Wheat heats up on some key USDA data

Afternoon report: Corn prices also slightly firm on Friday; soybeans face moderate cuts.

As it often does, USDA’s latest World Agricultural Supply and Demand Estimates (WASDE) report has the potential to shake up grain prices. Surprisingly, the biggest grain price move came for Kansas City HRW contracts after USDA reported the smallest crop for that wheat type since 1957. Other wheat prices also benefited from the ensuing round of technical buying. Corn prices managed modest gains after a shaky start this morning. Soybeans failed to follow suit after a round of technical selling left July futures more than 1% lower.

Most of the central U.S. will get at least some measurable rainfall between Saturday and Tuesday, with most fields likely to see somewhere between 0.25” to 0.5” during this time, per the latest 72-hour cumulative precipitation map from NOAA. Further out, the agency’s new 8-to-14-day outlook predicts drier-than-normal conditions for the northern half of the country, with seasonally warm weather settling into parts of the Plains between May 19 and May 25.

On Wall St., the Dow fell another 157 points in afternoon trading to 33,151 on bearish consumer sentiment data and expectations that inflation will remain relatively sticky over the next several years. Energy futures also moved lower, with crude oil down 1.25% this afternoon to $70 per barrel. Diesel dropped more than 1.75%, with gasoline down around 1.5%. The U.S. Dollar firmed moderately.

On Thursday, commodity funds were net buyers of soymeal (+4,500) contracts but were net sellers of corn (-8,500), soyoil (-2,500) and CBOT wheat (-5,000). Funds were roughly even when trading soybean contracts yesterday.

Corn

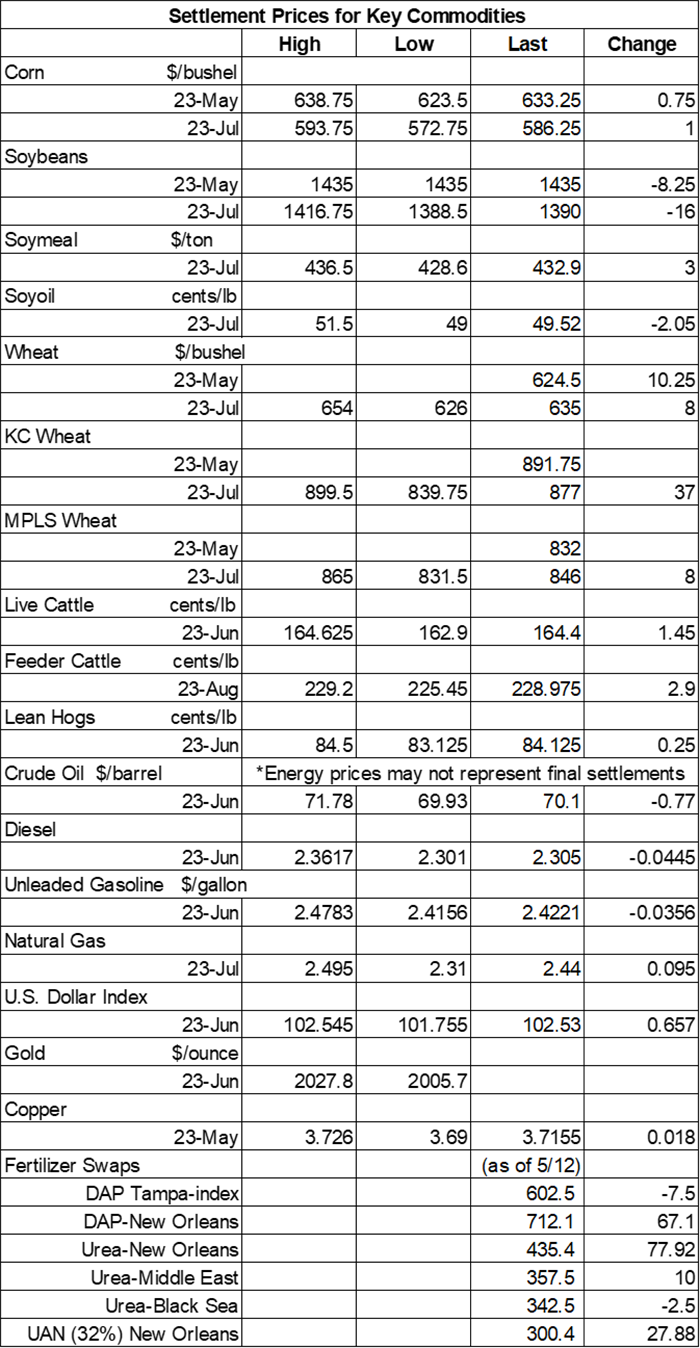

Corn prices held on to modest gains despite USDA predicting a record-breaking U.S. production this season (more on that below). However, USDA also anticipates corn exports will improve in 2023/24, and wheat lent additional some technical support. May futures picked up 0.75 cents to $6.3325, while July futures added a penny to reach $5.8325.

Corn basis bids were mostly steady to weak across the central U.S. after sliding 2 to 10 cents lower at three Midwestern locations on Friday. A Nebraska processor bucked the overall trend after firming 2 cents today.

