Markets remain worried about crop conditions

Afternoon report: Spotty weekend rains keep drought fears very much alive this week.

Feedback from the Field! How much rain did you end up with this weekend? Share your fieldwork insights with Farm Futures’ Feedback from the Field series. Just click this link to take the survey and share updates about your farm’s spring progress. I review and upload results daily to the FFTF Google MyMap, so farmers can see others’ responses from across the country – or even across the county!

Corn

Weekend showers across the Heartland turned out to be spotty, which likely accelerated declining crop conditions in key growing areas over the past week. Markets also digested news about advancing harvest paces in Brazil, where the country’s largest corn crop on record is currently being harvested.

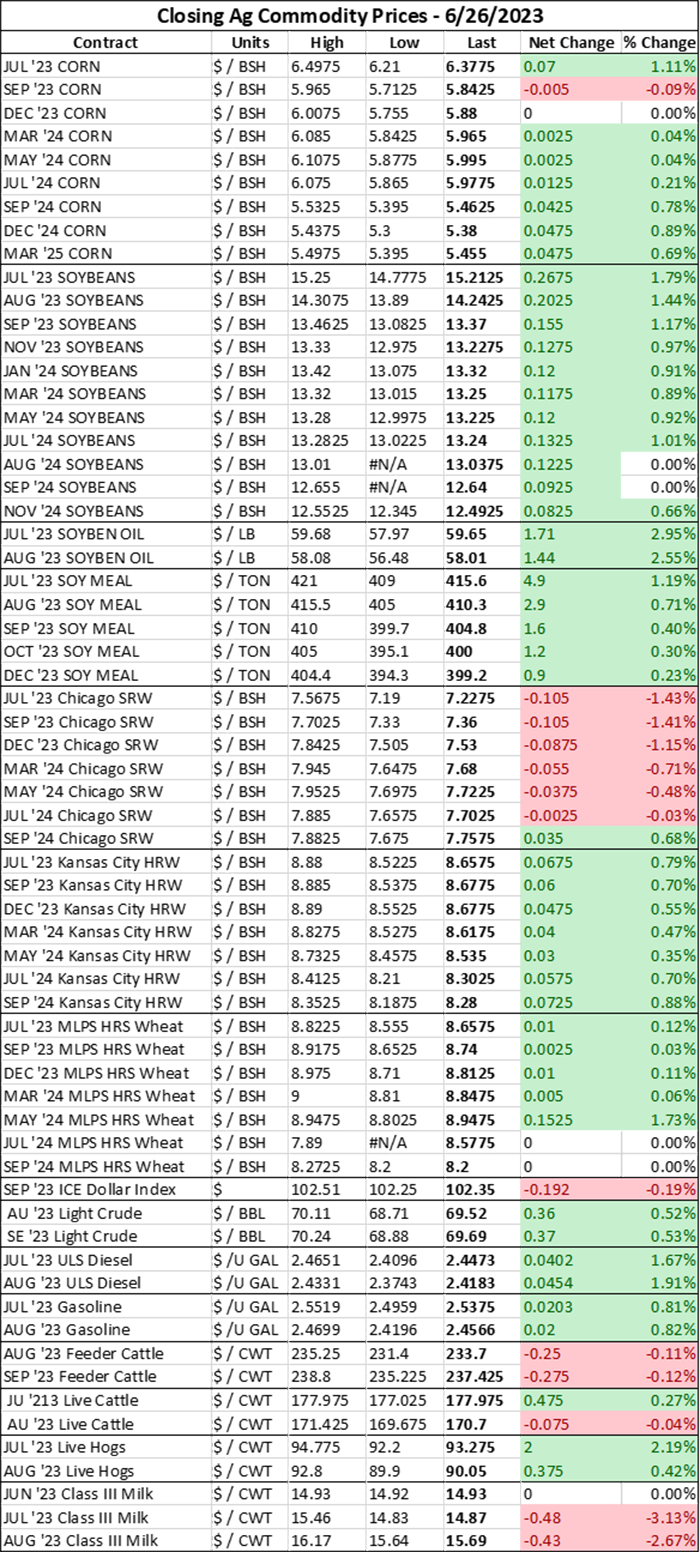

Nearby futures traded flat to $0.07/bushel higher on the sentiments, while growing worries about U.S. corn production sent new crop futures $0.01-$0.05/bushel higher during today’s trading session.

Markets are eagerly awaiting Crop Progress data expected later this afternoon from USDA. Pre-report trade estimates are expecting 52% of U.S. corn acres to be in good to excellent condition as of June 25, down 3% from last week. The estimate range is between 49%-53%.

USDA has made larger than expected downgrades in corn crop conditions over the past two weeks. Another big cut today would keep bullish pressure alive in these markets.

