Why the bears are still in charge

Afternoon report: Corn, soybeans and wheat all track lower for the fourth consecutive session.

Grain prices tested small gains overnight and early this morning, a possible signal that bargain buyers were ready to enter the fray. However, a large corn sale cancellation and a tepid round of export inspection data brought the bears racing back onto the scene. The resulting round of technical selling left corn prices at an eight-month low. Soybeans spilled 1.25% lower. Wheat losses were variable – some contracts were only down around 0.25%, while others lost more than 2.5% today.

The Southern Plains will see ample rains fall between Tuesday and Friday, with some areas set to gather 2” or more during this time, per the latest 72-hour cumulative precipitation map from NOAA. In fact, most of the central U.S. will get at least some measurable moisture during this time. Further out, NOAA’s new 8-to-14-day outlook predicts a return to seasonally dry weather for most of the Corn Belt between May 1 and May 7, with prevalent colder-than-normal conditions also likely next week.

On Wall St., the Dow was near-even at 33,810 points in afternoon trading. A more bullish economic signal is the fact that 76% of S&P 500 companies have beat analyst estimates after releasing corporate earnings reports so far this year. Energy futures trended higher today, with crude oil up 1% this afternoon to $78 per barrel on Chinese demand optimism. Diesel rose more than 1.5%, with gasoline up around 1.25%. The U.S. Dollar softened moderately.

On Friday, commodity funds were net sellers of all major grain contracts, including corn (-7,000), soybeans (-6,500), soymeal (-2,500), soyoil (-2,500) and CBOT wheat (-4,500).

Corn

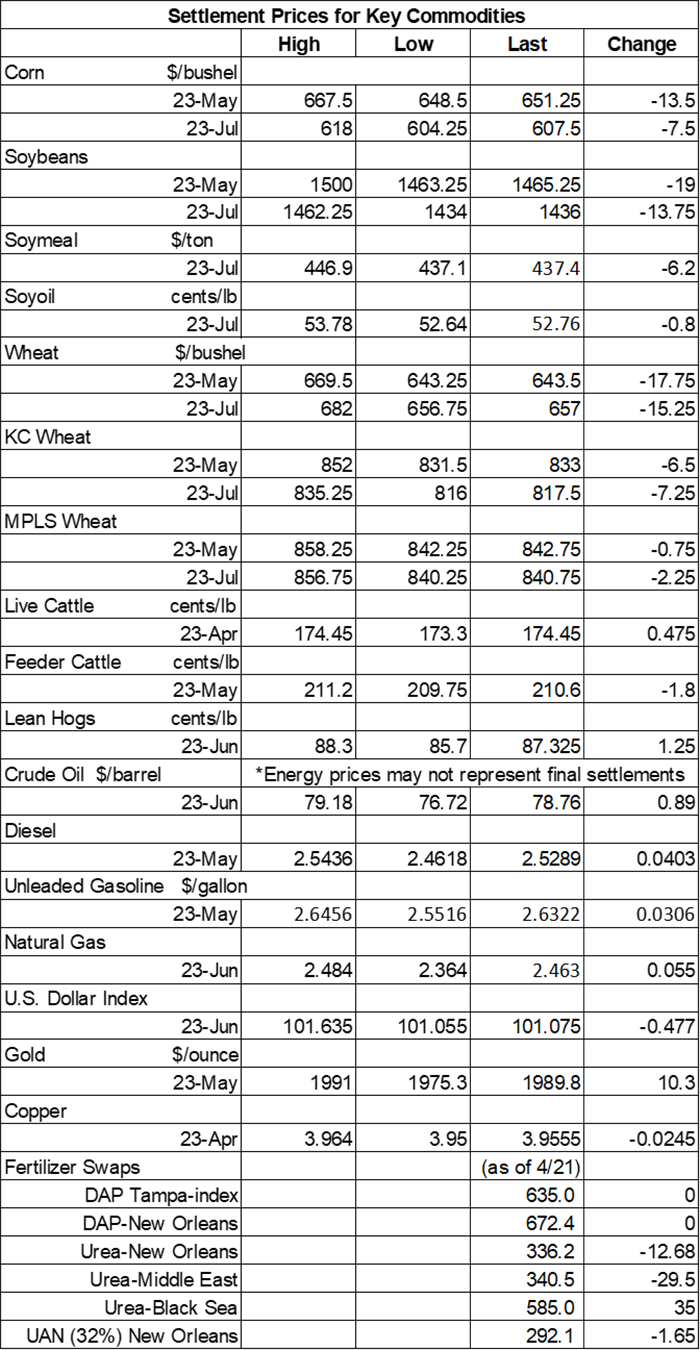

Corn prices faded back into the red again on Monday after a cancelled sale to China churned up some fresh export concerns. May futures dropped 13.5 cents to $6.4975, with July futures down 7.5 cents to $6.0775.

Corn basis bids were steady to firm across the central U.S. on Monday after climbing as much as 25 cents higher at an Iowa processor and eroding as much as 10 cents lower at an Iowa river terminal today.

