Persistent drought leads to ‘Cattle on Feed’ surprises

Drought and higher prices cause surge in September placements.

Nature is obviously continuing to have a very heavy impact on producers’ decisions, USDA Livestock Economist Shayle Shagam said following the release of USDA’s October “Cattle on Feed” report that showed higher feedlot placements and lower marketings. Shagam said large areas of the nation are still in drought, leading to short forage supplies and serious concerns about water availability in parts of the country.

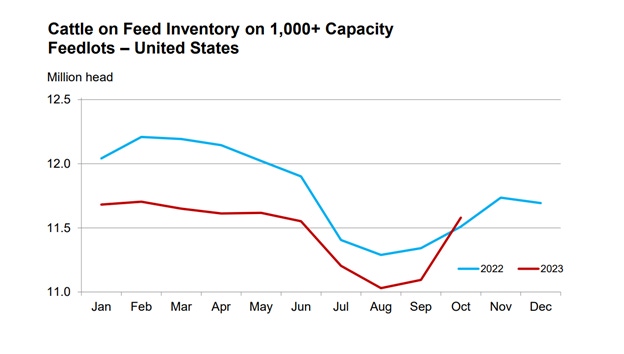

The report showed feedlot inventory totaled 11.6 million head on October 1, 2023, a 1% rise from October 1, 2022. USDA said this is the second highest October 1 inventory since the series began in 1996. The trade had expected the inventory to be unchanged from last year’s levels.

The inventory included 6.95 million steers and steer calves, up slightly from the previous year. The group accounted for 60% of the total inventory. Heifers and heifer calves accounted for 4.64 million head, up 1% from 2022. Shagam said reveals cattle producers are still sending more heifers to feedlots instead of retaining them for breeding.

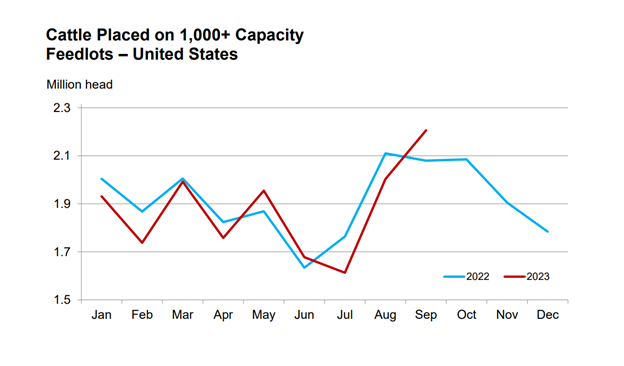

Placements in feedlots during September totaled 2.21 million head, 6% above 2022. The trade had only expected a 1% rise in the number.

Net placements were 2.15 million head. During September, placements of cattle and calves weighing less than 600 pounds were 460,000 head, 600-699 pounds were 355,000 head, 700-799 pounds were 485,000 head, 800-899 pounds were 521,000 head, 900-999 pounds were 290,000 head, and 1,000 pounds and greater were 95,000 head.

Image credit: USDA NASS

Marketings of fed cattle during September totaled 1.66 million head, 11% below 2022. The trade had expected an 8% decline.

Derrell Peel, livestock economist for Oklahoma State University Extension, said the September surge in placements has temporarily halted the slow decline seen over the last year. With 68% of the increase in September placements between 700 and 900 pounds, he said the bulk of the cattle will be marketed in the first quarter of 2024. The rest will be marketed in the second half of 2024.

Peel echoed Shagam’s sentiments that placements were likely drought induced. But he added, “Increased placements no doubt also reflects many producers selling feeder cattle to take advantage of the sharply higher prices this fall.”

Peel further pointed out that continued heifer feeding made up the biggest part of the increase in feedlot inventories. The September number of heifers on feed was 3.7% higher than July and 1.3% higher than the same period last year. At 40% of the total cattle on feed, Peel said this is the highest level since October 2001.

Female liquidation continues

According to Peel, the industry continues to liquidate females as monthly slaughter data through September shows that total female (cow and heifer) slaughter has averaged 51.8% of total cattle slaughter for the past twelve months. This is the highest twelve-month average female slaughter percentage since August 1986.

Peel said the latest slaughter data and the latest “Cattle on Feed” report both suggest that heifer retention is not beginning in 2023. Year-to-date beef cow slaughter is down 12.9% from last year but will still result in a net culling rate over 11.5% for year, indicating continued liquidation.

“The beef cow herd will be smaller in January 2024, and it increasingly looks like the best that could happen in 2024 is to stabilize the herd with significant growth delayed until 2025 or beyond,” Peel said.

Overall beef production is down 5.2% so far in 2023. Peel said this is a significant decline from 2022 record beef production but is less of a decrease than would be the case if herd liquidation were not continuing.

“Smaller beef cow inventories are ahead and more dramatic reductions in cattle slaughter and beef production – and higher cattle prices - will occur when herd rebuilding gets rolling. This process looks to continue into 2026 at least.

The latest “Cattle on Feed” report may be taken as bearish for cattle markets in the short term, but it is certainly bullish for cattle markets in the coming years.

Cattle prices lower on weaker demand

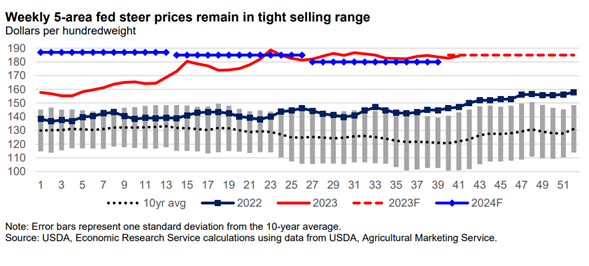

USDA’s latest “Livestock, Dairy and Poultry Outlook” reported that the weighted-average price in September for feeder steers weighing 750–800 pounds at the Oklahoma City National Stockyards was $255.39/cwt., an increase of $6.65/cwt. from August and nearly $82.00/cwt. higher than September 2022.

In the first two sales in October, feeder steers were steady at about $250.50/cwt., but on October 16, feeder steer prices dropped to $242.83/cwt. The pullback in prices is reflected in USDA’s latest Q4 2023 price forecast of $254.00/cwt.

The September average price for fed steers in the 5-area marketing region was $183.71/cwt, which USDA said has been relatively steady since June but nearly $40.00/cwt. higher year over year. Packers’ margins have declined since early September as the boxed beef prices fell and fed cattle prices remained relatively flat.

USDA expects cattle prices to increase through the end of the year, but less than previously anticipated as expected weak packer margins will likely limit much upside to cattle prices. As such, it lowered the fed steer price forecast for Q4 2023 to $185.00/cwt. These lower price expectations were carried through to the first half 2024 for an annual average of $185.00/cwt.

About the Author(s)

You May Also Like