Elanco reports strong 2018 Q4, full-year results

Global revenue up 6% for quarter and full year, reflecting strong volume growth.

February 7, 2019

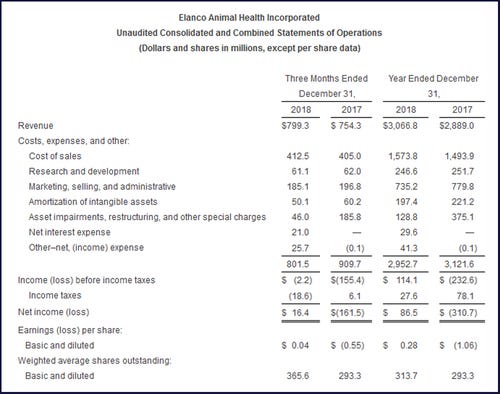

Elanco Animal Health Inc. reported that global revenue increased 6% to $3.1 billion for full 2018 fiscal year and also grew 6% to $799.3 million for the fourth quarter.

The results reflect strong volume growth and the execution of the company's targeted, three-pillar strategy focused on Portfolio, Innovation & Productivity. The results also reflect strong full-year performance in three targeted growth categories: companion animal disease prevention, companion animal therapeutics and food animal future protein and health.

“Our solid results for the full year demonstrate that our strategy is on track, we're executing efficiently and making strong progress against our strategy to deliver the results we promised to our customers, investors and employees,” Elanco president and chief executive officer Jeff Simmons said. “Overall, the animal health market continues to display strong fundamentals that will drive growth going forward. We are well positioned to capitalize on these industry growth drivers and are optimistic about our ability to continue to drive top- and bottom-line growth with the momentum we are carrying into 2019.”

Fourth-quarter results

* Companion Animal Disease Prevention revenue increased 43% for the quarter, primarily driven by volume and increased price but partially offset by an unfavorable impact from foreign exchange. Revenue growth improved in comparison to the prior year due to a reduction in channel inventory in the fourth quarter of 2017. Growth was also driven by continued uptake in demand for Interceptor Plus and Credelio and increased sales of certain vaccines from new customer agreements. Parastar contributed unique growth in the quarter as the company entered into a one-time agreement to sell all remaining inventory.

* Companion Animal Therapeutics revenue decreased 6% for the quarter, driven by decreased volume and an unfavorable impact from foreign exchange that was partially offset by increased price. The revenue decrease was affected by both the timing and availability of Galliprant shipments. A planned shipment in late 2018 was delayed until early 2019 to appropriately complete the quality release process. In addition, market demand for Galliprant continues to grow, exceeding supply capacity and resulting in backorders at the end of the year. Elanco said it is working diligently to expand production and expects to clear remaining backorders by late in the first quarter or early in the second quarter of 2019.

* Food Animal Future Protein & Health revenue increased 8% for the quarter, driven by both volume and increased price but partially offset by an unfavorable impact from foreign exchange. Growth was driven by poultry animal-only antibiotics and vaccines as well as aquaculture products.

* Food Animal Ruminants & Swine revenue decreased 8% for the quarter, driven by price, volume and an unfavorable foreign exchange impact, as well as by softness in swine antibiotics, particularly in Asia, and a stock outage of Micotil, an injectable treatment for bovine respiratory disease, that now has been resolved.

* Revenue from strategic exits -- businesses Elanco has exited or has made the decision to exit -- decreased 6% for the quarter and now represents 3% of total revenue.

Gross profit for the 2018 fourth quarter to $386.8 million, up 11% from the 2017 fourth quarter. Gross margin as a percent of revenue was 48%, a period-over-period increase of 200 basis points primarily due to favorable product mix and non-recurring costs in 2017 associated with the unwinding of purchase accounting inventory adjustments, which were partially offset by 200 basis points of unfavorable impact from foreign exchange rates.

Research and development expenses decreased 1% to $61.1 million, or 8% of revenue. This decrease was primarily driven by the timing of certain projects within the year. Marketing, selling and administrative expenses decreased 6% to $185.1 million, primarily driven by continued productivity initiatives, cost control measures across the business and the timing of marketing investments.

Amortization of intangibles decreased 17% to $50.1 million, driven primarily by the acceleration of amortization related to certain product exits and rationalization in 2017.

Asset impairments, restructuring and other special charges decreased $139.8 million to $46.0 million due to elevated severance and terminations cost incurred in 2017 associated with the U.S. voluntary early retirement program offered by Lilly and asset impairment charges in 2017 related to acquired IPR&D assets.

The fourth-quarter net interest expense was $21.0 million (no expense was incurred in the previous year). Other-net (income) expense was $25.7 million, compared with income of $100,000 in the fourth quarter of 2017. The higher expense was primarily driven by an increase in the Aratana contingent consideration associated with Galliprant.

Adjusted net income for the fourth quarter increased 148% to $105.4 million, which excludes the net impact of $128.0 million of asset impairments, restructuring and other special charges, the amortization of intangible assets and adjustments related to contingent consideration for Aratana, net of the impact from taxes.

Adjusted earnings were 29 cents per diluted share. Adjusted earnings before interest, taxes, depreciation and amortization margin were 21%, an increase of 400 basis points, primarily driven by increased gross margin and a reduction in operating expenses.

Fourth-quarter key events included:

* Innovation. The innovation portfolio launched since 2015 accounted for $69.8 million in revenue, up $29.7 million (74%) over the same quarter last year.

* Experior. The company received U.S. approval for Experior, a first-of-its-kind product for the reduction of ammonia gas emissions in cattle.

* Imvixa. Elanco and the Norwegian Medicines Agency met and agreed on a path forward for submission of Imvixa, a novel treatment for sea lice in salmon.

* Credelio. Credelio, an innovative oral flea and tick treatment for cats, was launched in Europe.

As a group, the targeted growth categories in Elanco's portfolio -- Companion Animal Disease Prevention, Companion Animal Therapeutics and Food Animal Future Protein & Health -- grew 20% on a constant currency basis, representing 60% of Elanco's total business. Interceptor Plus exceeded $100 million in annual sales for the first time.

Elanco reported that it completed the sale of the manufacturing facility in Cali, Colombia, in December 2018.

A restructuring program was announced that will replace the physical presence in 16 countries with other go-to-market models as well as streamline and delay international operations.

For the full year, Elanco reported that it reduced operating expenses by 5%, exited four manufacturing facilities, reduced 18 contract manufacturing organizations to finish the year with 100 and rationalized 15% of low-volume, low-margin stock-keeping units.

Full-year results

For the full 2018 fiscal year, global revenue increased 6% to $3.1 billion, compared with $2.9 billion for 2017. Reported net income and earnings per share were $86.5 million and 28 cents, respectively.

For 2018, net income and earnings per share on an adjusted non-generally accepted accounting principles basis were $431.8 million and $1.18 per diluted share, respectively.

Source: Elance Animal Health, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like