Soybeans continue to slide lower

Afternoon report: Corn prices bounce back on Wednesday after getting slashed on Tuesday.

Grain prices continue to face seasonal stress as planting progress marches forward in the Midwest. Wet weather in the Plains were also hard on most wheat contracts on Wednesday. Corn prices stayed in the green after posting moderate gains. Soybeans suffered double-digit declines and faded to a one-week low in the process. Most what contracts were also in the red, although nearby Kansas City HRW contracts climbed considerably higher today.

Loads of rainy weather is on its way to the Plains later this week, with some areas set to collect another 2” to 3” or more between Thursday and Sunday, per the latest 72-hour cumulative precipitation map from NOAA. Nearly all of the Corn Belt could see at least some measurable moisture during this time. NOAA’s new 8-to-14-day outlook predicts a return to seasonally dry weather for the Northern Plains and upper Midwest between May 17 and May 23, with colder-than-normal conditions likely for most of the Midwest.

On Wall St., the Dow sank 185 points lower in afternoon trading to 33,376 amid lingering concerns that the U.S. will fall into a recession later this year. Energy futures were mixed. Crude oil spilled 1.5% lower to $72 per barrel on larger-than-expected inventories. Diesel was near-even, meantime, with gasoline up almost 0.5%. The U.S. Dollar softened slightly.

On Tuesday, commodity funds were net sellers of all major grain contracts, including corn (-9,500), soybeans (-8,500), soymeal (-4,500), soyoil (-2,000) and CBOT wheat (-4,500).

Corn

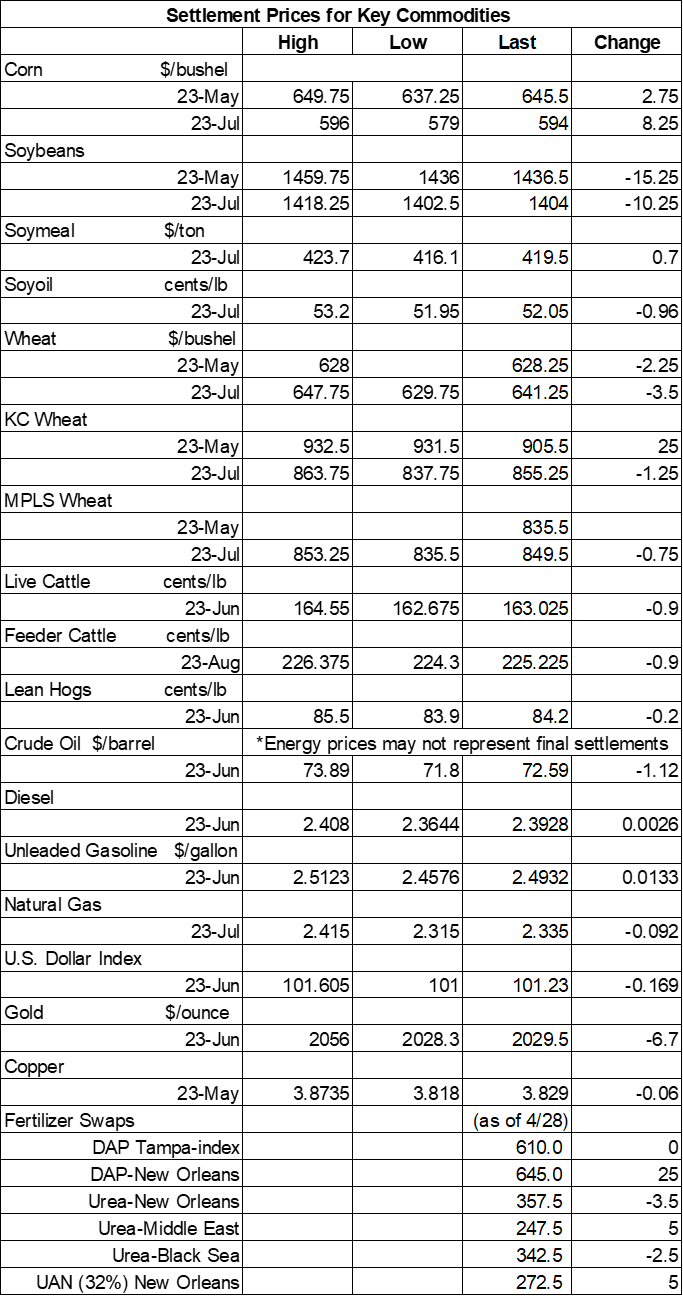

Corn prices bounced back on Wednesday, recapturing a portion of steep losses incurred on Tuesday. May futures picked up 2.75 cents to $6.45, with July futures up 8.25 cents to $5.93.

