Widespread rains sink corn, soybean prices

Afternoon report: Cash markets offer some reprieve for farmers as futures markets fall.

Feedback from the Field! Has your farm received any beneficial rains this week or are you still holding your breath for those forecasts? Share your fieldwork insights with Farm Futures’ Feedback from the Field (FFTF) series. Just click this link to take the survey and share updates about your farm’s spring progress. I review and upload results daily to the FFTF Google MyMap, so farmers can see others’ responses from across the country – or even across the county!

Corn

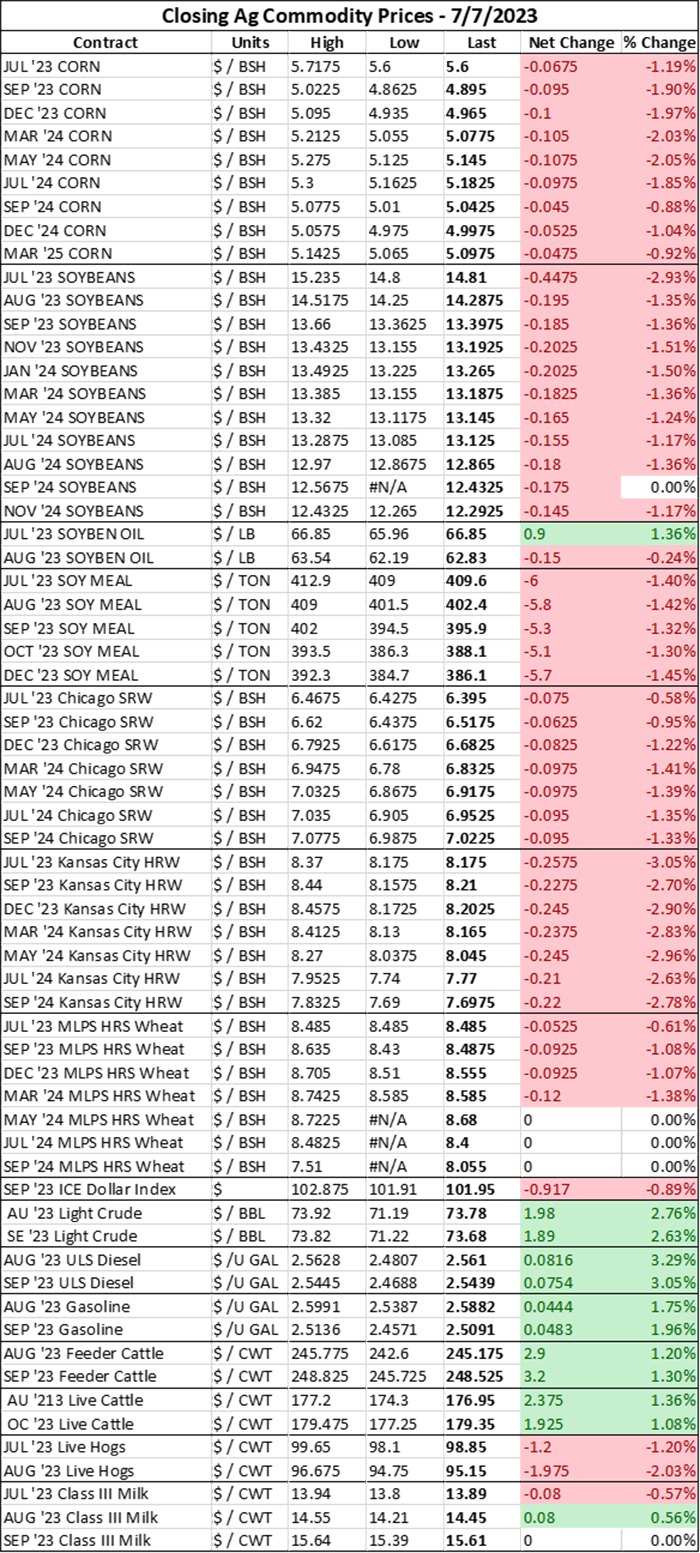

Corn prices fell $0.05-$0.11/bushel lower during today’s trading session, with the most actively traded December 2023 contract falling past the $5/bushel benchmark to close at $4.965/bushel at last glance. While the Dec23 corn contract only closed at a $0.0025/bushel loss on the week, on Wednesday prices matched the lowest price since January 2021. Several factors contributed to the continued bearish run in the corn market.

