Was the Black Sea dealbreaker already priced in?

Afternoon report: Corn and wheat prices fade lower to start the week, while soybeans stand firm.

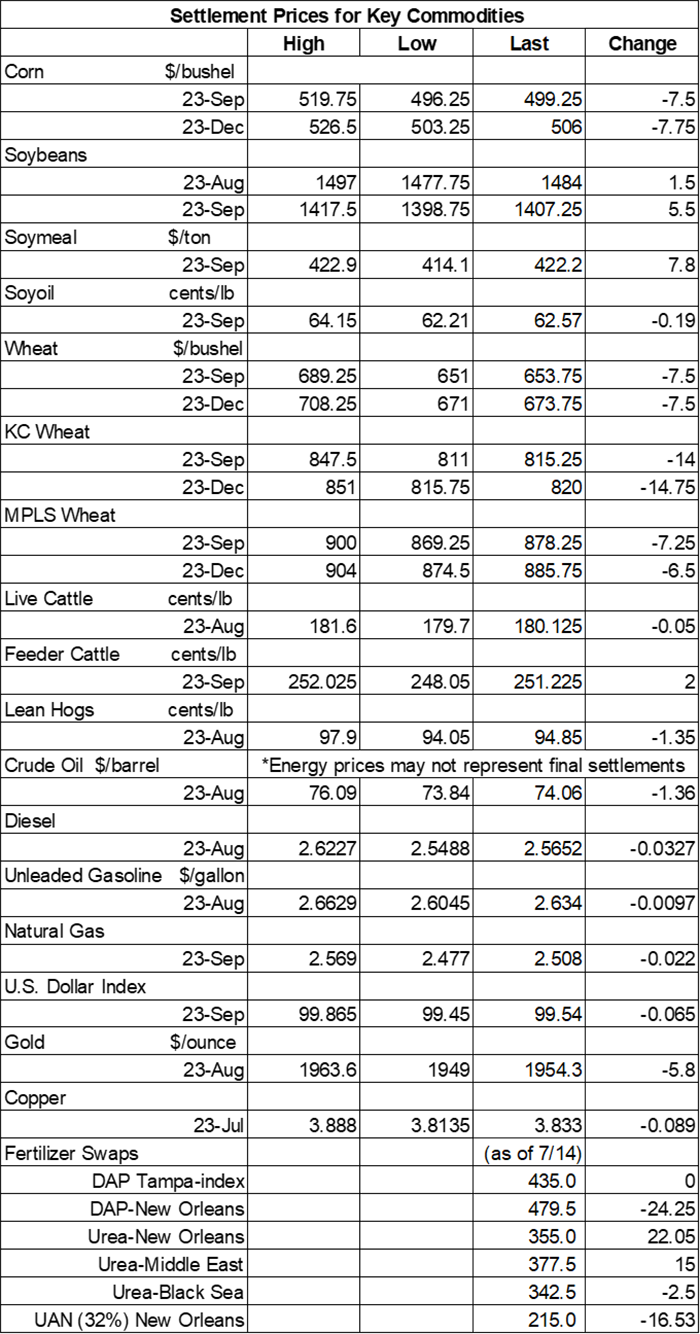

The deal that allowed safe passage of shipping vessels through the Black Sea has officially expired after Russia refused to renew it, complaining that their own food and fertilizer export needs weren’t being met. “Only upon receipt of concrete results, and not promises and assurances, will Russia be ready to consider restoring the deal,” according to a statement from the country’s foreign ministry. That should have been bullish news for corn and wheat prices, but gains made late last week suggest that expectations of the dealbreaker may have already been priced in. Corn prices trended 1.5% lower, while wheat prices dropped 0.75% to 1.75%. Soybeans bucked the overall trend after closing with modest gains.

Most parts of the Midwest and Plains will receive at least some measurable rainfall between Tuesday and Friday, with the Ohio River Valley likely to see the largest amounts later this week, per the latest 72-hour cumulative precipitation map from NOAA. Further out, NOAA’s new 8-to-14-day outlook predicts a return to seasonally dry conditions in the Northern and Central Plains and the western Corn Belt between July 24 and July 30, with hotter-than-normal conditions probable for the western half of the United States next week.

On Wall St., the Dow moved 98 points higher in afternoon trading to 34,607 as traders await another round of corporate earnings reports that will be released later this week. Energy futures suffered a moderate technical setback, with crude oil down more than 1.5% this afternoon to $74 per barrel.

On Friday, commodity funds were net buyers of corn (+10,500), soybeans (+500), soymeal (+500) and CBOT wheat (+7,500) but were net sellers of soyoil (-2,000).

