China’s pork situation remains dire

USDA forecasts China’s 2020 pork production to fall more than 33% from 2018 levels.

Assessments by industry observers suggest that the number of African swine fever (ASF) outbreaks and losses of swine far exceeded officially reported numbers, U.S. Department of Agriculture economists recently noted.

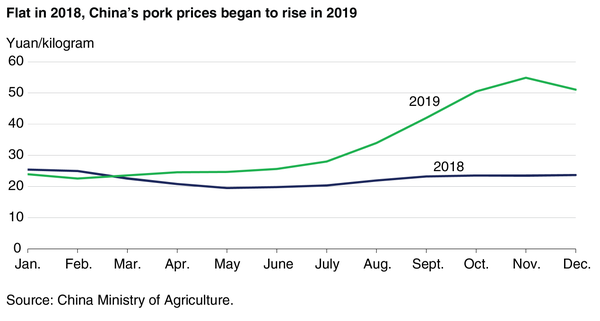

In the latest USDA “Amber Waves” report, economists Mildred Haley and Fred Gale said Chinese government statistics showed a decline in swine inventory in October 2019 of more than 40% from a year earlier, and pork output for the fourth quarter was down more than 30% from a year earlier. China’s National Bureau of Statistics estimated that a 97% increase in pork prices accounted for more than half of the 4.3% increase in China’s December 2019 consumer price index from a year earlier.

“High Chinese pork prices due to ASF losses and relatively low U.S. pork prices due to processing sector expansion have created opportunities for mutually beneficial trade between China and the United States,” the economists said.

Additionally, due the absence of a cure for ASF or an effective vaccine against it, Haley and Gale said sector recovery is likely to be slow and protracted.

For 2020, USDA data and forecasts indicate that China’s pork production will fall to 36 million metric tons, a decrease of more than 33% from the 54 mmt produced in 2018.

As such, China’s 2020 pork imports are expected to rise to a record 3.7 mmt, more than double its imports of 1.6 mmt in 2018. These imports, USDA said, will offset a fraction of the 21 mmt production decline.

“Despite the surge of imports, Chinese consumption of pork is expected to decline dramatically as consumption of poultry and other animal protein substitutes increases,” Haley and Gale relayed, adding that estimated Chinese per capita pork disappearance, or availability per person, will fall to 62 lb. in 2020 from 88 lb. in 2018.

“Anecdotal information suggests that consumers, cafeterias and foodservice establishments cut back on pork purchases as pork prices soared to more than double their previous-year levels in the second half of 2019.”

U.S. Meat Export Federation (USMEF) senior vice president for the Asia Pacific Joel Haggard recently reported that while coronavirus has dominated headlines lately, large protein shortages from the ASF outbreak are still apparent.

“I was quite interested to see local pork prices stay so high over the holidays," he noted, adding that "with so few people venturing out and with foodservice demand plummeting, it’s just a sign, in my mind, that this ASF-induced pork shortfall is still very much with us. So, fundamental imported meat demand should continue to be at an unprecedented level.”

According to USMEF, following a record performance in November, demand for U.S. pork in China/Hong Kong climbed even higher in December to 110,876 mt – more than quadruple the year-ago volume – while value was nearly six times higher at $274.9 million. For 2019, pork exports to China/Hong Kong were up 89% to 665,665 mt, with value up 71% to $1.45 billion. China/Hong Kong pork imports from all suppliers in 2019 reached a record 3.45 mmt, up 40% year over year, and accelerated into December after China’s hog prices peaked in November.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)