Soybeans finally stop the bleeding

Afternoon report: Corn prices suffer another technical setback, with wheat prices mixed on Thursday.

Grain prices saw some steep losses earlier this week after rainy weather forecasts triggered plenty of technical selling – especially on Tuesday and Wednesday. Corn prices continued to erode lower today, while soybeans finally captured some gains. Spring wheat prices moved moderately higher, while winter wheat prices faced small to moderate declines on Thursday.

Between Friday and Monday, a band stretching from Nebraska through Ohio could potentially see as much as 1.5” or more additional rainfall, per the latest 72-hour cumulative precipitation map from NOAA. And the rest of the Corn Belt should see at least some measurable moisture during this time. Also be aware that a “likely derecho” is moving across some key production areas – click here for some initial details. Further out, NOAA’s new 8-to-14-day outlook predicts above-normal precipitation for the entire central U.S. between July 6 and July 12, with some warmer-than-normal temperatures also likely for the eastern Corn Belt.

On Wall St., the Dow improved 215 points in afternoon trading to reach 34,068 on a positive revision for the GDP. As the first half of 2023 draws to a close, the S&P 500 is up 14.2%, the Nasdaq is up 29.5% and the Dow is up 2.8%. Energy futures were also in the green today, with crude oil up around 0.4% this afternoon to stay just below $70 per barrel. Diesel and gasoline captured similar percentage gains. The U.S. Dollar firmed moderately.

On Wednesday, commodity funds were net sellers of all major grain contracts, including corn (-20,000), soybeans (-18,000), soymeal (-5,000), soyoil (-4,000) and CBOT wheat (-13,000).

Corn

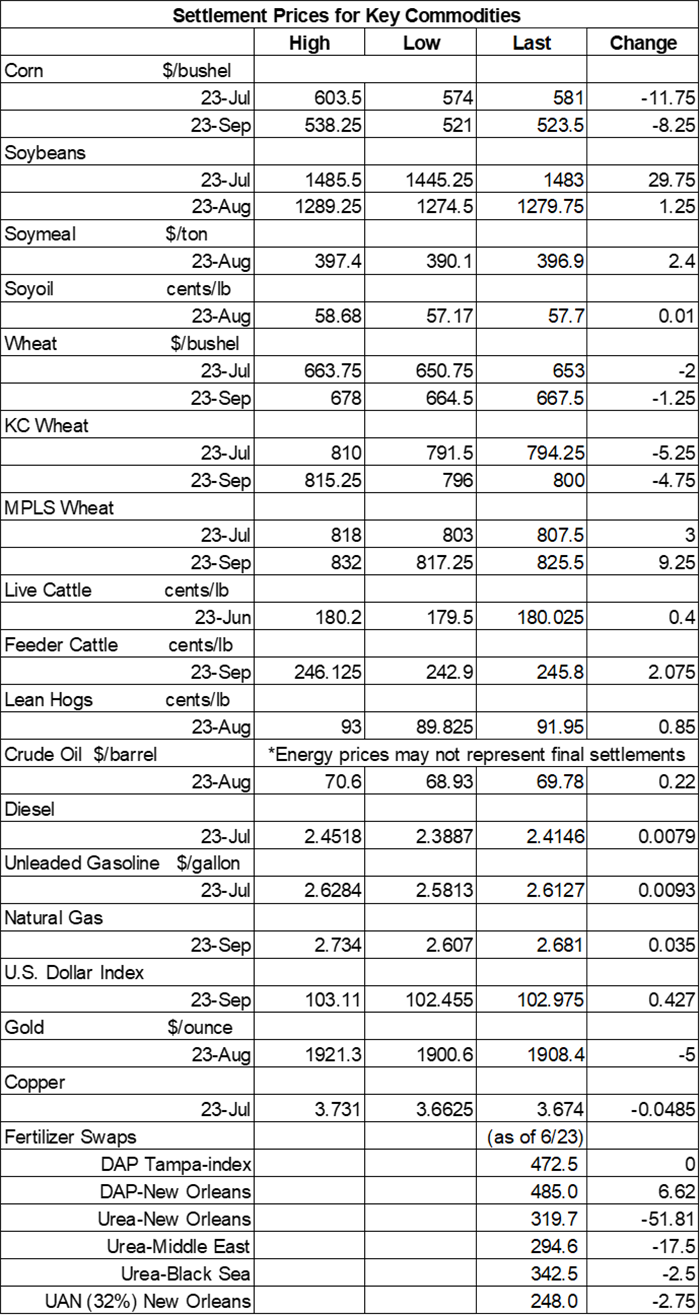

Corn prices once again eroded lower on yet another round of technical selling, losing another 1.5% to 2% on Thursday. July futures fell 11.75 cents to $5.7825, with September futures down 8.25 cents to $5.23.

