Profit-taking threatens some grain prices

Afternoon report: Soybeans stand firm, but corn closes with narrowly mixed results; wheat mixed but mostly lower.

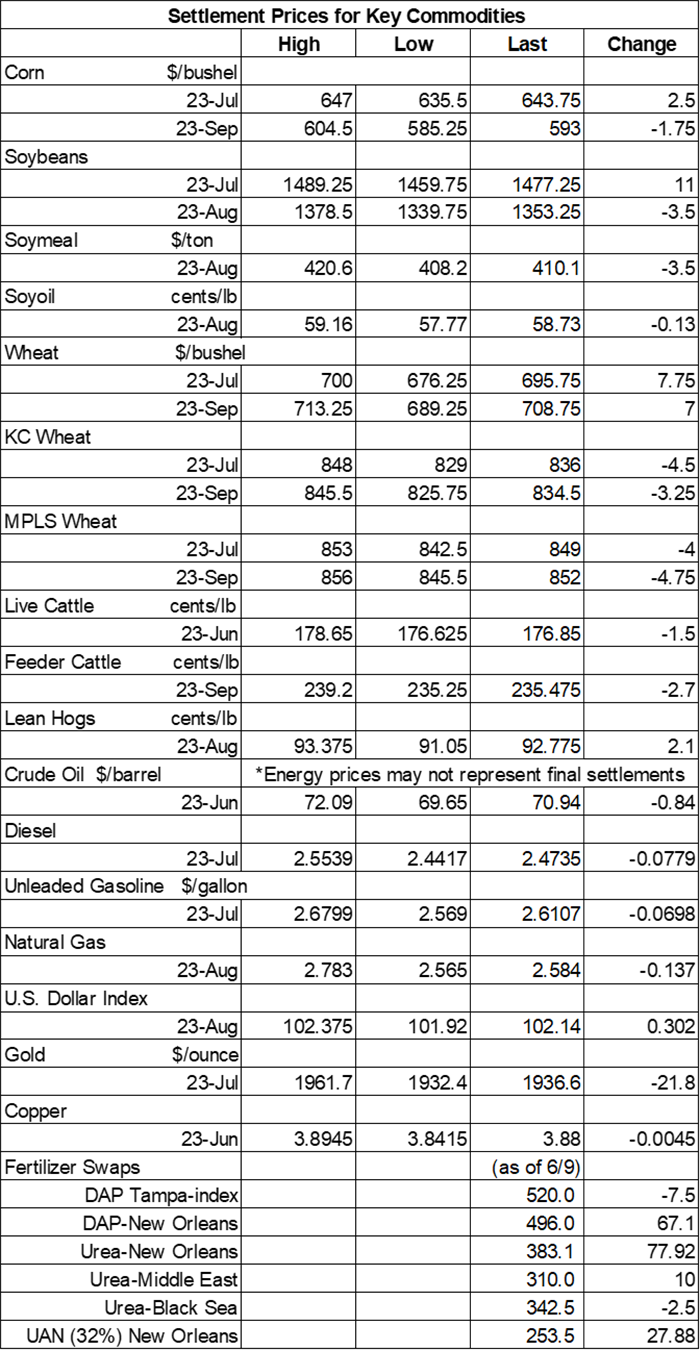

A major weather rally surfaced late last week, but prices were hard-pressed to push even higher today with some profit-takers entering the fray. Soybeans stood firm, as did CBOT wheat contracts. However, Kansas City HRW and MGEX spring wheat prices faded 0.5% lower. Corn finished today’s session with lightly mixed results.

The Northern and Central Plains should see some decent rains fall later this week, with some fields likely to gather another 1” or more between Wednesday and Saturday, per the latest 72-hour cumulative precipitation map from NOAA. In contrast, most of Missouri, Illinois, Iowa and Wisconsin won’t receive any measurable moisture during this time. Further out, NOAA’s new 8-to-14-day outlook predicts some seasonally wet conditions returning to the eastern Corn Belt between June 27 and July 3, with warmer-than-normal temperatures in store for the central U.S.

On Wall St., the Dow shifted 187 points lower in afternoon trading to 34,111 as the latest rally takes a bit of a breather following a three-day weekend. Energy futures also took a hit, with crude oil down more than 1% to slide just below $71 per barrel on concerns over China’s growth potential. Gasoline and diesel both dropped more than 2.5%. The U.S. Dollar firmed moderately.

On Friday, commodity funds were net buyers of all major grain contracts, including corn (+16,000), soybeans (+23,500), soymeal (+12,500), soyoil (+5,500) and CBOT wheat (+11,000).

Corn

Corn prices pushed through a choppy session on Tuesday but was ultimately not able to move the needle much in either direction after closing with narrowly mixed results. July futures added 2.5 cents to $6.4275, while September futures eased 1.75 cents lower to $5.9225.

