Poor U.S. crop quality keeps wheat firm

Afternoon report: Corn also climbs higher on Monday, with the soybean complex narrowly mixed.

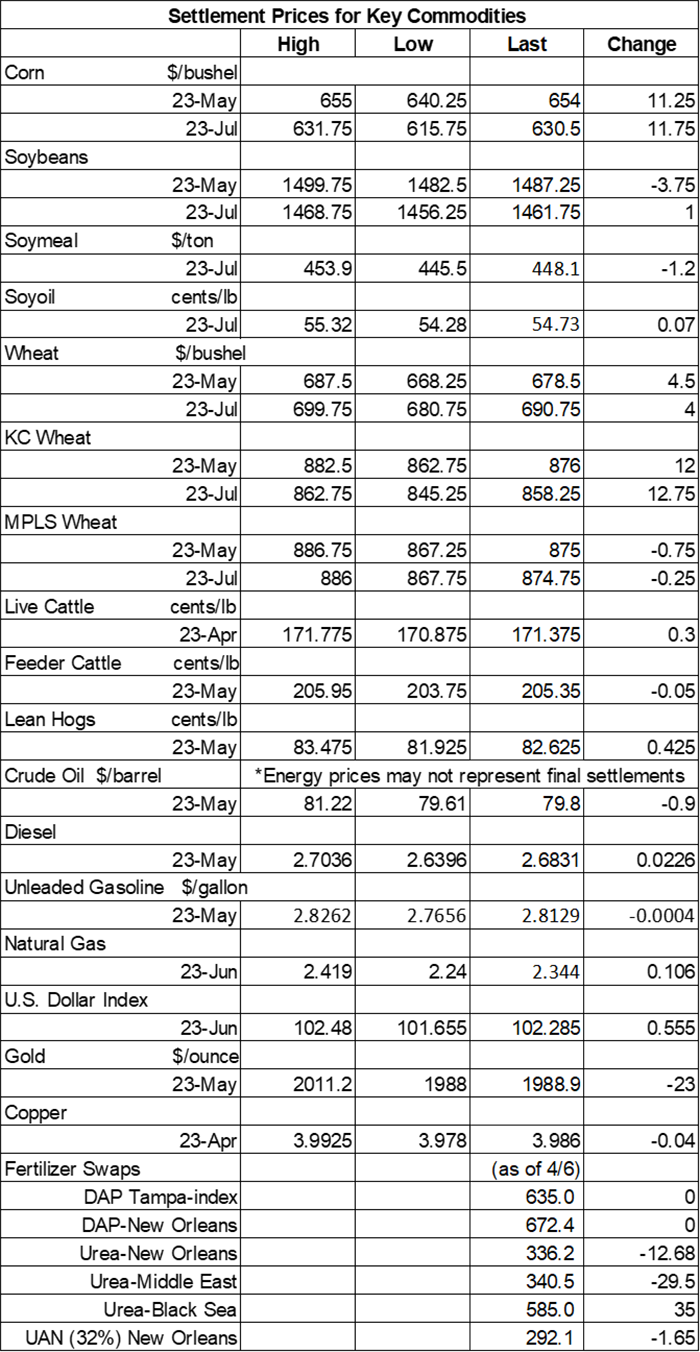

Worries about crop quality in the United States, compounded with lingering concerns that a key Black Sea shipping deal won’t get renewed next month without some substantive revisions, kept winter wheat prices moving higher on Monday. Corn prices also finished strong today, with gains of around 1.75%. The soybean complex was lightly mixed, meantime, as traders finished squaring positions ahead of tomorrow’s World Agricultural Supply and Demand Estimates (WASDE) report from USDA.

The Midwest and Plains will be mostly dry between Tuesday and Friday, although the Dakotas and Minnesota will see at least some measurable moisture during that time, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts below-average precipitation for the Great Lakes region between April 17 and April 23, with seasonally cool weather likely for most of the Corn Belt next week.On Wall St., the Dow tested modest gains of 34 points in afternoon trading, reaching 33,519, as investors await a new critical round of inflation data out later this week. Energy futures were mixed. Crude oil retreated 0.75% lower to $80 per barrel. Gasoline faced fractional cuts, while diesel climbed 1% higher. The U.S. Dollar firmed moderately.

Last Thursday, commodity funds were net buyers of soymeal (+2,500) contracts but were net sellers of corn (-7,500), soybeans (-9,000), soyoil (-3,000) and CBOT wheat (-3,000). Grain markets were closed on Friday in observance of Good Friday.

Corn

Corn prices were near-even in overnight trading but made some solid forward momentum after a round of technical buying on Monday led to gains of 1.75% by the close. May futures rose 11.25 cents to $6.5475, with July futures up 11.75 cents to $6.3150.

Corn basis bids were mostly steady across the central U.S. to start the week but did trend as much as 5 cents higher at an Indiana ethanol plant and as much as 10 cents lower at an Illinois ethanol plant on Monday.