USDA is expecting to see a record-breaking corn production of 15.3 billion bushels for the 2023 season. That would be a year-over-year increase of more than 10%, if realized. USDA also offered a bullish yield estimate of 181.5 bushels per acre – well above the average trade guess of 180.7 bpa. Total supplies could move to the highest level since 2017/18, with 16.7 million bushels.

Corn use in 2023/24 is expected to increase 5% year-over-year, which USDA attributes to higher domestic use and exports. Food, seed and industrial use could rise 55 million bushels to 6.7 billion bushels. Corn used for ethanol could increase 1%. And 2023/24 exports are forecast to rise 325 million bushels to 2.1 billion. Unfortunately, that’s due to lower prices that will make U.S. grain more competitive on the world market. The season-average farm price is expected to trend $1.80 lower from 2022/23, falling to $4.80 per bushel.

China’s agriculture ministry expects the country’s 2023/24 corn plantings will increase by 1% to 107.417 million acres. That should help production increase to 11.115 billion bushels. China’s corn imports are also expected to ease 2.8% lower to 688.9 million bushels.

French corn plantings for the 2023 season moved from 59% complete a week ago up to 80% through May 8, according to the latest report from FranceAgriMer. That’s noticeably behind 2022’s pace of 90% and five points below the prior five-year average of 85%.

South Korea purchased 5.2 million bushels of animal feed corn, likely sourced from South America, in an international tender that closed earlier today. The grain is for arrival in October.

Would it be worth it to grow more sorghum in America? Farm broadcaster Max Armstrong explores some possible upsides in today’s edition of Farm Progress America – click here to learn more.

Preliminary volume estimates were for 347,478 contracts, trending moderately higher than Thursday’s final count of 284,264.

Soybeans

Soybean prices eroded 0.5% to 1% lower after USDA estimated that 2023 soybean production will reach record levels, which spurred a round of technical selling on Friday. May futures dropped 8.25 cents to $14.35, with July futures down 16 cents to $13.8950.

The rest of the soy complex were mixed. Soyoil futures tumbled 4% lower, while soymeal futures scraped together some fractional gains.

Soybean basis bids were mostly steady across the central U.S. on Friday but did track 7 cents lower at an Ohio elevator today.

USDA’s initial outlook for 2023/24 calls for higher soybean supplies, crush and ending stocks, with exports trending lower from the prior year’s pace. Production is expected to reach 4.51 billion bushels, which would be 5% above 2022 totals, if realized. “With lower beginning stocks partly offsetting increased production, soybean supplies are forecast at 4.75 billion bushels, up 4 percent from 2022/23,” USDA adds.

Soybean exports are expected to trend 40 million bushels below 2022/23 levels to 1.98 billion bushels. USDA attributes the change to increased competition from South America. Ending stocks in 2023/24 are projected at 335 million bushels, which is up 120 million from 2022/23.

In South America, USDA made no changes to its 2022/23 soybean production estimates in Argentina, which remains at 992 million bushels. The agency did increase its Brazilian production estimates to 5.695 billion bushels, however.

If you haven’t been to FarmFutures.com in a few days, our Friday feature “7 ag stories you can’t miss” is an easy way to catch up on the industry’s top headlines. The latest batch of content includes recommendations on “the two biggest paybacks in farming,” a look at farm real estate debt trends and more. Click here to get started.

Preliminary volume estimates were for 222,852 contracts, firming 14% above Thursday’s final count of 195,806.

Wheat

Wheat prices shot higher on Friday after USDA reported declining per-acre yields and the lowest ending stocks in over a decade. July Chicago SRW futures gained 8 cents to $6.3525, July Kansas City HRW futures climbed 37 points to $8.7850, and July MGEX spring wheat futures added 8 cents to $8.4475.

USDA’s 2023/24 outlook for wheat includes “reduced supplies and exports, increased domestic use, and smaller stocks compared with 2022/23.” All-wheat production could rise slightly higher to 1.659 billion bushels due to an increase in harvested area, although average yields may decline 1.8 bushels per acre from last year, to 44.7 bpa.

Domestic use in 2023/24 is expected to reach 1.112 billion bushels, a yearly increase of 1%. Exports could fade 50 million bushels lower, to 725 million bushels. Ending stocks could erode 11% lower year-over-year and reach the lowest level in 16 years. USDA doesn’t expect an encore for record-breaking prices this season. The agency’s 2023/24 season-average farm price projection is down 85 cents a bushel to $8.00.

Turkey’s defense minister expressed confidence that a critical Black Sea shipping deal is close to getting extended after negotiations occurred this week between Ukraine, Russia, Turkey and the United Nations. Even so, Russia has remained tight-lipped recently and has demanded concessions regarding its own grain and fertilizer exports to extend the deal, which is otherwise set to expire on May 18.

French farm office FranceAgriMer reported modest improvements for the country’s soft wheat crop quality ratings, with 94% now in good-to-excellent condition through May 8. That puts ratings at this time of year at the highest level in more than a decade for Europe’s top wheat producer.

Preliminary volume estimates were for 114,869 CBOT contracts, shifting moderately above Thursday’s final count of 85,833.

About the Author(s)

You May Also Like