Wheat prices continue to march lower

Afternoon report: Soybean prices also face steep cuts on Friday; corn manages narrowly mixed results.

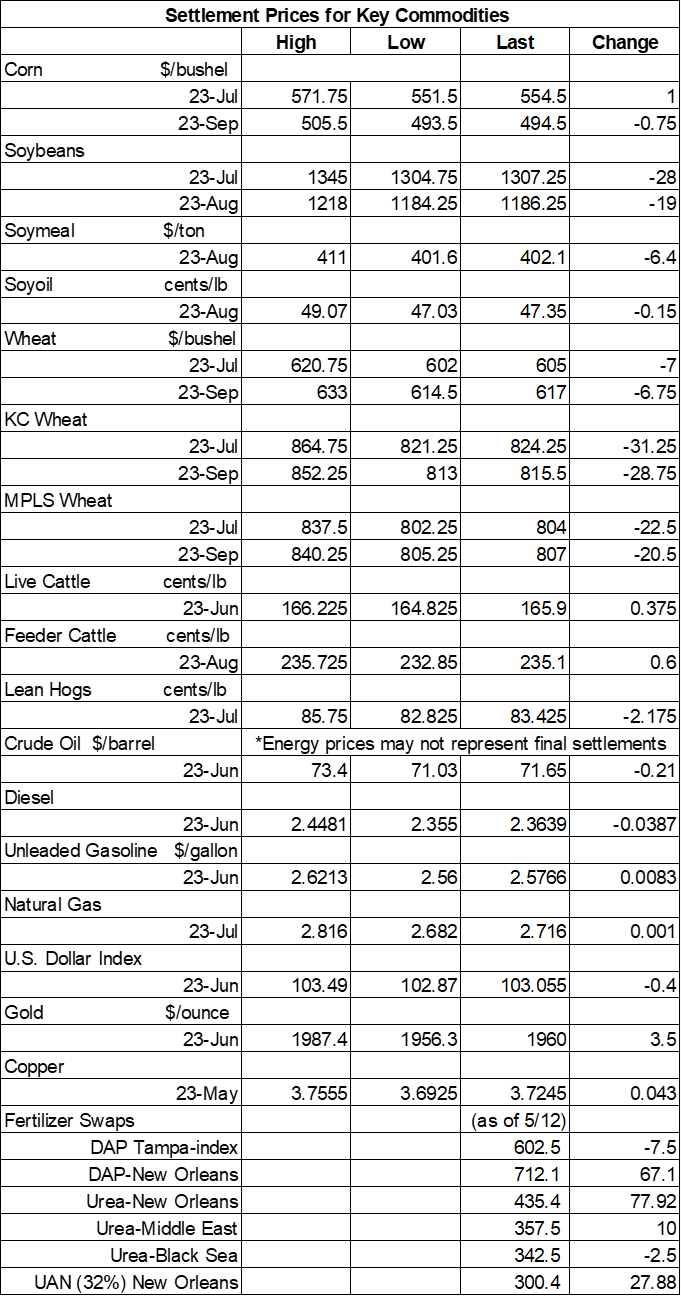

Grain prices were finally trending higher in overnight trading before slumping right back into the red on Friday on creeping concerns over whether U.S. lawmakers will increase the debt ceiling limit. Seasonal pressures also continue to be in play right now, including planting progress in the U.S. and harvest progress in Brazil. Corn prices managed narrowly mixed results, while soybeans eroded 2% lower. Wheat losses also suffered a major technical setback today, with some contracts down more than 3.5%.

Drier weather is in store for much of the central U.S. between Saturday and Tuesday, although the bulk of the eastern Corn Belt will gather at least some measurable moisture during that time, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts more seasonally dry weather in the Ohio River Valley between May 26 and June 1, with warmer-than-normal conditions for the Midwest and Plains also likely.

On Wall St., the Dow fell 115 points in afternoon trading to 33,420 after GOP lawmakers walked out of a debt ceiling meeting because according to them, the White House is being unreasonable. (As a reminder, raising the debt ceiling is about meeting financial obligations that Congress has already approved – if the U.S. Treasury does not have the ability to pay for these obligations, it would likely throw the country into a recession almost immediately.)

Energy futures were mixed but mostly lower. Crude oil faced modest cuts of around 0.25% to $71 per barrel this afternoon. Diesel stumbled more than 1.5% lower. Nearby gasoline contracts bucked the overall trend after picking up gains of around 0.4%. The U.S. Dollar softened moderately.

On Thursday, commodity funds were net buyers of soyoil (+3,500) contracts but were net sellers of corn (-1,000), soybeans (-4,000), soymeal (-6,000) and CBOT wheat (-5,500).