First, markets remain conscious of USDA’s increased 2023 corn acreage forecast published last week. That means that recent rain showers across the Heartland are having an increasingly bearish impact on corn markets. Second, long-term export and overall demand weakness is weighing on the corn complex, especially as Brazilian corn shipping paces intensify.

“Central and southern areas of the Midwest corn belt are expected to receive above-normal precipitation in the six- to 15-day period, adding to recent crop-boosting rains,” Karl Plume explained for Reuters earlier this afternoon. “The northwest corner of the belt was seen remaining largely dry, forecasters said.”

Cash markets continued to remain strong today, underscored by support from ethanol plants and sluggish farmer sales. Weekly ethanol production neared a seven-month high last week, according to Energy Information Administration data published on Wednesday. That is great news for the ethanol complex, especially after the EPA published plateaued mandated blending volumes late last month for the next three years.

As a result of this dynamic, cash bids ranged from $0.40-$1.00/bushel over nearby September 2023 corn contracts, though the quote from the Illinois River at the Seneca terminal was quoted at $0.10/bushel under July 2023 futures.

Brazil ousted the U.S. as the world’s largest corn exporter this year following a second consecutive bumper crop in the South American country, compounded with the reality of another year of production headaches for U.S. corn growers. But supplies are only a part of the growing unease facing the U.S. corn market.

A brilliant Reuters article published overnight by Karl Plume highlights the increasing competitive advantage Brazilian corn exports are enjoying in the current market environment. It also focuses on demand outlook for U.S. corn – and amid a smaller cattle herd, production nightmares, plateaued current ethanol production and future forecasts, and dwindling export volumes, the demand for U.S. corn faces a very uncertain future.

Plus, the U.S. lacks the acreage to be able to compete with Brazilian exports. Differences in on-farm storage capabilities are also driving the price variances between the two countries, which currently favor Brazilian corn production. Plus, turmoil with Mexico due to a potential import ban on U.S. GMO corn varieties could also limit future demand.

The market is bracing for this year’s smaller U.S. corn crop to drop our corn exports to the lowest global market share since the catastrophic 2012 drought. Future U.S. acreage outlays are increasingly expected to shift towards lower corn acres, resulting in a 50-50 split between corn and soybean acreages going forward (especially as more soybean crush plants come online).

More corn export cuts are likely ahead for the U.S. corn balance sheet. Demand struggles will be closely watched and will be a key driver of price movement in the weeks to come following updated supply data from USDA last week.

Soybeans

Soybean prices were also responsive to forecasts for weekend showers across the Heartland, falling $0.15-$0.21/bushel during today’s trading session. The November 2023 futures contract closed around the $13.19/bushel benchmark, falling below the 200-day moving price average after lingering just above it all week.

The rains dropped November 2023 soybean futures prices nearly 2% on the week, following last Friday’s late week rally on smaller than expected soybean acres planted in the U.S. during the 2023 growing season.

Cash soybean prices have trending lower all week after November 2023 futures hit a four-month high on Monday. Many soy crush plants are currently taking downtime for seasonal maintenance, so the fresh flood of new farmer sales is oversupplying end users.

But crush margins continue to be profitable, which will likely keep cash offerings to farmers at a hefty premium. Currently, soy crush plants’ cash bids are being quoted between $0.95-$1.45/bushel over November 2023 futures contract prices.

Wheat

Kansas City wheat prices took a bath in recent rain showers today, falling $0.23-$0.26/bushel amid heavy showers today in Southern Kansas and Eastern Nebraska. Chicago and Minneapolis futures only fell $0.05-$0.09/bushel, with Chicago futures ending the week virtually flat. Both contracts were supported by growing concerns about the Black Sea Grains Initiative as its deadline approaches next week.

"Rain makes grain and we've had some pretty good rains. There are some questions as to how much has fallen and how much good it has done, but I would expect that the (crop condition) ratings on Monday should be steady to up," Mark Gold, managing partner at Top Third Ag Marketing, told Reuters today.

Peak wheat harvest season is underway across the Northern Hemisphere and despite some of the production issues at play in the U.S., there is already reason to expect a larger global wheat crop this year.

Top global wheat producer the European Union faced some dry weather scares earlier this year but is on track to harvest its largest wheat crop since 2015 thanks to favorable planting conditions last fall and beneficial rains early this spring.

