Weekly Export Sales: China sales pick up

Soybean exports still relatively low, but wheat sales move higher.

For soybean exports, all eyes remain on China. For the week ending April 18, export sales to that country did move higher, notes Farm Futures senior grain market analyst Bryce Knorr.

“China’s soybean purchases picked up a little last week, with buyers there taking another 8 million bushels,” he says. “But those customers have been slow to ship out sales as trade talks with the U.S. drag on. Chinese customs data out overnight showed imports from the U.S. picking up in March, but lagging behind purchases from Brazil, as new crop deliveries increase from South America after a good harvest there.”

A caveat moving forward – Brazil tends to dominate the export market in April and May, Knorr says. That trend could make it difficult for the U.S. to compete, with or without a resolution in ongoing U.S.-China trade talks.

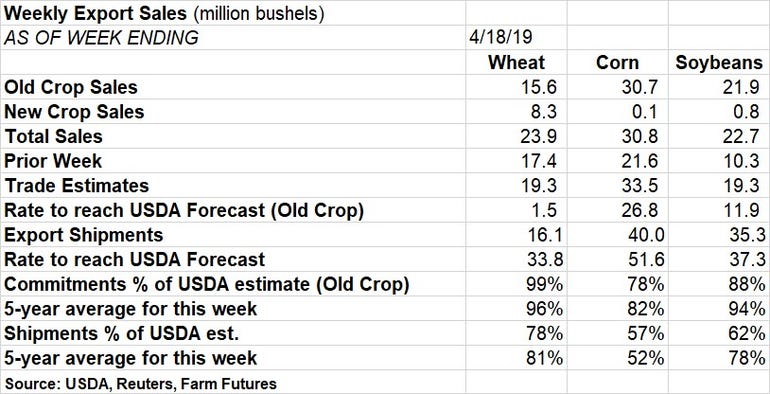

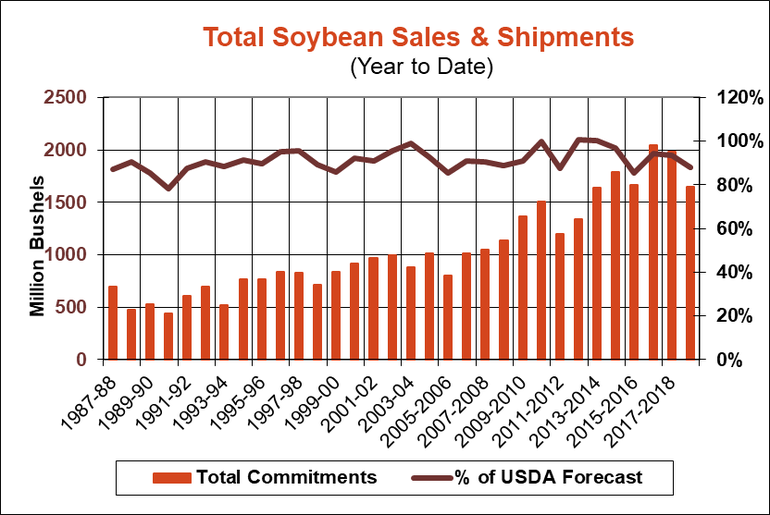

Last week, soybeans found 21.9 million bushels in old crop sales plus another 800,000 bushels in new crop sales, for a total of 22.7 million bushels. That moved ahead of the prior week’s tally of 10.3 million bushels and slightly exceeded trade estimates of 19.3 million bushels. The weekly rate needed to match USDA forecasts moved lower to a manageable 11.9 million bushels.

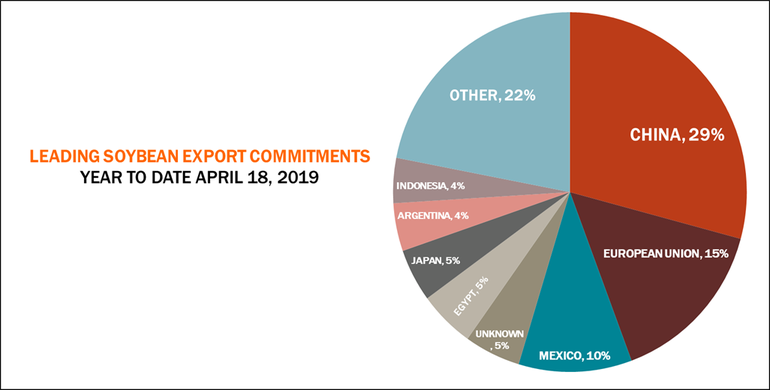

Soybean export shipments were for 35.3 million bushels last week. For the 2018/19 marketing year, China continues to lead all destinations for U.S. soybean export commitments, accounting for 29% of the total. Other top destinations include the European Union (15%), Mexico (10%), unknown destinations (5%), Egypt (5%) and Japan (5%).