Corn

Corn prices tested moderate gains on Friday morning but were mostly unable to hold onto them by the close. July futures picked up a penny to reach $5.5625, while September futures eased 0.75 cents lower to $4.9475.

Corn basis bids trended 2 to 5 cents lower at two Midwestern processors while holding steady elsewhere across the central U.S. on Friday.

Grain prices have been in a recent downward spiral, but there are three potential scenarios that could reverse that trend, according to Matthew Kruse, president of Commstock Investments. “We call it the futures market and not the ‘today’s market,’ but nevertheless the market is looking way beyond its typical horizon and all it sees is big supply coming,” he admits. However, if North Dakota turns in a lot of prevent plant acres, if new export sales pick up, and if there’s a weather scare later in the season, the tides could turn. Click here to learn more.

If you’re waiting for a summer rally to unfold, putting a floor on prices may be a better option than “holding and hoping,” according to Bill Biedermann, hedging strategist with AgMarket.net. “When we play with the numbers, it would take an approximate 3 million acre prevent plant [in corn] to even suggest the outlook is no longer bearish,” he asserts. “Since that does not look likely, we have to look at the odds of a yield loss.” Biedermann shares his latest round of advice in yesterday’s Ag Marketing IQ blog �– click here to learn more.

South Korea has been an active corn buyer amid slumping prices this week. A feed association purchased another 2.6 million bushels of animal feed corn, likely sourced from South America or South Africa, in a tender that closed on Thursday. The grain is for arrival around October 20.

Preliminary volume estimates were for 414,397 contracts, tracking slightly higher than Thursday’s final count of 385,203.

Soybeans

Soybean prices eroded steadily throughout Friday’s session that left them around 2% lower by the close on the ensuing round of technical selling. July futures lost 28 cents to $13.0525, with August futures down 23 cents to $12.4650.

The rest of the soy complex was also in the red on Friday. Soymeal futures stumbled more than 1% lower, while soyoil futures faced more modest cuts of around 0.25%.

Soybean basis bids were steady across the central U.S. on Friday.

Brazil’s Safras & Mercado is now estimating the country’s 2022/23 soybean production will reach 5.720 billion bushels. That’s slightly above its prior projection of 5.698, and it’s one of the more bullish estimates on record right now.

Financial adviser Sarah Wiersma contends that when it comes to planning for retirement, the sooner you get started, the better. “Many farmers say their farm is their retirement plan,” Wiersma noted at the recent Professional Dairy Producers conference, held in Wisconsin. “Some want to help the next generation. With rising interest rates, I don’t even want a loan for a car right now.” Click here for Wiersma’s advice on IRAs, life insurance and more.

If it’s been a few days since you’ve been to FarmFutures.com, our Friday feature “7 ag stories you can’t miss” is an easy way to quickly catch up on the industry’s top headlines. The latest batch of content includes details about the Black Sea shipping deal extension, a look at a new farm machinery partnership and more. Click here to get started.

Preliminary volume estimates were for 247,452 contracts, trending 10.5% higher than Thursday’s final count of 223,909.

Wheat

Wheat prices were slashed again on Friday on yet another round of technical selling, finishing a week that was highly volatile. September Chicago SRW futures dropped 6.75 cents to $6.0475, September Kansas City HRW futures lost 28.75 cents to $8.1675, and September MGEX spring wheat futures fell 20.5 cents to $8.1025.

The 2023 Wheat Quality Council’s Hard Winter Wheat Tour wrapped up on Thursday, offering a final estimated yield of 178 million bushels for the wheat crop in Kansas, which is the nation’s top producer. That’s 13 million bushels lower than USDA’s latest estimate of 191 million bushels. Average yields were around 30 bushels per acre (not counting abandoned fields). Kansas Farmer editor Jennifer Latzke was among the tour participants and shared her analysis of the trip, along with a slideshow of some photos she took – click here for more.

Russian consultancy Sovecon raised its estimates for the country’s 2023 wheat production potential to 3.233 billion bushels, which is a bit higher than its prior projection of 3.189 billion bushels. Russia is the world’s No. 1 wheat exporter.

French soft wheat quality ratings are at their highest levels in a decade, although ratings eased a point lower last week, with 93% of the crop in good-to-excellent condition through May 15, according to farm office FranceAgriMer. The country’s 2023 corn crop is now 88% planted.

Preliminary volume estimates were for 96,014 CBOT contracts, inching slightly above Thursday’s final count of 92,541.

About the Author(s)

You May Also Like