Corn basis bids were steady to mixed across the central U.S. on Wednesday after moving as much as 10 cents higher at an Iowa river terminal and as much as 15 cents lower at an Iowa processor today.

Ethanol production for the week ending May 5 eased slightly, with a daily average of 965,000 barrels, per the latest data from the U.S. Energy Information Administration, out earlier today. It was also the third consecutive week that volume failed to reach the 1-million-barrel-per-day benchmark. Ethanol stocks faded to a 22-week low.

Ahead of Thursday morning’s export report from USDA, analysts expect to see corn sales ranging between net reductions of 3.9 million bushels and net sales of 43.3 million bushels for the week ending May 4.

Turkey’s foreign minister said he has hopes that the deal currently in place that allows for safe passage of shipping vessels in the Black Sea could be extended for another two months. Negotiations among Turkey, Ukraine, Russia and the United Nations are ongoing. The current deal is set to expire on May 18 unless it is further extended.

Per the latest data from the European Commission, 2022/23 EU corn imports are tracking 67% above last year’s pace after reaching 914.1 million bushels through May 7. Ukraine, Brazil, Canada, Serbia and Russia were the top five suppliers.

Brazilian consultancy Pátria Agronegócios moderately increased its estimates for the country’s 2022/23 second corn crop production, moving that total to 3.825 billion bushels. Brazil’s safrinha crop accounts for roughly three-fourths of its total corn production.

And according to results from a separate analyst poll conducted by Reuters, Brazil’s total 2022/23 corn production could reach 4.988 billion bushels, citing favorable weather to close out the year despite some late plantings. If realized, this would be a year-over-year increase of 12%.

Taiwan purchased 2.6 million bushels of animal feed corn, likely sourced from Brazil, in an international tender that closed earlier today. Additional details were not immediately available.

Grain traveling the nation’s railways included an additional 21,700 carloads last week. That brings cumulative totals for 2023 to 389,442 carloads, which is down 6% from last year’s pace so far.

Preliminary volume estimates were for 356,403 contracts, which was moderately higher than Tuesday’s final count of 325,024.

Soybeans

Soybean prices slid back into the red after rapid planting progress triggered another round of technical selling today. May futures dropped 15.25 cents to $14.3650, with July futures down 10.25 cents to $14.04.

The rest of the soy complex was mixed. Soymeal futures moved modestly higher, while soyoil futures tumbled more than 1.75% lower.

Soybean basis bids held steady across the central U.S. on Wednesday.

Prior to tomorrow morning’s export report from USDA, analysts think the agency will show soybean sales ranging between 5.5 million and 25.7 million bushels for the week ending May 4. Analysts also expect to see another 50,000 to 350,000 metric tons of soymeal sales last week, plus up to 22,000 MT of soyoil sales.

European Union soybean imports during the 2022/23 marketing year have reached 391.7 million bushels through May 7, which is 12% below last year’s pace so far. The United States, Brazil, Ukraine, Canada and Uruguay are the top five suppliers. EU soymeal imports are trending slightly below last year’s pace, meantime, with 13.36 million metric tons.

Preliminary volume estimates were for 151,750 contracts, tracking moderately below Tuesday’s final count of 173,337.

Wheat

Wheat prices suffered a minor technical setback on Wednesday as more rain is expected to land on the parched Plains later this week. Traders remain wary of whether a critical Black Sea shipping deal will see an extension before it expires next week. July Chicago SRW futures dropped 3.5 cents to $6.40, July Kansas City HRW futures slid 1.25 cents to $8.55, and July MGEX spring wheat futures eased 0.75 cents to $8.47.

Prior to Thursday morning’s export report from USDA, analysts expect to see wheat sales ranging between 6.4 million and 23.0 million bushels for the week ending May 4.

European Union soft wheat exports during the 2022/23 marketing year are trending 11% higher year-over-year after reaching 973.3 million bushels through May 7. Morocco, Algeria, Nigeria, Egypt and Saudi Arabia were the top five destinations. EU barley exports are down 19% compared to last year’s pace, meantime, with 250.3 million bushels over the same period.

Russian consultancy Sovecon is now estimating that the country’s wheat exports will reach 141.5 million bushels in May. That would be a monthly decrease of 10.5%, if realized and the lowest monthly tally since February. Russia is the world’s No. 1 wheat exporter.

Algeria purchased an estimated 18.4 million bushels of milling wheat from optional origins in an international tender that closed today. The grain is for shipment in June or July, depending on the source.

Japan is hoping to acquire 2.2 million bushels of feed wheat and a little over 900,000 bushels of feed barley in a simultaneous buy-and-sell auction that will be held on May 17. The grain will be for arrival in late October pending any sales.

About the Author(s)

You May Also Like