Farm income projected to increase

Market Facilitation Program payments help keep farmers afloat.

Direct government farm payments offered the boost of relief for this year’s net farm income forecast increase of 4.8% from 2018 to $88 billion in 2019, according to deputy chief economist Warren Preston, who highlighted the latest findings from the August 2019 "Farm Income Forecast." There have been improvements to the farm economy in the form of a lower costs structure, although livestock receipts remain mixed.

Net cash farm income is forecasted to increase $7.6 billion (7.3%) to $112.6 billion. Inflation-adjusted net cash farm income is forecasted to increase $5.8 billion (5.4%) from 2018, which would be 4% above the 2000-18 average ($108.3 billion). Net cash farm income encompasses cash receipts from farming as well as farm-related income, including government payments, minus cash expenses. It does not include non-cash items — including changes in inventories, economic depreciation and gross imputed rental income of operator dwellings — reflected in the net farm income measure above.

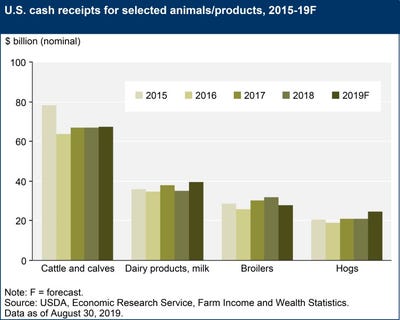

The U.S. Department of Agriculture’s Economic Research Services (ERS) noted that cash receipts for all commodities are projected to decrease $2.4 billion (0.6%) to $371.1 billion (in nominal terms) in 2019. Total animal/animal product receipts are expected to increase $900 million (0.5%) but will fall 1.3% when adjusted for inflation. Increases in milk and hog receipts are expected to be nearly offset by declines in broiler and chicken egg receipts. Total crop receipts are expected to decrease $3.3 billion (1.7%) in nominal terms from 2018 levels following expected decreases in soybean receipts.

Milk producers should see so

Meanwhile, broiler and egg prices look to put a lid on overall livestock cash receipts. Broiler receipts are expected to decline $3.9 billion (12.4%) in 2019 due to a price drop, with only a marginal increase in quantities sold. Chicken egg receipts are expected to fall $3.8 billion (35.9%), reflecting lower prices. Turkey receipts are expected to increase $400 million (10.8%) in 2019, reflecting higher prices and quantities sold.

Soybean receipts in 2019 are expected to decrease $5.7 billion (14.3%), reflecting anticipated declines in both price and quantities sold, ERS added. Corn receipts are expected to fall $200 million (0.4%) in 2019, reflecting a forecasted decrease in quantity sold.

Government payouts on the rise

Direct government farm payments are forecasted to increase $5.8 billion (42.5%) to $19.5 billion in 2019, with most of the increase due to higher anticipated payments from the Market Facilitation Program (MFP). The Dairy Margin Coverage Program, which replaced the Dairy Margin Protection Program in the 2018 farm bill, is projected to make net payments of $600 million to dairy operators in 2019.

David Widmar, an agricultural economist and co-founder of Agricultural Economics Insights, said, "One on hand, it’s good to see net farm income has broken out of the $60-70 billion range we seemed stuck in. However, we now have to wonder how the farm economy will eventually transition off MFP payments. Will it be gradual or abrupt? Will a decline in MFP payment be offset with higher commodity prices?"

Widmar noted that the improved cost structure and recent MFP payments led to higher net farm income and a more favorable farm economy outlook. "While this is a welcome improvement, this is also not a time to get comfortable or declare the worst is behind us. The improvements are not sustainable, and many questions linger as 2020 comes into focus," he added.

Production costs decrease

Total production expenses (including operator dwelling expenses) are projected to increase $1.5 billion (0.4%) to $346.1 billion (in nominal terms) in 2019. This year’s forecasted production expenses are still below the record high of $391.1 billion in 2014.

Spending on feed and hired labor is expected to increase, while spending on seed, pesticides, fuels/oil and interest are expected to decline. After adjusting for inflation, total production expenses are forecasted to decrease $4.6 billion (1.3%). Feed expenses, which account for 18% of cash expenses, are projected to increase 4.4% (to $56.2 billion) in 2019. Spending on fuels and oils in 2019 is expected to decrease 8.6% to $12.1 billion in nominal dollars. The 2019 forecast is driven, in part, by the U.S. Energy Information Agency's August forecast of lower diesel prices (down 11 cents/gal., on average) in 2019.

Interest expenses (including those associated with operator dwellings) are expected to decline for the first time in five years, down 5.3% ($1.1 billion in nominal terms) to $19.6 billion in 2019. This decrease reflects the effect of lower interest rates as overall loan volumes are forecasted to increase, USDA said.

Equity remains stable

Farm sector equity has taken a hit in recent years. However, this year’s forecast is for a 1.8% increase in normal terms. Farm assets are forecasted to increase by $59.8 billion (2.0%) to $3.1 trillion in 2019, reflecting an anticipated 1.9% rise in farm sector real estate value. Meanwhile, farm debt is projected to increase 3.4% to $415.7 billion, led by an expected 4.6% rise in real estate debt.

“Overall, for the farm sector, the likelihood of default remains relatively low, despite the increases we’ve seen in debt since 2012,” Preston said.

The farm sector debt-to-asset ratio is expected to rise from 13.31% in 2018 to 13.49% in 2019. Working capital, which measures the amount of cash available to fund operating expenses after paying off debt due within 12 months, is forecasted to decline 18.7% from 2018.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)