Argentina has been plagued by dry soils the past two years due to La Niña weather patterns. But the shift to El Niño conditions means that the South American country is receiving plentiful rains and will likely double its 2023 harvest relative to a year ago.

Canada and India are also boosting production this year, though the final verdict on larger crop sizes will be dependent upon summer weather. Both countries are grappling with excessive heat this summer that could limit production expansion.

That larger crop hopes in some areas of the world are not a guarantee that shortfalls in other regions should be overlooked this year. Dry El Niño weather conditions expected in Australia will end consecutive years of bumper crops.

In early July, Russian news agencies published agriculture ministry forecasts that pegged 2022/23 Russian wheat exports at 1.7 billion bushels. USDA expects the 2023/24 Russian crop will feature slightly smaller exportable supplies, shrinking 1% to 1.7 billion bushels.

Russian wheat crops have enjoyed idyllic weather this growing season, but ongoing constraints from the West’s banking sanctions dissuaded many Russian growers from further expanding wheat acreage last fall. The absence of Ukraine’s wheat supplies on the international markets will continue to keep supplies somewhat constrained in the ongoing marketing year.

China’s crop remains a wild card. Heavy rains during peak harvest season eroded grain quality, causing grain to sprout in the fields before harvest. That means China, which is currently tied with Egypt as the world’s largest wheat importer, will be more reliant on international wheat supplies during the 2023/24 year than previously expected.

USDA’s June 30 Acreage Report finally shed some light on U.S. winter wheat abandonment totals. This year’s drought on the Plains is likely to bring the total winter wheat abandonment figure for the entire country to 31% - the highest winter wheat abandonment rate since 1933 and the third largest on record.

Wheat is once again likely to be a strong acreage contender in the U.S. this fall, despite the larger global crop expected to be harvested during the current 2023/24 marketing campaign. But not including China, global wheat stocks over the past three years are among the top ten tightest on record even after a 1.5% annual increase in production in 2023.

Global wheat usage isn’t slowing down, either. Higher prices limited growth last year, but larger European crops will help revive supplies this summer. Domestic usage remains the best hope for profit opportunities for U.S. wheat growers, so if more wheat acres are in the cards this fall, growers should carefully consider locking in sales strategies for those extra acres sooner rather than later.

Weather

More scattered showers will stretch across the Plains and Upper Midwest today, according to NOAA’s short-term forecasts. About a half inch is expected across much of the Heartland, with Eastern Nebraska and Western Iowa expected to receive over an inch while Southern Kansas and Oklahoma could see up to two inches of moisture during the next 24 hours.

Today’s system will move slowly across the Heartland over the weekend, shifting into the Eastern Corn Belt by late tomorrow evening. Skies will begin to clear by Sunday night.

Extended forecasts continue to trend cooler for the Upper Midwest and Plains, as well as the Eastern Corn Belt, through the middle of July. However, temperatures across the West and South will shoot above seasonal averages during that time.

Moisture outlooks continue to trend above average for the Upper Plains, Mississippi River Valley, Eastern Corn Belt, and Southeast through the middle of the month, which bodes favorably for heat-stressed crops in those regions. However, as the end of the month approaches, the odds for more moisture decrease slightly.

Recent showers have been spotty at best, but there is a much better chance for significant rainfall across the Midwest and Plains over the next week. The break from scorching heat will also give plants a chance to recover from earlier season heat stress and could set up plants to be in decent shape during pollination.

Financials

S&P 500 futures closed the day down 0.29% to $4,389.95, dipping below the $4,300 benchmark on lower-than-expected June 2023 unemployment data published today. Hiring paces did cool in June, but markets are bracing for more Federal Reserve interest rate hikes as a result of today’s jobs data updates.s

Here’s what else I’m reading this morning on FarmFutures.com:

Indiana farmer Kyle Stackhouse chronicles the end of fertilizer and herbicide applications as well as wheat harvest.

Naomi Blohm dissects surprisingly low soybean acres and sluggish wheat harvesting paces, which will inevitably keep soybean supplies tight for another year.

Executive editor Mike Wilson previews smart sprayers currently on or about to be released on the market to ensure weed control.

Wilson also breaks down the costs and benefits of upgrading to a smart sprayer.

Bryce Knorr reviews June 30 USDA reports and weighs the odds of further summer rallies.

About the Author(s)

You May Also Like