Chicken leads overall decline in cold storage

Total cold storage stocks of meat and poultry 9% below a year ago.

July 2, 2021

The latest from USDA’s National Agricultural Statistics Service showed depressed levels of red meat and poultry, according to American Farm Bureau Federation economist Michael Nepveux.

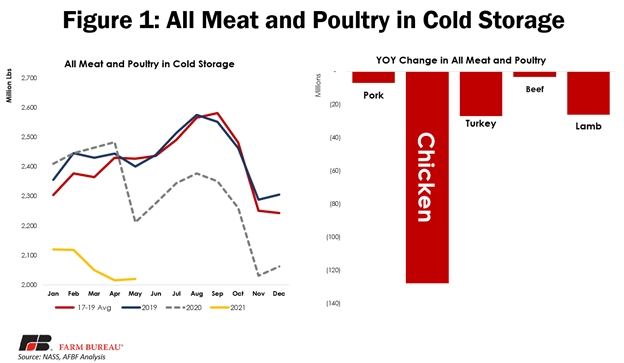

At the end of May, total cold storage stocks of meat and poultry (excluding duck) came in at slightly above 2 billion pounds. This is approximately 190 million pounds, or 9%, below a year ago. All meat and poultry categories showed a year-over-year decline, with chicken declining the most.

“Total levels of red meat and poultry have been down since the height of the pandemic last year when packing plants were severely disrupted by the, leading to a decline in production and consumer panic buying,” explained Nepveux, adding that total levels of animal protein followed the typical seasonal pattern through the rest of 2020 but began to diverge from the expected in February 2021. “Normally, stocks would begin to rebuild this time of year, but instead cold storage levels have been declining for the last several months.”

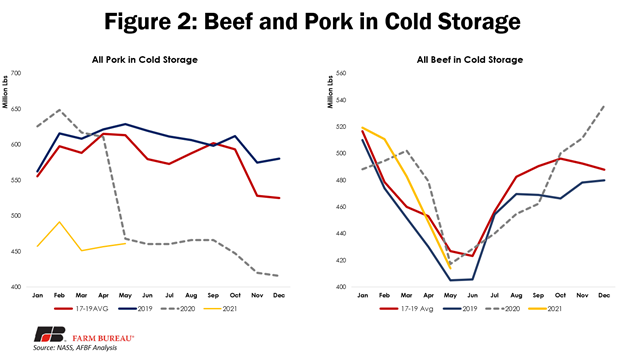

Total beef in cold storage was reported at 414 million pounds at the end of May, a 1% year-over-year decline. Nepveux said this was mostly driven by an 8-million-pound drop in boneless beef in storage, as bone-in beef increased by over 4 million pounds.

“Beef in cold storage has largely remained immune to pandemic disruptions over the last year, maintaining its overall levels while following typical seasonal patterns.”

Pork, on the other hand, is a very different story, Nepveux said.

“At the beginning of the pandemic, pork in cold storage dropped significantly and has not recovered. However, since May of last year, pork has followed typical seasonal patterns without experiencing any more declines, but also not rebuilding its levels either.”

Nepveux explained that May is a month in which base effects are taken into account when looking at year-over-year comparisons for pork.

“Compared to recent history, we are looking at very low levels of pork in cold storage, but due to the drop in May 2020 it is only registering as a 1% year-over-year decline.”

Total pork in cold storage was reported at 461 million pounds, a drop of just under 7 million pounds from last year.

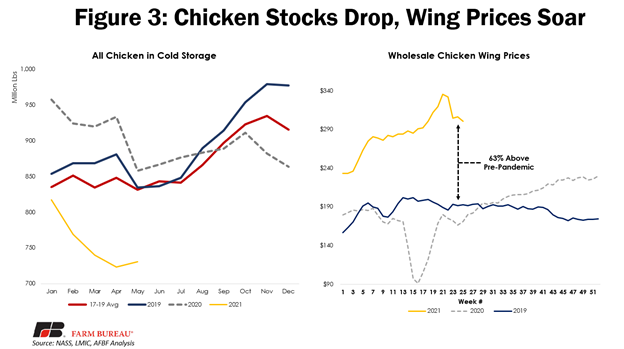

So far in 2021, Nepveux said the story in cold storage has largely been about chicken.

“The overall declines in red meat and poultry were mostly driven by chicken, with 730 million pounds of the protein in cold storage, according to this most recent report. This equates to a drop of nearly 130 million pounds, or 15%, from last year.”

While this was actually an increase over last month, he said there was a counter seasonal decline over first five months of this year compared to recent years.

“It remains to be seen if chicken will experience its typical fall build-up in cold storage levels.”

However, it is a mixed story when looking at individual categories. The largest driver of the decline in chicken levels compared to 2020 is in the “other” category, which dropped by 85 million pounds, or 23%, Nepveux relayed. “Other notable declines were in breast meat, which decreased by nearly 15 million pounds, and thigh meat, which dropped almost 20 million pounds, or 60%.”

Drumsticks jumped by 7-million-pounds (24%), while chicken paws increased by 55%, or 12 million pounds. With a nearly 20% decline from last year, chicken wings have made headlines over the last several months.

Nepveux reported that wings have been experiencing a pretty spectacular price run, which has been squeezing national chains that cater largely to buffalo-style wings. In the second half of 2020, wholesale wing prices began an upward trend that really took off in 2021, resulting in spectacularly high chicken wing prices. “These prices have backed off a bit in the last few weeks but remain nearly 65% above pre-pandemic levels.”

He said the elevated prices are likely more a function of stellar demand placing upward pressure on not only chicken wing prices but red meat and poultry prices in general.

“Unfortunately, we cannot just simply adjust the supply of chicken wings to match consumers’ increased appetites; we only get two wings per bird, and we don’t raise the birds just for their wings. This highlights the inherent complexity of livestock and meat markets, and producers’ inability to respond to demand with specific products.”

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)