some short-covering over the next month or two, he says.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)