Traders await fresh planting data

Afternoon report: How will USDA’s Agricultural Outlook Forum findings drive grain prices?

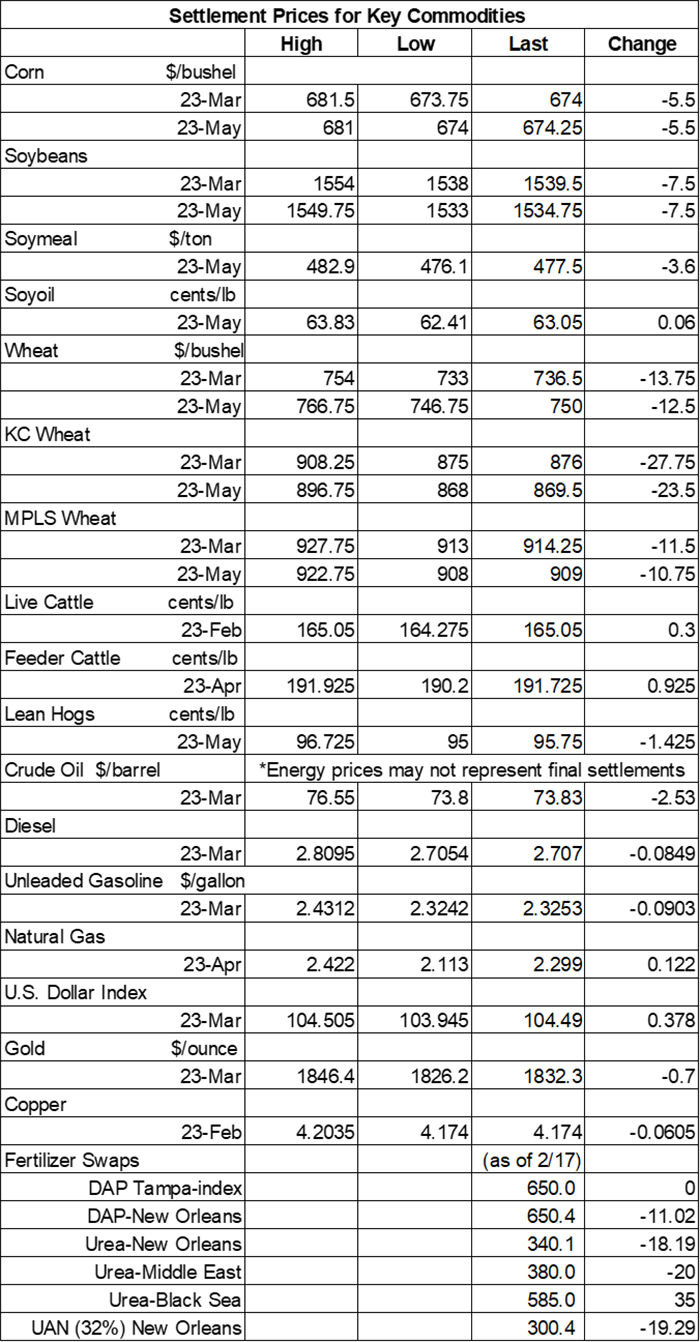

Grain prices suffered some blowback on Wednesday amid broad technical selling. Wheat futures faced the most downside after an uptick in Black Seas competition and a strengthening U.S. Dollar pushed some contracts down as much as 3%. Corn prices faded 0.8% lower, while soybeans closed with losses of around 0.5%.

Most of the central U.S. will see at least some measurable rain and/or snow between Thursday and Sunday, per the latest 72-hour cumulative precipitation map from NOAA. The Great Lakes region is likely to see the highest totals through the rest of this week. NOAA’s new 8-to-14-day outlook predicts more seasonally wet weather for the Midwest and Plains between March 1 and March 7, with warmer-than-normal conditions east of the Mississippi River to start the month.

On Wall St., the Dow trended 52 points lower to 33,076 as investors search for the latest clues on whether the Federal Reserve will continue its currently aggressive interest rate policy amid high inflation. Energy futures faced big cuts, with crude oil sinking more than 3% lower this afternoon to just under $74 per barrel. Diesel dropped 2.75%, while gasoline tumbled 3.5% lower. The U.S. Dollar firmed moderately.

