Wheat prices catch a major break

Afternoon report: Corn and soybeans also firm in Wednesday’s session.

CBOT wheat contracts recently eroded to their lowest levels in more than two years, but rising tensions in Russia (which is accusing Ukraine of trying to assassinate Putin in a drone attack on the Kremlin) ignited a broad wave of technical buying that lifted prices more than 4% higher. Other wheat contracts were boosted 3% to 7.75%. The ensuing spillover strength also helped corn and soybean prices move higher on Wednesday.

Most of the Corn Belt will receive at least some measurable moisture between Thursday and Sunday. A few fields could gather as much as 1” or more during this time, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts seasonally wet weather is likely for most of the central U.S. between May 10 and May 16, with warmer-than-normal conditions likely for the Midwest and Plains during this time.

On Wall St., the Dow shifted 46 points higher in afternoon trading to 33,730. The economic news of the day was the Federal Reserve raising interest rates by another 25 basis points, but that move was largely expected by analysts, who are increasingly of the opinion that the Fed won’t make additional rate hikes in 2023. Energy futures continued to slump lower on worries over a possible recession, along with rising tensions between Ukraine and Russia. Crude oil lost 4.25% this afternoon to $68 per barrel. Diesel dropped 2.5%, with gasoline down more than 4.5%. The U.S. Dollar softened moderately.

On Tuesday, commodity funds were net sellers of all major grain contracts, including corn (-3,000), soybeans (-5,000), soymeal (-3,000), soyoil (-1,000) and CBOT wheat (-3,500).

Corn

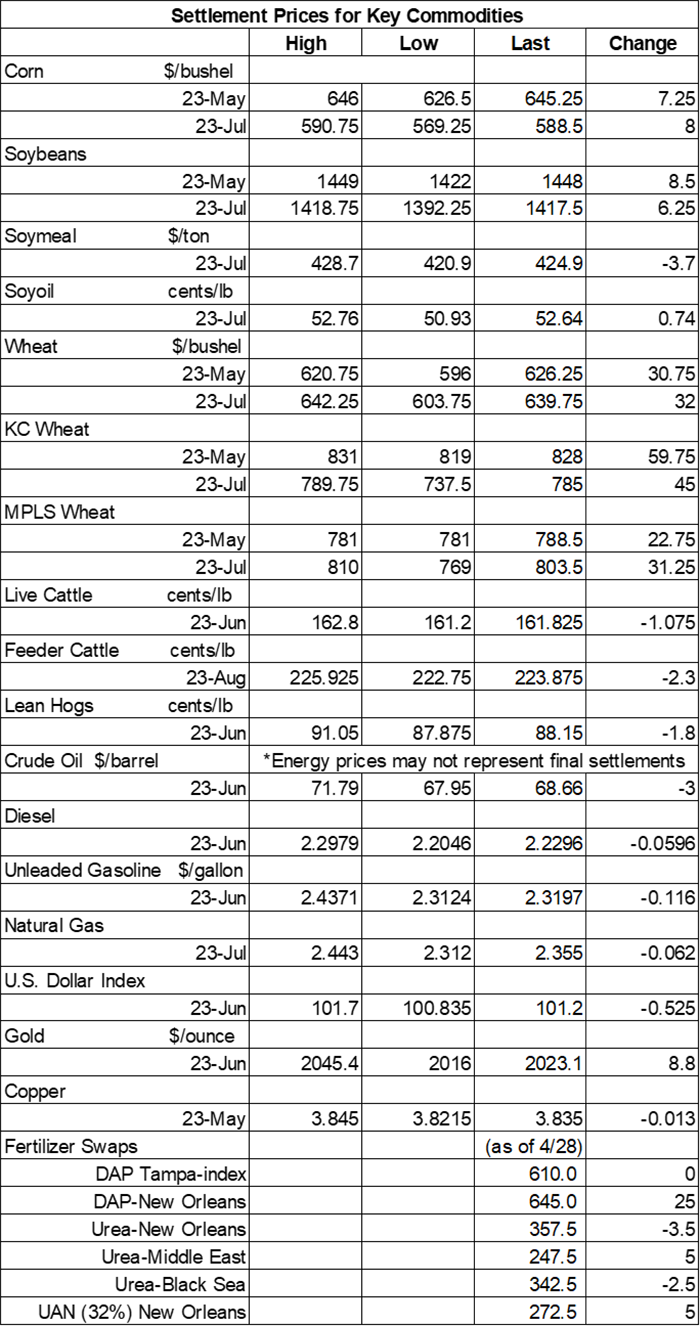

Corn prices rose steadily throughout Wednesday’s session, shaking off moderate overnight losses in the process and finishing with gains of more than 1%. Spillover support from wheat was the primary move for this shift. May futures added 7.25 cents to $6.4525, with July futures up 8 cents to $5.88.

