ADM reports 'solid' 2019 Q3 results

Company reports strong year-over-year growth in Nutrition revenue and profitability.

November 1, 2019

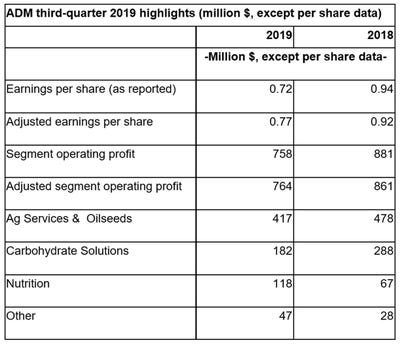

Archer Daniels Midland Co. (ADM) has reported financial results for its third quarter ended Sept. 30, 2019, calling the results "solid" despite challenging external conditions.

“We delivered solid third-quarter results, consistent with the perspectives we provided last quarter, despite a difficult external environment,” ADM chairman and chief executive officer Juan Luciano said. “We maintained our focus on serving our customers and advancing our strategic goals and continued to realize the benefits of the actions that we took earlier this year.

“We are excited about our strategic growth activities, and particularly our participation and leadership in major global trends such as flexitarian diets, nutrition for health and sustainable materials. We have invested in assets, platforms and technological capabilities to serve and grow with our customers, who are embracing these market-changing trends," he added.

“While external conditions for certain businesses may remain fluid and potentially challenging in the near term, our growing leadership position in major global trends, and our strength in innovation, efficiency and customer service, position us well for stronger results in 2020 and beyond,” Luciano said.

Ag Services & Oilseeds results were lower than the third quarter of 2018, which benefited from very strong crush margins, ADM reported.

Ag Services results were in line with the prior-year quarter. In South America, results were up on improved origination margins in Brazil and increased export volumes from Argentina. In North America, improved merchandising results from favorable ownership positions helped offset a continued challenging volume and margin environment for U.S. exports.

In crushing, results were lower year over year. Crush margins globally were substantially below the record-high levels seen in 2018, although still solid in North America and the Europe, Middle East and Africa (EMEA) region. In South America, margins were pressured by continued strong exports of soybeans to China. Global crush margins benefited from positive net timing effects of approximately $50 million during the third quarter.

Results for refined products and other were significantly higher than in the third quarter of 2018, largely driven by significant improvements in golden peanut and tree nuts.

Wilmar results were lower year over year.

Carbohydrate Solutions results were substantially lower than the year-ago period, according to ADM.

Starches and sweeteners results were down versus the third quarter of 2018. Results in North America were affected by higher net corn costs, partly offset by lower manufacturing costs, which included improvements at the Decatur corn complex. EMEA results were affected by lower selling prices and continued pressure from Turkish sweetener quotas. In wheat milling, an increase in sales volumes was more than offset by lower margins due to limited opportunities in wheat procurement.

Bioproducts results were significantly lower, driven by a continued unfavorable margin environment in the ethanol industry.

Nutrition results were substantially higher, the earnings release reported.

WFSI results were significantly higher than the prior-year quarter, with growth across the portfolio. Higher sales and margins globally led to record quarterly results for WILD. In specialty ingredients, the protein business continued to expand amid the growing consumer market for alternative proteins. Continued contributions from growth investments in bioactives and fibers benefited the health and wellness business.

Animal nutrition results were up year over year, driven largely by contributions from Neovia. Improvements in vitamin additives also helped contribute to positive results. Lysine production improved, although pricing was negatively affected by lower global demand.

Other results were up substantially from the year-ago period, primarily driven by higher captive insurance earnings.

For more than a century, ADM has transformed crops into products that serve the needs of a growing world, making products for food, animal feed, industrial and energy uses. Today, the company is one of the world's largest agricultural processors and food ingredient providers, with approximately 40,000 employees serving customers in nearly 200 countries. ADM's global value chain includes approximately 450 crop procurement locations, more than 330 food and feed ingredient manufacturing facilities, 62 innovation centers and a premier crop transportation network.

Source: Archer Daniels Midland, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like