EU compound feed production climbs 0.8% in 2018

Slight decrease expected for 2019 compound feed production.

February 27, 2019

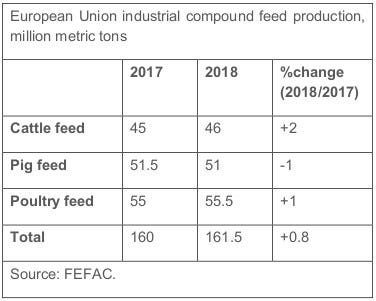

Industrial compound feed production for farmed animals in the European Union in 2018 reached an estimated level of 161 million metric tons, which is 0.8% more than in 2017 (Table), according to data provided by members of the European Compound Feed Manufacturers’ Federation (FEFAC).

FEFAC reported that for cattle feed, 2018 was affected more than usual by weather conditions, with an exceptional drought and heat wave during late spring/summer in northwestern Europe severely affecting forage production. This resulted in a significant increase in compound feed demand, FEFAC said, noting that the effect may become more dramatic in early 2019 when forage stocks are further diminished.

Farmers in certain countries have also increased culling cow numbers, which lowered not only milk production but also feed demand. All in all, the demand for cattle feed in 2018 was estimated to be 2.5% higher than in 2017, FEFAC reported.

FEFAC said poultry feed production increased 1% overall, mostly driven by the development of poultry production in Poland, with growth of more than 5% for the fourth year in a row, as well as a recovery in France's poultry sector after last year’s drop due to an avian influenza outbreak.

Furthermore, the group pointed out that increased poultry exports, coupled with a sharp reduction in imports from Brazil, also contributed positive momentum for the EU poultry sector and, therefore, increased demand for commercial poultry feed, which remains the leading segment of EU industrial compound feed production, well ahead of pig feed.

On the pig feed side, FEFAC said a decreasing trend recorded in 2016 and 2017 continued in 2018, with feed production falling 1% despite an increase in pork production. The group said declining pork prices in the second half of 2018 led to a sharp reduction in the number of sows in several countries. In addition, the rather good cereal harvest on the Iberian Peninsula favored on-farm use instead of commercial feed purchases.

Country results

For the fifth year in a row, Poland was the best-performing country, with total annual compound feed production growth of 5.5%, boosted equally by the demand for poultry, pig and dairy feeds, FEFAC said.

Among the largest compound feed-producing countries, France and Italy maintained their production levels, whereas Spain, the Netherlands and Germany recorded a decrease of about 1.0-1.5%, while the U.K. increased its production by almost 4%, FEFAC reported.

Germany strengthened its position as the leading EU country in terms of total compound feed production, ahead of Spain and France.

The final estimates and detailed breakdown of the 2018 data (including national estimates) will be issued on the sidelines of the FEFAC annual general meeting, which will be held June 6-7 in Brussels, Belgium.

2019 market outlook

FEFAC said its market experts are pessimistic concerning industrial compound feed production in 2019.

Although an increase may still be expected during the first months of 2019, FEFAC noted that the demand for cattle feed has been at a rather high level over the last three years, boosted by the withdrawal of dairy quotas that triggered a higher demand for efficient commercial feed, although limited by restrictions on phosphorous emissions. Assuming normal forage growing conditions, the demand for cattle feed could decrease by 2%.

Concerning the pig sector, the reduction in sow numbers is set to continue in the first half of 2019, with the additional pressure of welfare standards in certain countries, FEFAC said. This is expected to weigh on the demand for pig feed, and a 0.5% reduction in demand for compound feed can be anticipated.

The expectations for poultry feed demand in 2019 will be mostly conditioned on international trade and, in particular, the capacity of Brazil to recover its position on the global market, FEFAC said. In case the EU can maintain its export levels as well as rely on still-growing internal consumption, FEFAC reported that 1% growth in poultry feed can be expected, which would lead to a moderate 0.5% decrease in compound feed production in 2019 versus 2018.

A number of parameters will evidently affect this outlook: the evolution of outbreaks of avian influenza and African swine fever will be decisive, in particular in terms of preserving EU export capacities, FEFAC suggested.

The group pointed out that the possible effects of Brexit are difficult to foresee, but a no-deal Brexit is likely to deeply affect trade in livestock products and, therefore, feed demand.

FEFAC represents 23 national associations in 23 EU member states as well as associations in Switzerland, Turkey, Serbia, Russia and Norway with observer/associate member status. The European compound feed industry employs more than 100,000 people on approximately 3,500 production sites.

Farm animals in the EU consume an estimated 490 mmt of feed per year, about 30% of which is produced by compound feed manufacturers.

Source: FEFAC, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)