Corn basis bids were steady to mixed after trending 6 cents lower at an Ohio river terminal while firming 5 to 7 cents higher at two other Midwestern locations on Wednesday.

Ethanol production for the week ending April 28 improved modestly, with a daily average of 976,000 barrels, per the latest data from the U.S. Energy Information Administration, out Wednesday morning. It was the second consecutive week that failed to meet the 1-million-barrel-per-day benchmark, however. Stocks trended 4% lower last week.

Ahead of the next USDA export report, out Thursday morning and covering the week through April 27, analysts expect the agency to show corn volume ranging between net reductions of 17.7 million bushels and net sale of up to 31.5 million bushels.

As 2023 plantings continue in earnest, the industry has seen a lot of chatter over whether the statistical trend line yield of 181.5 bushels per acre is going to be achievable, according to Josh Green with Advance Trading. “Mother Nature is the only one that holds the answer to that question, yet the USDA will comb through its data and give us its best estimate to start the year,” he notes. “Add the remaining carryout from the 2022 marketing year and it is foreseeable for the US total supply to increase 1.3 billion bushels year on year.” Green offers additional supply and demand analysis in yesterday’s Ag Marketing IQ blog – click here to learn more.

Grain traveling the nation’s railways moved another 21,181 carloads last week. That brings cumulative totals for 2023 to 367,742 carloads, which is trending 6.2% below last year’s pace so far.

Preliminary volume estimates were for 335,075 contracts, which is slightly above Tuesday’s final count of 310,874.

Soybeans

Soybean prices pushed through a somewhat choppy session to find gains of around 0.5% following a round of technical buying on Wednesday. May futures rose 8.5 cents to $14.48, with July futures up 6.25 cents to $14.17.

The rest of the soy complex was mixed. Soyoil contracts also firmed around 0.5% higher, while soyoil futures were trimmed by a similar percentage.

Soybean basis bids improved 4 cents at an Ohio elevator and 5 cents at an Indiana processor while holding steady elsewhere across the central U.S. on Wednesday.

Prior to Thursday morning’s export report from USDA, analysts think the agency will show soybean sales ranging between 3.7 million and 18.4 million bushels for the week ending April 27. Analysts also anticipate seeing soymeal sales ranging between 75,000 to 375,000 metric tons last week, plus up to 30,000 MT in soyoil sales.

Will rising interest rates finally put a dent into red-hot farmland prices? We talked to two experts who generally expect to see a short-term plateau, although long-term prospects remain relatively bullish. Click here for details.

Preliminary volume estimates were for 226,873 contracts, moving moderately above Tuesday’s final tally of 183,284.

Wheat

Wheat prices found significant gains on rising tensions between Ukraine and Russia, which could jeopardize a Black Sea shipping deal that is due for an extension (or expiration) on May 18. July Chicago SRW futures rose 32 cents to $6.4125, July Kansas City HRW futures climbed 45 cents to $7.8525, and July MGEX spring wheat futures gained 31.25 cents to $8.0475.

Ahead of tomorrow morning’s export report from USDA, analysts expect to see wheat sales ranging between 1.8 million and 20.2 million bushels for the week ending April 27.

Negotiations are ongoing to extend a deal that allows for safe passage of shipping vessels in the Black Sea, which will otherwise expire on May 18. However, Russia has been pushing back on some of the terms of the current deal. “Russia will not do anything further that will be contrary to its interests,” according to a Kremlin spokesperson. Russia contends that its own grain and fertilizer exports still face significant obstacles. Additional talks with the United Nations will be held on Friday.

Egypt purchased 24.1 million bushels of wheat in an international tender that closed on Tuesday. “Large volumes of cheap Russian wheat continue to be offered in export markets to the pleasure of importers,” according to one European trader. “Russia had a record harvest last summer and is expecting a decent crop this year so stocks have to be cleared out, while uncertainty about Ukraine's grains export channel continues.” The grain is for shipment in June.

Preliminary volume estimates were for 149,514 CBOT contracts, tracking moderately higher than Tuesday’s final count of 104,960.

About the Author(s)

You May Also Like