Overnight gains mostly evaporate on Tuesday

Afternoon report: Corn and soybeans improve slightly, while wheat turns in mixed performance.

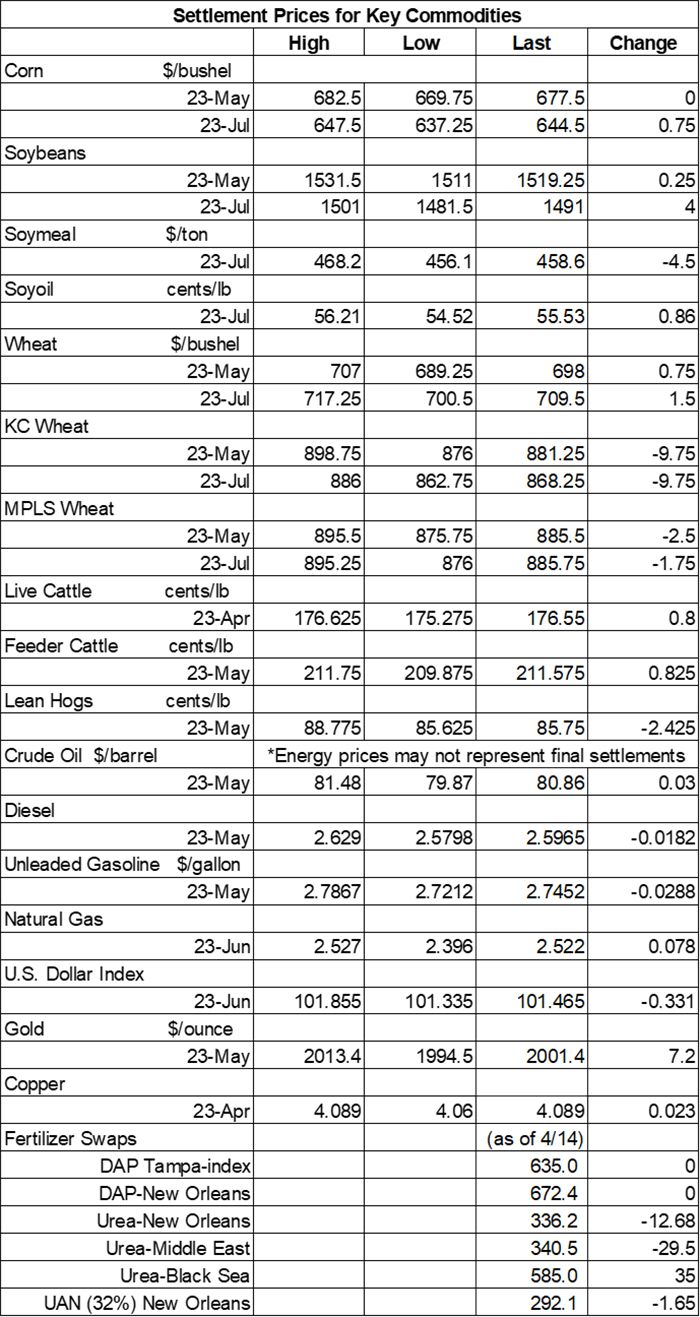

Grains tested moderate overnight gains but were largely unable to hold onto them by the close on Tuesday. Nearby corn contracts finished the session unchanged, while soybeans barely stayed in the green. CBOT wheat contracts also pushed slightly higher, while Kansas City HRW contracts lost more than 1% and MGEX spring wheat contracts eased 0.25% lower.

A bounty of wet weather is on its way to the central U.S. later this week – particularly in the Mid-South and the upper Midwest. Some areas could gather another 1.5” or more between Wednesday and Saturday, per the latest 72-hour cumulative precipitation map from NOAA. Further out, NOAA’s 8-to-14-day outlook predicts more seasonally wet weather for the Plains between April 25 and May 1, with colder-than-normal conditions probable for the eastern half of the United States during that time.

On Wall St., the Dow scraped together meager gains of 18 points, reaching 34,005, amid a new round of corporate earnings reports. Energy future were mixed but mostly lower. Crude oil moved modestly higher, nearly reaching $81 per barrel. Gasoline and diesel were each down around 0.5%, in contrast. The U.S. Dollar softened moderately.

On Monday, commodity funds were net buyers of all major grain contracts, including corn (+7,000), soybeans (+7,000), soymeal (+2,000), soyoil (+2,500) and CBOT wheat (+8,000).

Corn

Corn prices weren’t unable to move the needle much on Tuesday, closing steady to slightly higher on some light technical buying. May futures held steady at $6.7650, while July futures picked up 0.75 cents to $6.4325.

Corn basis bids were mostly steady to soft across the central U.S. on Tuesday after dropping 1 to 8 cents at three interior river terminal and losing as much as 15 cents at an Iowa processor. An Illinois processor bucked the overall trend, firming 5 cents higher today.