Corn basis bids were mostly steady to soft across the central U.S. after eroding 3 to 13 cents lower at five Midwestern locations on Tuesday. An Iowa processor bucked the overall trend after trending 6 cents higher today.

According to USDA’s website, the agency’s latest grain export inspection report, which should have been released Tuesday morning, has been delayed “due to technical difficulties with data collection.” Prior to the report, analysts indicated they are expecting corn volume to trend between 23.6 million and 49.2 million bushels for the week ending June 15.

Prior to the next crop progress report from USDA, out later today, analysts expect the agency to show corn quality degrading another three points lower amid ongoing hot and dry conditions through much of the Midwest, with 58% rated in good-to-excellent condition through June 18. Individual trade guesses ranged between 56% and 59%.

Per the latest data from the European Commission, EU corn imports during the 2022/23 marketing year have reached 1.196 billion bushels through June 18, which is a year-over-year increase of 57% so far. Ukraine, Brazil, Canada, Serbia and Russia are the top five destinations.

Brazilian consultancy AgRural reported that 4.6% of the country’s second corn crop has been harvested, which is noticeably slower than last year’s pace of 11.4%. Brazil’s total corn production is expected to reach a new record of around 5 million bushels this season.

Taiwan issued an international tender to purchase 2.6 million bushels of animal feed corn, sourced from the United States, South America or South Africa, that closes on Wednesday. The grain is for shipment starting in September, depending on origin.

Preliminary volume estimates were for 540,137 contracts, sliding moderately below Friday’s final count of 727,522.

Soybeans

Soybean prices continued to gain some ground following a choppy session on Tuesday as traders remain mostly focused on hot, dry weather forecasts that could further plague this year’s crop. July futures rose 11 cents to $14.7750, with August futures up 2 cents to $14.0950.

The rest of the soy complex spilled into the red today. Soymeal futures fell more than 0.75% lower, while soyoil futures eased 0.25% lower.

Soybean basis bids took a beating across half a dozen Midwestern processors on Tuesday after dropping between 5 and 35 cents at those locations. Bids also eroded 10 cents lower at an Ohio river terminal and eased a penny lower at an Ohio elevator today.

Ahead of the next grain export inspection report from USDA, analysts expect the agency to show soybean volume between 3.7 million and 11.0 million bushels for the week ending June 15.

Prior to this afternoon’s crop progress report from USDA, analysts expect the agency to lower soybean quality ratings from 59% in good-to-excellent condition a week ago down to 57% through Sunday. Individual trade guesses ranged between 55% and 58%.

European Union soybean imports during the 2022/23 marketing year have reached 460.0 million bushels through June 18, which is a year-over-year decrease of 11.6% so far. EU soymeal imports are also down from last year’s pace after totaling 3.86 million metric tons over the same period.

In an attempt to cool high prices and draw down its stockpile, China will auction off 11.3 million bushels of its state soybean reserves on June 27. This will be the first soybean auction of 2023, but China has held multiple auctions for corn and wheat in recent months.

Preliminary volume estimates were for 368,749 contracts, declining moderately from Friday’s final count of 473,294.

Wheat

Wheat prices were mixed but mostly lower following some uneven technical maneuvering on Tuesday. September Chicago SRW futures added 7 cents to $7.0850 while September Kansas City HRW futures fell 3.25 cents to $8.3575 and September MGEX spring wheat futures dropped 4.75 cents to $8.5175.

Prior to USDA’s next grain export inspection report, analysts think the agency will show wheat volume come in between 5.5 million and 14.7 million bushels for the week ending June 15.

Ahead of this afternoon’s crop progress report from USDA, analysts expect the agency to hold winter wheat quality ratings steady, with 38% of the crop in good-to-excellent condition through June 18. Harvest progress is expected to move from 8% a week ago up to 19% through Sunday. Spring wheat quality ratings are expected to decline two points, with 57% rated in good-to-excellent condition through Sunday.

European Union soft wheat exports during the 2022/23 marketing year are down 11% from last year’s pace after reaching 1.116 billion bushels through June 18. Morocco, Algeria, Nigeria, Egypt and Saudi Arabia were the top five destinations.

Algeria’s state grains agency is thought to have purchased 20.9 million bushels of milling wheat, likely sourced from Russia, in an international tender that closed on Monday. The grain is for shipment in August.

Japan issued a regular tender to purchase 3.4 million bushels of food-quality wheat from the United States, Canada and Australia that closes on Thursday. Of the total, 35% is expected to be sourced from the U.S. The grain is for shipment in August.

Preliminary volume estimates were for 179,251 CBOT contracts, which was moderately below Friday’s final count of 241,214.

About the Author(s)

You May Also Like