Producers not as concerned about trade war as they were in previous month.

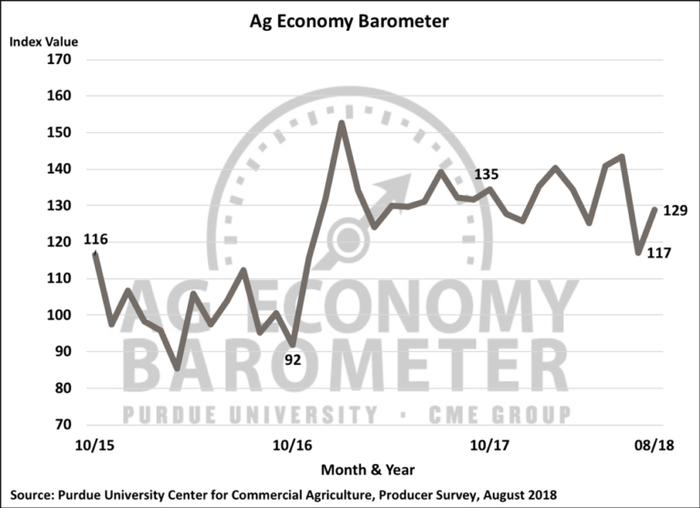

The latest Purdue University/CME Group Ag Economy Barometer reading, which is based on a monthly survey of 400 agricultural producers from across the country, showed a rebound in producer sentiment in August to a reading of 129 after falling to 117 in July. Although the index increased by 12 points in August, the report noted that producer sentiment remains well below its late-spring readings of 141 in May and 143 in June.

According to authors James Mintert, the barometer's principal investigator and director of Purdue University's Center for Commercial Agriculture, and Purdue University agricultural economist Michael Langemeier, the shift in producer sentiment occurred primarily because producers' perception of current conditions improved as the Index of Current Conditions increased to a reading of 121 following a dip to 99 in July. The Index of Future Expectations also rose in August, but the increase was modest, rising just six points above the July reading to 132.

Before the August survey was conducted, the U.S. Department of Agriculture announced intentions to provide aid to farmers affected by importers' tariffs.

"Farmer sentiment has improved over the past month, but producers are uncertain about the aid package's ability to offset income losses on their farm," Mintert said.

When asked specifically about the relief plan's expected impact, farmers were split on whether they believed the plan addressed concerns about tariffs' impact on their farm's income, with 47% saying "not at all," 4% saying "completely" and 43% saying "somewhat."

The survey results also showed that while U.S. agricultural producers are still concerned about a trade war, they were somewhat less concerned in August than they were in July. In August, 51% of respondents thought a trade war was likely to reduce U.S. agricultural exports, down from 54% in July. The percentage of producers who thought a trade war was unlikely increased to 28% in August, compared to 23% who felt that way in July.

Producers were again asked how likely they thought it was that a trade war would reduce their farm's net income. While 71% feel that their farm income will be negatively affected -- which is virtually unchanged from July -- respondents who expect to see an income reduction of 20% or more fell from 35% in July to 26% in the August survey.

"Farmers are still concerned trade conflicts will reduce their farm's income, but some farmers clearly scaled back the magnitude of losses they expect compared to what they told us in July," Mintert said.

This less pessimistic view also affected producers' expectations for the future of U.S. agriculture. In August, there was a small increase in the number of respondents expecting good times in agriculture in the year ahead, rising to 22% from 19% in July. The improvement was reinforced by a significant downturn in those expecting bad times, which fell to 52% in August versus 61% in July. Similar readings occurred for attitudes on whether it was a good time to make large farm investments, which improved to 26% in August compared to 20% in July.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)