Soybeans

Ongoing worries about crop ratings and persistently dry weather kept bullish hopes alive in the soy market today. Soybean futures closed $0.11-$0.27/bushel higher in today’s trading session, following gains in the soyoil market amid worries about global edible oil supplies.

Soybean ratings are estimated between 49%-52% good to excellent through the week ending June 25 in today’s Crop Progress report, with an average guess of 51% good to excellent expected today. Last week, USDA rated the crop as 54% good to excellent condition which was lower than the markets had been anticipating at that time.

If another downgrade does occur today (it seems likely it will), then it would mark the second consecutive week of ratings cuts for U.S. soybeans.

The U.S. EPA failed to expand biomass-based diesel mandates in 2023-2025 last week past current levels of production and expansion. A similar situation is shaking out over in Indonesia, where palm oil is the chief feedstock of biodiesel production.

The Indonesian government announced plans today to increase biodiesel blending from current levels at 35% to 40% over the next few years. “Indonesia wants to maximise the use of domestic resources and reduce dependency on crude oil,” Indonesian Energy Minister Arifin Tasrif told Reuters on Monday.

Indonesia is the world’s largest palm oil consumer. The risk of dry weather due to El Niño weather patterns in Southeast Asia could also constrain palm production in the coming months at a time when global cooking oil supplies are increasingly tight as more societies buy into renewable fuel production.

Wheat

Chicago wheat markets gave up some of their overnight gains following the Wagner Group’s attempted mutiny against the Russian government over the weekend that sent jitters across global markets this morning. Chicago soft red winter wheat prices fell $0.08-$0.11/bushel during today’s trading session in a technical retreat as markets worries about Russia’s political stability dissipated throughout the day.

"More uncertainty caused some short covering in wheat, but that's really simmered down since the open ... We've reached a key technical objective in the Chicago wheat, so we'll see where it goes from here," Ted Seifried, chief market strategist with the Zaner Group, told Reuters today.

Cooler temperatures across the Heartland this week and lackluster export demand for U.S. wheat also weighed heavily on the soft red winter wheat complex today. The Northern Hemisphere is about to enter peak harvest season, so that will likely result in more bearish price movement for wheat in the weeks ahead.

Kansas City and Minneapolis futures closed $0.01-$0.07/bushel higher on dry weather in the Plains.

While markets will continue to pay attention to winter wheat condition ratings in today’s Crop Progress report, increasing focus is being paid to harvesting paces. The trade is expecting winter wheat conditions to remain unchanged from last week’s total at 38% good to excellent through the week ending on Sunday.

But harvesting paces are forecast between 25%-32% complete with an average guess of 29% complete as of June 25. If realized, that would be a 14% weekly rise and would suggest that harvest activity is moving further north, with more progress being made for soft red wheat crops in the Midwest.

Spring wheat conditions are expected to hold steady at 51% good to excellent for a second consecutive week in today’s report.

Weather

The weekend showers weren’t a “one-and-done” scenario for Midwestern crop growers, according to NOAA’s short-term forecasts. As the weekend system moves through the Eastern Corn Belt today, another precipitation system is building in the Northern Rockies that will push more moisture back into the Heartland by tomorrow and Wednesday.

Extended forecasts are showing above average chances for moisture for most of the Heartland through the first week of July, though widespread and persistent heat will creep into the outlook by the middle of next week.

The Upper Midwest and Eastern Corn Belt aren’t completely out of the woods either following weekend showers. NOAA’s 3-4-week outlook shows heat and dryness battering the regions through the middle of July – peak pollination time.

Financials

Global financial markets were rattled by the Wagner paramilitary group’s attempted coup against the Russian government over the weekend. As was I – I spent the weekend toggling between lawn care videos and updates about the Russian debacle (and playing with Stella, of course). It was thrilling.

But even though Belarus was able to broker an agreement between Wagner’s Yevgeny Prigozhin and Russian President Vladimir Putin, markets remained slightly jittery following the weekend’s events. The S&P 500 closed 0.12% lower to $4,342.92 today, with additional weakness spilling over from the tech sector.

Market focus this week will turn to global growth prospects and persistent inflation, as the Federal Reserve’s favored metric for inflation – the personal consumer expenditure (PCE) index – will be released on Friday. Since Fed comments last week indicated more interest rate hikes could be ahead and sluggish European manufacturing data was published on Friday, there are some real bearish concerns afoot for financial markets, even as U.S. markets continue on at a bullish pace.

Here’s what else I’m reading this afternoon on FarmFutures.com:

Are milk futures finally nearing a bottom? Naomi Blohm investigates.

Bryce Knorr explains how the recent Fed rate pause could impact corn and soybean markets.

Biofuels groups are disappointed with the EPA’s updated biofuel blending volume announcements – and rightfully so.

AgMarket.Net’s Jim McCormick warns farmers about the risks of supply-driven rallies.

About the Author(s)

You May Also Like