Private exporters announced the cancellation of 12.9 million bushels of corn sales from China that was originally for delivery during the 2022/23 marketing year, which began September 1.

Corn export inspections reached 36.0 million bushels for the week ending April 20, which was moderately below the prior week’s tally of 48.7 million bushels. That was toward the lower end of analyst estimates, which ranged between 27.6 million and 53.1 million bushels. Japan was the No. 1 destination, with 11.4 million bushels. Cumulative totals for the 2022/23 marketing year remain well below last year’s pace so far, with 880.3 million bushels.

Prior to the next crop progress report from USDA, out Monday afternoon, analysts expect the agency to show corn plantings move from 8% complete a week ago up to 14% through April 23. Individual trade guesses ranged between 11% and 20%.

Ukraine’s 2022/23 grain exports are down around 11% year-over-year as the country continues to face significant production and transportation challenges amid the ongoing Russian invasion. That includes corn sales totaling 944.8 million bushels so far, plus another 510.7 million bushels of wheat sales. Ukraine is among the world’s top exporter of both commodities.

Large banks are required to perform stress tests so a repeat of the 2008 financial crisis doesn’t happen, notes grain market analyst Bryce Knorr. Farmers can borrow from that playbook when it comes to their own operational finances. “A good place to start is to create a sensitivity analysis showing how profits are affected by different combinations of prices and yields,” he says. Knorr expands on this idea and walks through some examples in today’s Ag Marketing IQ blog – click here to learn more.

Preliminary volume estimates were for 460,822 contracts, which was moderately higher than Friday’s final count of 418,257.

Soybeans

Soybean prices followed other grains lower on a round of technical selling that led to double-digit gains by the close. Brazil’s record-breaking harvest continues to apply downward pressure as well. May futures lost 19 cents to $14.6450, with July futures down 13.75 cents to $14.3525.

The rest of the soy complex also trended lower on Monday, with soymeal and soyoil contracts each incurring losses of around 1.5%.

Soybean basis bids were mostly steady across the central U.S. on Monday but did inch a penny higher at an Ohio elevator while spilling 10 cents lower at an Iowa river terminal today.

Soybean export inspections only reached 13.8 million bushels last week, fading moderately below the prior week’s tally of 19.5 million bushels. It was also on the low end of trade estimates, which ranged between 11.0 million and 25.7 million bushels. China was again the No. 1 destination, with 4.7 million bushels. Cumulative totals for the 2022/23 marketing year are still slightly ahead of last year’s pace, with 1.729 billion bushels.

Ahead of this afternoon’s crop progress report from USDA, analysts think the agency will show soybean plantings at 8% complete through April 23, up from 4% a week ago. Individual trade guesses ranged between 6% and 10%.

Brazil’s 2022/23 soybean harvest is nearing completion, with the country’s AgRural consultancy noting 92% progress through April 20. That’s slightly above last season’s pace of 91% so far.

A new bill has been introduced that would prohibit purchases of U.S. land by anyone associated with China if it were to pass. Farm broadcaster Max Armstrong takes a closer look in today’s edition of Farm Progress America – click here to listen.

Preliminary volume estimates were for 273,480 contracts, sliding moderately below Friday’s final count of 319,494.

Wheat

Wheat prices continued to push lower on Monday on fears that an influx of Russian exports will lower demand for U.S. grain. July Chicago SRW futures lost 15.25 cents to $6.5775, July Kansas City HRW futures dropped 7.25 cents to $8.1825, and July MGEX spring wheat futures eased 2.25 cents to $8.4350.

Wheat export inspections reached 13.4 million bushels last week, which was moderately above the prior week’s tally of 9.3 million bushels. That was also toward the higher end of trade estimates, which ranged between 7.3 million and 18.4 million bushels. The Philippines topped all destinations, with 2.1 million bushels. Cumulative totals for the 2022/23 marketing year are slightly below last year’s pace so far, with 656.5 million bushels.

Prior to Monday afternoon’s crop progress from USDA, analysts expect to see winter wheat quality fade a point lower, with 26% of the crop rated in good-to-excellent condition through April 23. Spring wheat planting progress is expected to move from 3% a week ago up to 7% through Sunday.

European Union crop monitoring service MARS slightly reduced its estimates for average soft wheat yields to 88.6 bushels per acre.

Ahead of the next Statistics Canada planting intentions report, out Wednesday morning, analysts expect the agency to show 2023 all wheat plantings will come in at 26.3 million acres, with individual trade estimates ranging between 25.5 million and 27.0 million acres. If realized, that would be moderately above last season’s total of 25.388 million acres.

Russia’s Sovecon consultancy estimates that the country’s wheat exports will reach 154.3 million bushels in April, which would be a month-over-month decline of 6.7%, if realized. Russia is the world’s No. 1 wheat exporter.

Preliminary volume estimates were for 133,833 CBOT contracts, moving slightly above Friday’s final count of 120,386.

About the Author(s)

You May Also Like