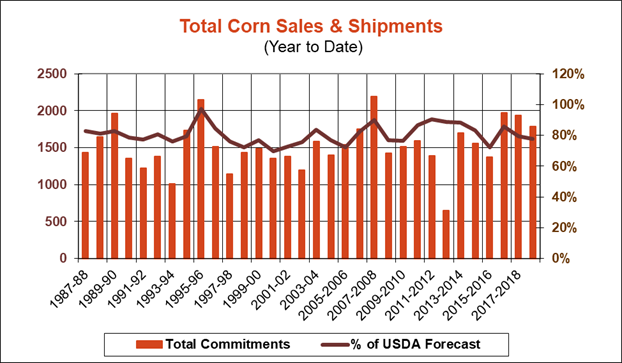

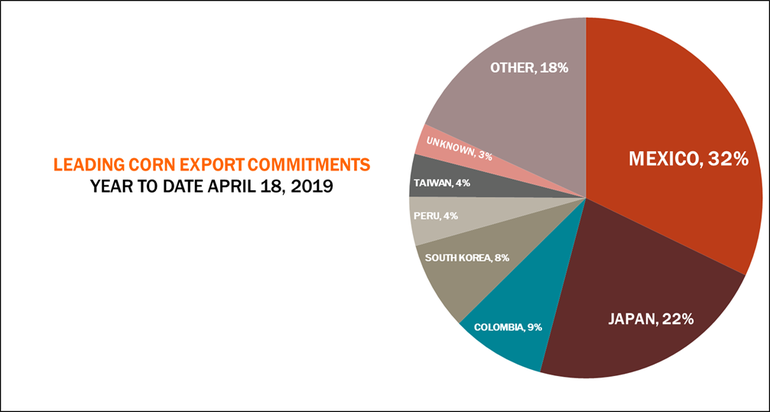

Corn exports last week included 30.7 million in old crop sales plus another 100,000 bushels in new crop sales, for a total of 30.8 million bushels. That was moderately ahead of the prior week’s tally of 21.6 million bushels but slightly beneath trade estimates of 33.5 million bushels. The weekly rate needed to meet USDA forecasts still moved lower, however, to 26.8 million bushels.

Corn export shipments were for 40.0 million bushels last week. For the 2018/19 marketing year, Mexico leads all destinations for U.S. corn export commitments, with 32% of the total. Other top destinations include Japan (22%), Colombia (9%) and South Korea (8%).

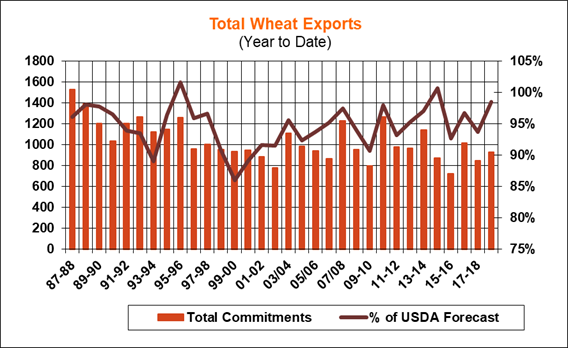

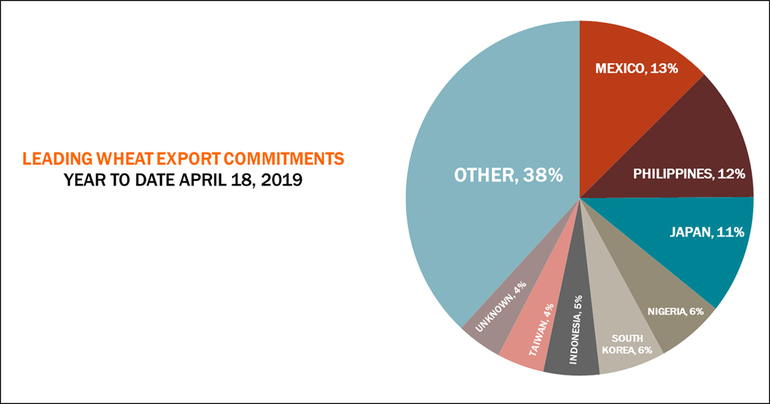

Wheat exports included 15.6 million bushels in old crop sales and another 8.3 million bushels in new crop sales for a total of 23.9 million bushels last week. That was moderately ahead of the prior week’s total of 17.4 million bushels and also higher than trade estimates of 19.3 million bushels. The weekly rate needed to match USDA forecasts is now a slim 1.5 million bushels.

Wheat export shipments were for 16.1 million bushels last week. For the 2018/19 marketing year, which wraps up in the next five weeks, Mexico is the No. 1 destination for U.S. wheat export commitments, accounting for 13% of the total. Other top destinations include the Philippines (12%), Japan (11%), Nigeria (6%), South Korea (6%), Taiwan (4%) and unknown destinations (4%).

About the Author(s)

You May Also Like