Yesterday, USDA showed 8% progress for 2023 corn plantings as of April 16, which is up from 3% the prior week. Analysts were expecting progress to reach 10%, although individual trade guesses varied widely (between 6% and 17%). It’s also worth noting that six of the top 18 production states – Michigan, Minnesota, North Dakota, Ohio, Pennsylvania and South Dakota – have not made measurable planting progress so far.

European Union corn imports during the 2022/23 marketing year are still trending significantly above last year’s pace after reaching 879.9 million bushels through April 16. Ukraine, Brazil, Canada, Serbia and Russia were the top five suppliers.

What factors are the most influential for corn prices right now? Kent Stutzman with Advanced Trading has been watching four in particular, including supplies, Brazil’s production potential, U.S. planting progress and a few unknowns. Click here to catch up on the details in one of the newer Ag Marketing IQ blog entries.

China imported 86.2 million bushels of corn in March, which was 9.2% below the country’s February imports. That brings cumulative totals in 2023 to 296.0 million bushels, which is 6% ahead of 2022’s Q1 tally.

Preliminary volume estimates were for 327,768 contracts, which was slightly lower than Monday’s final count of 342,670.

Soybeans

Soybean prices shifted slightly higher following some light technical buying on Tuesday as traders try to assess the potential for planting delays due to wet Midwestern weather. May futures picked up 0.25 cents to $15.1725, while July futures added 4 cents to $14.8950.

The rest of the soy complex was mixed. Soyoil futures jumped 1.5% higher, while soymeal futures eroded 1% lower.

Soybean basis bids were mostly steady to firm after trending 1 to 5 cents higher at three Midwestern locations on Tuesday but did tilt 5 cents lower at an Illinois river terminal today.

Soybean plantings are just getting underway, with a nationwide average of 4% through Sunday. That’s better than the prior five-year average of 2% and two points higher than the average trade guess. Louisiana (30%) and Mississippi (23%) are leading the charge so far. Seven of the top 18 production states have yet to make measurable progress, however.

USDA expects Argentina’s 2022/23 soybean production to fall to the lowest level in more than two decades, with 878.1 million bushels. Because of that, Argentina could import more than 400 million bushels to supply its domestic crushing industry as it looks to protect its status as the world’s No. 1 soymeal exporter.

European Union soybean imports during the 2022/23 marketing year are trending moderately below the prior year’s pace so far after reaching 359.7 million bushels through April 16. The United States, Brazil, Ukraine, Canada and Uruguay are the top five suppliers so far. EU soymeal imports are also down year-over-year, with 12.54 million metric tons.

Brazil’s Anec estimates that the country’s soybean exports will reach 556.7 million bushels in April, which is 5.4% above the group’s prior project made a week ago. Anec also expects to see Brazilian soymeal exports reach 2.04 million metric tons this month.

Preliminary volume estimates were for 235,934 contracts, moving slightly ahead of Monday’s final count of 206,743.

Wheat

Wheat prices were mixed but mostly lower following an uneven round of technical maneuvering on Tuesday. May Chicago SRW futures added 0.75 cents to $6.9725, May Kansas City HRW futures lost 9.75 cents to $8.80, and May MGEX spring wheat futures eased 2.5 cents to $8.8650.

Winter wheat quality ratings held steady from the prior week, with 27% of the crop in good-to-excellent condition through April 16. Another 34% is rated fair (down two points from last week), with the remaining 39% rated poor or very poor (up two points from last week). In Kansas, the No. 1 winter wheat production state, only 14% of the crop is rated in good-to-excellent condition.

Physiologically, 10% of the crop is now headed, up from 7% a week ago and two points ahead of the prior five-year average. Regional differences are quite apparent, with only seven of the top 18 production states showing measurable progress as of Sunday.

European Union soft wheat exports during the 2022/23 marketing year have reached 895.4 million bushels through April 16, which is a year-over-year increase of 8.5% so far. Morocco, Algeria, Nigeria, Egypt and Saudi Arabia were the top five customers. EU barley exports are moderately below last year’s pace, meantime, with 231.9 million bushels over the same period.

Russian consultancy Sovecon expects the country’s 2023/24 export potential at 1.580 billion bushels after making its first forecast of the new season. Russia is the world’s No. 1 wheat exporter.

Ukraine’s first deputy prime minister expressed concerns that a current Black Sea deal that allows for safe passage of shipping vessels is not functioning properly because Russia has been blocking the inspection of ships. “It is extremely important for us to unblock transit, otherwise Ukraine will remain blocked. We cannot together with our partners give Russia the opportunity to take advantage of this situation,” according to Yulia Svyrydenko.

China’s 2023 wheat imports are substantially higher year-over-year so far after purchasing another 48.9 million bushels in March. That leaves year-to-date totals at 159.8 million bushels, which is around 43% above 2022’s Q1 tally.

Preliminary volume estimates were for 128,988 CBOT contracts, shifting around 21% below Monday’s final count of 163,139.

About the Author(s)

You May Also Like