On Tuesday, commodity funds were net buyers of corn (+2,500), soybeans (+9,000), soymeal (+3,500) and soyoil (+3,500) contracts but were net sellers of CBOT wheat (-6,000).

Corn

Corn prices faded moderately lower amid a broad commodity selloff on Wednesday, closing with losses of around 0.8% on Wednesday. March and May futures each dropped 5.5 cents, closing at $6.75.

Corn basis bids were largely steady across the central U.S. on Wednesday but did tilt 2 to 5 cents lower at two Midwestern ethanol plants today.

USDA will release its initial 2023 crop acreage estimates later this week during the agency’s annual Agricultural Outlook Forum. Ahead of the agency’s official estimates, analysts are expecting to see corn plantings at 90.9 million acres. Assuming average yields of 179.7 bushels per acre, that would generate a total production of 14.949 billion bushels.

Brazil’s Anec estimates that the country’s corn exports will reach 78.3 million bushels this month, which is slightly below the group’s prior projection from a week ago. Anec also predicts the country will export 24.6 million bushels of wheat this month.

“Pushing a pencil in the middle of February may not seem very exciting,” according to grain market analyst Bryce Knorr. “But crop budgets farmers are finishing right now could prove just as important to prices as the swashbuckling antics of big traders in the commodity markets.” Both corn and soybeans appear to be profitable choices for 2023, Knorr adds, and digs through some additional interesting historical data in his latest column – click here to learn more.

What is confirmation bias, and why is it important to learn about it as part of your grain marketing strategy? Ryan Fogel, ag risk advisor with Advance Trading, explores the situation in detail in today’s Ag Marketing IQ blog – click here to learn more.

Preliminary volume estimates were for 278,542 contracts, which was moderately below Tuesday’s final count of 360,185.

Soybeans

Soybean prices spilled 0.5% lower, which was relatively mild compared to some other commodities amid a broad selloff on Wednesday. March and May futures each lost 7.5 cents, closing at $15.4125 and $15.3650, respectively.

The rest of the soy complex was mixed. Soymeal futures also suffered a moderate technical setback, trending almost 1% lower, while soyoil futures picked up fractional gains today.

Soybean basis bids were steady across most Midwestern locations on Wednesday but did shift 5 cents lower at an Ohio elevator today.

Ahead of the 2023 USDA Agricultural Outlook Forum, analysts expect the agency to show soybean plantings to reach 88.6 million acres this season. Assuming average yields of 51.5 bushels per acre, that would generate a total production of 4.515 billion bushels.

Brazil’s Anec estimates that the country’s soybean exports will reach 305.0 million bushels in February, which is moderately below the group’s prior projection from a week ago. Anec also predicts that Brazilian soymeal exports will reach 1.54 million metric tons this month.

High stakes farming doesn’t have to be a gamble! See what Illinois farmer Terry Pope is doing to minimize the risk on his operation, along with additional expert recommendations – click here to learn more.

Preliminary volume estimates were for 208,353 contracts, trending moderately lower than Tuesday’s final count of 268,035.

Wheat

Wheat prices incurred double-digit losses following a major round of technical selling spurred by fierce global competition and a rising U.S. Dollar that keeps U.S. exports locked out of some markets at current prices. March Chicago SRW futures fell 13.75 cents to $7.3675, March Kansas City HRW futures lost 27.75 cents to $8.7650, and March MGEX spring wheat futures dropped 11.5 cents to $9.13.

Ahead of the 2023 USDA Agricultural Outlook Forum, analysts expect the agency to show all wheat plantings at 48.7 million acres. Assuming an average yield of 48.6 bushels per acre, that would lead to a total production of 1.893 billion bushels.

Iraq issued a tender to purchase 7.3 million bushels of milling wheat that closes on Thursday. The tender is restricted to a limited number of trading houses and can only be sourced from the United States, Canada or Australia. Additional information about shipment timing was not immediately available.

After announcing yesterday that it intends to buy an unusually large amount of wheat, Turkey followed up by issuing an additional international tender to purchase 20.2 million bushels of animal feed barley from optional origins that closes on March 2. Turkey is looking to ramp up its grain supplies following a massive, deadly earthquake earlier this month. Turkey is seeking rapid delivery starting in early March.

Japan purchased 3.5 million bushels of food-quality wheat from the United States, Canada and Australia in a regular tender that closed earlier today. Of the total, 38% was sourced from the U.S. The grain is for shipment starting in late March.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)