Corn

Corn prices tracked moderately lower after expectations for improved crop quality triggered a round of technical selling on Monday. September futures dropped 7.5 cents to $7.99, with December futures down 7.75 cents to $5.06.

Corn basis bids were steady to mixed after moving as much as 5 cents higher at two Indiana ethanol plants and as much as 20 cents lower at an Ohio elevator on Monday.

Corn export inspections only reached 14.3 million bushels last week. That was a modest improvement from the prior week’s tally but still on the lower end of trade estimates, which ranged between 10.8 million and 33.5 million bushels. Mexico was the No. 1 destination, with 6.8 million bushels. Cumulative totals for the 2022/23 marketing year remain significantly below last year’s pace, with 1.334 billion bushels.

Ahead of the next USDA crop progress report, out later this afternoon, analysts think the agency will boost corn quality ratings by another two points following some timely rains in some parts of the Midwest this past week, with 57% in good-to-excellent condition through July 16. Individual trade guesses ranged between 56% and 57%.

It should be no surprise that the bigger the corn production, the lower the commodity price, per grain market analyst Bryce Knorr. “USDA kept its forecast for 2023 average cash prices at $4.80, in line with futures contracts for 2023-2024 marketing year delivery,” he notes. “But if USDA’s record 15.320 billion bushel crop is confirmed, futures could ultimately test $4, a benchmark last visited in November 2020. So, unless the toll from the dry June on production potential was too big to overcome, prices in the rest of the summer and fall could have limited upside and more downside.” Click here for more of Knorr’s analysis in today’s Ag Marketing IQ blog.

Brazilian consultancy AgRural reports that 36% of the country’s second corn crop has now been harvested through July 13. That’s noticeably slower than year-ago results of 53%. However, Brazil’s total corn production is still likely to rewrite the record books at just over 5 billion bushels.

Algeria issued an international tender to purchase up to 9.4 million bushels of animal feed corn to be sourced from South America and which closes on Tuesday. The grain is for shipment beginning later this month.

Preliminary volume estimates were for 282,173 contracts, trending 10% below Friday’s final count of 314,288.

Soybeans

Soybean prices survived a choppy session with modest gains after some light net technical buying on Monday. August futures picked up 1.5 cents to $14.8175, while September futures added 5.5 cents to $14.0525.

The rest of the soy complex was mixed. Soymeal futures climbed 2.25% higher, while soyoil futures faded 0.3% to 0.4% into the red today.

Soybean basis bids were steady to week after eroding 5 to 10 cents lower across three Midwestern locations on Monday.

Soybean export inspections were disappointing last week after only reaching 5.7 million bushels. That was below the entire range of trade guesses, which came in between 6.4 million and 14.7 million bushels. Germany was the No. 1 destination, with 2.4 million bushels. Cumulative totals for the 2022/23 marketing year are still modestly below last year’s pace, with 1.833 billion bushels.

Prior to this afternoon’s crop progress report from USDA, analysts think the agency will increase soybean quality ratings by another two points, with 53% rated in good-to-excellent condition through July 16. Individual trade guesses ranged between 52% and 54%.

Preliminary volume estimates were for 167,730 contracts, sliding moderately below Friday’s final count of 202,683.

Wheat

Wheat prices struggled on Monday following a round of technical selling and profit-taking partly spurred by seasonal harvest pressure. September Chicago SRW futures fell 7.5 cents to $6.54, September Kansas City HRW futures lost 14 cents to $8.15, and September MGEX spring wheat futures dropped 7.25 cents to $8.77.

Wheat export inspections were mostly lackluster last week after only reaching 9.3 million bushels. That was toward the lower end of analyst estimates, which ranged between 7.3 million and 17.5 million bushels. Chile was the No. 1 destination, with 3.0 million bushels. Cumulative totals for the 2023/24 marketing year are trending moderately lower year-over-year so far, with 65.2 million bushels.

Ahead of this afternoon’s USDA crop progress report, analysts expect the agency to leave spring wheat quality ratings unchanged, with 47% of the crop in good-to-excellent condition through July 16. Winter wheat harvest progress is expected to move from 46% a week ago up to 57% through Sunday.

According to Russian consultancy Sovecon, the country’s wheat exports could reach 154.3 million bushels. That would be a month-over-month increase of 20%, if realized. Russia is the world’s top wheat exporter.

Bangladesh issued an international tender to purchase 1.8 million bushels of milling wheat that closes on August 1. The grain is for shipment within 40 days of signing a contract.

Preliminary volume estimates were for 113,097 CBOT contracts, shifting moderately above Friday’s final count of 87,516.

About the Author(s)

You May Also Like