China talks resume, with ag on table

Pork industry remains hopeful goodwill purchases could bring needed boost to U.S. ag exports to China.

U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin will travel to Shanghai, China, to continue trade talks. These trade talks will begin July 30 and will cover a range of issues, including agriculture and non-tariff barriers.

"There'll be a few more meetings before we get a deal done," Mnuchin told reporters, according to CNBC. "I wouldn't expect that we'll resolve all the issues, but the fact that we're back at the table at the direction of the two presidents is important."

President Donald Trump also downplayed any lofty goals for the discussions, saying, "I don't know if they're going to make a deal," despite China hinting at goodwill purchases of U.S. farm goods.

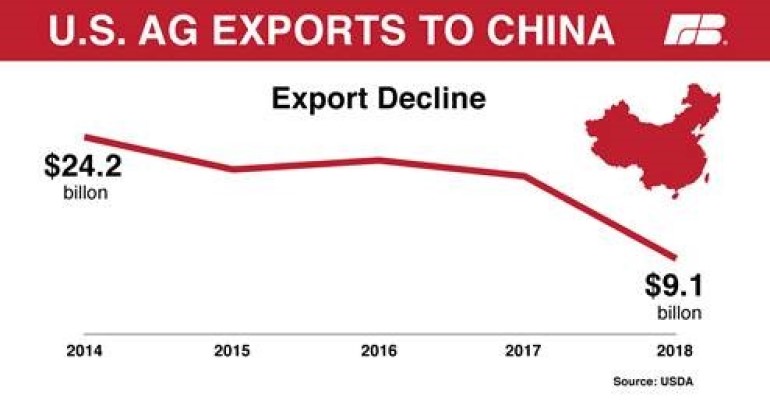

In 2014, U.S. agricultural exports to China exceeded $24 billion. From 2000 to 2017, U.S. agricultural exports to China increased by 700%, according to a statement from the American Farm Bureau Federation (AFBF). From 2017 to 2018, however, U.S. agricultural exports to China fell more than 50% to $9.1 billion.

“All eyes will be on this week’s trade negotiations in China, because reopening the door to one of the largest markets in the world is key to helping farmers get back on their feet," AFBF president Zippy Duvall said.

“We wholly support the Administration’s efforts to stop unfair trade practices by China. Now, it’s time to write the next chapter in our trade relationship by eliminating tariff barriers,” Duvall added. “American agriculture can compete with anyone in the world on a level playing field. I hope this week’s talks create that opportunity.”

U.S. sales of soybeans to China have been down dramatically since the start of the trade war. The 25% retaliatory tariff China imposed on soybeans last July has all but halted shipments to China, which, up until last year, had been the largest export destination for U.S. soybeans. In 2017, China purchased $14 billion worth of U.S. soybeans. The tariff has caused immediate and severe damage to the price of U.S. soybeans, which fell from $10.89 to $8.68/bu. last summer.

The U.S. Soybean Export Council reported that shipments of U.S. soybeans to China were down 19.2 million metric tons (705.2 million bu.) in the first 10 months of the current marketing year compared to the 2017-18 marketing year. As the China market continues to erode, opportunities increase for other soy-producing countries to steal U.S. market share. That lost market opportunity, along with a significant drop in the price of soybeans, has led to a historic carryover stock of unsold U.S. soybeans: The U.S. Department of Agriculture reported the amount of stored soybeans for June up 47% year over year.

“Hearing that negotiations will resume, we are better off this week than last, but continued talks between the U.S. and China won’t undo the damage done the past 12 months. The only action that will truly start to repair our industry is an agreement between both countries to rescind the tariffs,” said American Soybean Assn. president Davie Stephens, a Kentucky soybean grower. “We understand that any movement of U.S. beans to China is better than no movement, but the long-term answer for the viability of our industry is not patchwork promises to buy our beans; it’s reopening the door to trade for American farmers by rescinding the tariffs.”

Pat Westhoff, director of the University of Missouri’s Food & Agricultural Policy Research Institute, said soybean producers certainly will take whatever “goodwill” purchases China will offer up this week, but he’s not expecting any massive sales. The African swine fever outbreak sweeping through China's pig herd has devasted soybean demand. In lieu of purchasing large quantities of meat to make up for lost domestic production, China has allowed for decreased meat consumption.

“A significant pork purchase or two could signal that they are trying to do more good will and create more consumption of meat,” Westhoff said.

The National Pork Producers Council (NPPC) continued to reiterate the importance of ending the trade dispute with China, which placed a 50% punitive tariff on U.S. pork in addition to the regular tariff of 12%, putting the U.S. pork industry at a significant disadvantage to its global competitors. NPPC said were it not for China's trade retaliation, U.S. pork producers would be in a strong position to capitalize on an unprecedented sales opportunity in China, where domestic production is down significantly because African swine fever has ravaged the country's swine herd.

Bloomberg recently reported that the Chinese government has suggested waiving tariffs on certain U.S. agricultural exports, including pork. “If actually implemented for pork, this would be a very significant development,” NPPC said in a July 26 "Capital Update."

Westhoff said discussions of some corn, wheat and rice purchases could also be positive.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)