Estimated 3 billion lb. of pork expected to head to China to boost U.S. prices by 6%.

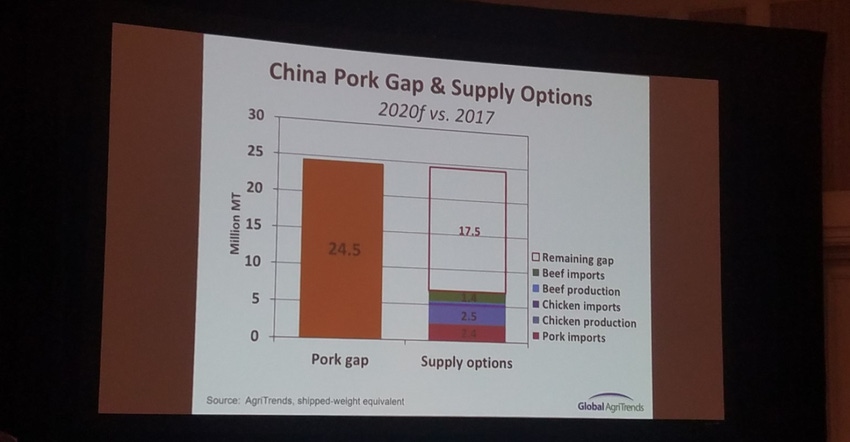

Due to the African swine fever (ASF) outbreak in China, the country faces a shortage of 24.5 million metric tons of pork. Because of the magnitude of the shortage, there is not enough beef or pork either produced domestically or for import, creating an overall protein gap of 17.5 mmt, according to Brett Stuart, president of Global Agri Trends.

While speaking at the the U.S. Department of Agriculture's Agricultural Outlook Forum on Feb. 21, Stuart said imports will become a long-term fixture for China, creating an “incredible situation for global protein markets for years to come.”

For U.S. producers, Stuart estimates that the U.S. will export 3 billion lb. of pork to China in 2020, or roughly 11% of total U.S. production. Weekly export sales data show that 8-10% of U.S. production has been headed to China recently, and that was before recent new tariff waivers.

He said this 33% increase in exports equates to a 6% price increase from a year ago.

Stuart estimated that 65% of China’s herd is now gone, or one-third of the global swine herd. Although China is starting to rebuild its herd, Stuart said he doesn’t see China's production recovering to those pre-ASF levels.

Reports indicate that China has released 200,000 tons of frozen pork from supplies, but Stuart pointed out that this is just 5 oz. per capita and is not having an impact on overall national markets. “This isn’t a goal to be fixed really soon. In the end, it will bring them closer to the goal of more commercialized production, but it’s going to be a bumpy road,” he said.

Interestingly, Chinese poultry producers attempted to increase production but saw a backlash. Highly pathogenic avian influenza outbreaks in China had a destructive effect on demand for poultry. “The Chinese poultry sector is in a dire spot because of concerns over disease, lower production and issues surrounding coronavirus,” including live poultry markets being closed and fears over the virus in general, Stuart said.

In Vietnam, another ASF-infected country, Canada has seen significant increases in pork exports as it has preferential tariff treatment in Vietnam due to the Comprehensive & Progressive Trans-Pacific Partnership, of which the U.S. is not a part, meaning no level playing field for the U.S.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)