Corn basis bids were largely steady across the central U.S. on Thursday but did tilt 8 cents lower at an Iowa river terminal today.

Corn exports found 10.4 million bushels in combined old and new crop sales last week. Old crop sales trended 16% below the prior four-week average. Last week’s tally was also toward the lower end of trade guesses, which ranged between net reductions of 3.9 million bushels and net sales of 27.6 million bushels. Cumulative totals for the 2022/23 marketing year are nearly 700 million bushels below last year’s pace, with 1.348 billion bushels.

Corn export shipments eased 9% lower week-over-week to 23.8 million bushels. Mexico, Japan, Colombia, El Salvador and Panama were the top five destinations.

Brazil’s head of the country’s food agency Conab announced that the Brazilian government will began purchasing around 19.7 million bushels of corn to rebuild its local stocks but did not immediately offer additional details.

After a solid run-up in prices earlier this year, followed by some steep cuts caused by rainy forecasts, some analysts were left wondering if the “summer high” for grain prices has already come and gone, including Naomi Blohm, senior market adviser with Stewart Peterson. “In the coming weeks, there will be a plethora of information thrown at the grain markets which could potentially allow for another rally or price plunge,” she notes. Blohm offers a breakdown of four important factors to track over the next several weeks in today’s Ag Marketing IQ blog – click here to learn more.

South Korea purchased 2.7 million bushels of animal feed corn, likely sourced from South America or South Africa, in a private deal that closed earlier today. The grain is for arrival by mid-November.

Preliminary volume estimates were for 392,445 contracts, tracking moderately below Wednesday’s final count of 563,565.

Soybeans

Soybean prices captured variable gains amid a somewhat choppy session on Thursday. July futures climbed 29.75 cents to $14.8075, while August futures only picked up 3.5 cents to $13.6450. The rest of the soy complex was also in the green today. Nearby soymeal futures trended 0.25% higher, while nearby soyoil contracts jumped more than 2% higher.

Soybean basis bids were steady to soft after eroding 5 to 15 cents lower across five Midwestern locations on Thursday.

Soybean exports landed 9.0 million bushels in combined old and new crop sales last week. Old crop sales were down 50% week-over-week and were 28% below the prior four-week average. Total sales were also on the very low end of trade estimates, which ranged between 7.3 million and 25.7 million bushels. Cumulative totals for the 2022/23 marketing year are modestly below last year’s pace, with 1.804 billion bushels.

Soybean export shipments faded 24% below the prior four-week average to 7.0 million bushels. Mexico, Japan, Indonesia, Colombia and Taiwan were the top five destinations.

Prior to the next monthly soybean crushing report from USDA (out July 3), analysts expect the agency to show a May crush totaling 189.8 million bushels. Individual trade guesses ranged between 188.0 million and 191.0 million bushels. If realized, it would be an increase from April’s tally of 187.0 million bushels and the highest May crush on record. Soyoil stocks are expected to come in at 2.437 billion pounds through May 31.

Preliminary volume estimates were for 200,508 contracts, sliding moderately below Wednesday’s final count of 264,407.

Wheat

Wheat prices were mixed but mostly lower following an uneven round of technical maneuvering on Thursday, with winter wheat futures trending lower and spring wheat futures trending higher. September Chicago SRW futures eased 1.25 cents lower to $6.6850, September Kansas City HRW futures dropped 4.75 cents to $8.01, and September MGEX spring wheat futures rose 9.25 cents to $8.2750.

Wheat exports only gathered 5.7 million bushels in new crop sales last week. That was toward the lower end of trade estimates, which ranged between 1.8 million and 14.7 million bushels. Cumulative totals for the young 2023/24 marketing year are slower than last year’s pace so far, with 27.7 million bushels.

Wheat export shipments were pedestrian last week, with just 5.8 million bushels. Japan, Taiwan, Mexico, Jamaica and Guatemala were the top five destinations.

Tim Schaefer, founder of Encore Wealth Advisors, has found that the more successful the farm, the more opportunities that seem to come their way. “Saying no to the wrong opportunities or people is just as important as saying yes to the right ones,” he adds. Schaefer explores the idea of understanding your operation’s values to create clarity and alignment for when these opportunities present themselves in his latest blog – click here to learn more.

About the Author(s)

You May Also Like