Will corn basis gains keep coming? That’s a question that has been on grain market analyst Bryce Knorr’s mind recently. “While watching new crop bids for preharvest pricing opportunities is important, farmers still have a whole lot of inventory to move – 4.1 billion bushels of it, according to USDA’s recent estimate of March 1 supplies,” he notes. “That grain represents around 30% of the 2022 corn crop, smack on the average over the past decade or so. In all, 7.4 billion bushels were sitting in on-farm and commercial storage. On-farm bins held 55% of March 1 inventories, in the middle of the 49% to 60% range seen in recent years.” Knorr explores the topic in much greater detail in today’s Ag Marketing IQ blog – click here to learn more.

Corn export inspections moved 27% lower week-over-week to 31.7 million bushels. That was also toward the lower end of trade estimates, which ranged between 23.6 million and 51.2 million bushels. Mexico (8.5 million) and China (8.2 million) were the top two destinations. Cumulative totals for the 2022/23 marketing year remain well below the prior year’s pace so far, with 794.2 million bushels since the beginning of September.

Ahead of the April WASDE report from USDA, out Tuesday morning, analysts expect the agency to show 2022/23 corn ending stocks at 1.319 billion bushels, which would be moderately below March’s tally of 1.342 billion bushels, if realized. Individual trade guesses ranged between 1.242 billion and 1.392 billion bushels.

Ukraine’s total grain exports during the 2022/23 marketing year are down around 14% compared to last year’s pace as the country continues its struggles against an ongoing Russian invasion. That includes corn sales totaling 897.6 million bushels, plus another 488.7 million bushels of wheat sales. Ukraine is among the world’s top exporters of both commodities.

Preliminary volume estimates were for 288,795 contracts, shifting slightly ahead of Thursday’s final count of 271,649.

Soybeans

Soybean prices failed to find much positive momentum after some uneven technical maneuvering on Monday led to mixed results. May futures dropped 3.75 cents to $14.8875, while July futures picked up a penny to reach $14.6350.

The rest of the soy complex was also mixed today. Soymeal prices faced moderate cuts, while soyoil futures found fractional gains.

Soybean basis bids were mostly steady across the central U.S. on Monday but did tilt 3 cents lower at an Ohio elevator today.

Soybean export inspections moved moderately higher week-over-week after reaching 24.6 million bushels. That was also on the higher end of trade estimates, which ranged between 13.8 million and 29.4 million bushels. China topped all destinations, with 10.6 million bushels. Cumulative totals for the 2022/23 marketing year are trending slightly above last year’s pace so far, with 1.695 billion bushels.

Prior to Tuesday morning’s WASDE report from USDA, analysts think the agency will show 2022/23 soybean ending stocks at 198 million bushels in April, which would be modestly below March’s tally of 210 million bushels, if realized. Individual trade guesses ranged between 170 million and 225 million bushels.

Brazilian consultancy AgRural reported that 82% of the country’s 2022/23 soybean harvest is now complete through April 6. That’s two points slower than last year’s pace of 84% so far. Most entities are predicting a record-breaking harvest somewhere north of 5.5 billion bushels this season.

Naomi Blohm, senior market adviser with Stewart Peterson, has described soybean ending stocks so far in 2023 as “snug.” Will the April WASDE report continue to show historically tight stocks? “Time will tell, but a number under 200 million bushels would be quite supportive to old crop soybean futures prices and cash prices for the short term,” she says. Analysts are anticipating that ending stocks will indeed fall below that benchmark, with an average trade guess of 198 million bushels. For more of Blohm’s latest analysis, click here.

Preliminary volume estimates were for 206,779 contracts, tracking moderately below Thursday’s final count of 238,549.

Wheat

Wheat prices were mixed but mostly higher as traders assessed the latest conditions in the Plains, where 77.6% of the region is still under drought conditions. Worries over the long-term viability of a current Black Sea shipping deal, which is set for a possible extension in May, lent additional price support on Monday. May Chicago SRW futures added 4.5 cents to $6.80, May Kansas City HRW futures rose 12 cents to $8.7650, and May MGEX spring wheat futures eased 0.75 cents to $8.7125.

Wheat export inspections made moderate week-over-week improvements, reaching 12.3 million bushels. That was near the middle of analyst estimates, which ranged between 5.5 million and 18.4 million bushels. Japan was the top destination, with 3.8 million bushels. Cumulative totals for the 2022/23 marketing year are running slightly below last year’s pace, with 631.8 million bushels.

Ahead of Tuesday morning’s WASDE report from USDA, analysts expect to see 2022/23 wheat ending stocks shift from 568 million bushels in March up to 574 million bushels in April. Individual trade estimates ranged between 553 million and 598 million bushels.

And prior to the next USDA crop progress report, out Monday afternoon, analysts expect the agency to show winter wheat quality at 28% rated in good-to-excellent condition through April 9, steady from a week ago and the lowest level at this time of year since 1996, if realized. Spring wheat plantings are expected to reach 2%. Individual trade guesses ranged between zero and 3%.

Russian consultancy Sovecon estimates that the country’s wheat exports in April will reach 161.7 million bushels. That would be a monthly decline of 2.2%, if realized. Russia is the world’s No. 1 wheat exporter.

Preliminary volume estimates were for 128,541 CBOT contracts, which was slightly above Thursday’s final count of 115,305.

About the Author(s)

You May Also Like