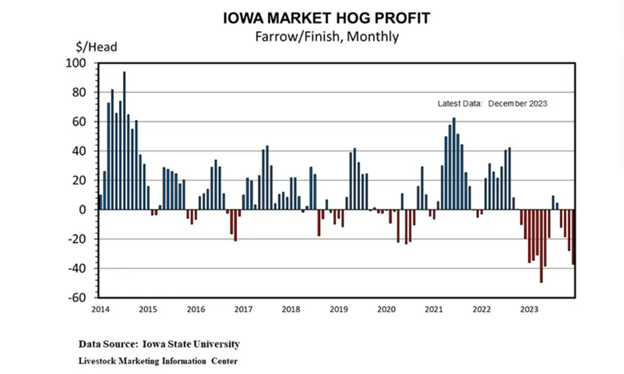

Hog returns remain negative despite lower breakeven

Declining feed costs should help keep losses in 2024 less than 2023.

The December estimated returns for a farrow-to-finish hog operation posted a loss of $37.16/head, according to recent Iowa State University data. Total costs were $180.57/head in December, a decline of 7.3% (down $14.29/head) from last year. The lower total costs were due largely to a 19.1% (down $24.71 per head) decrease in total feed costs from last year to $104.45/head in December.

Livestock Marketing Information Center (LMIC) said corn feed costs were the main driver in lower feed costs, declining 28.6% (down $18.76/head) from last year to $46.75/head in December. Soybean meal feed costs were also lower, at $20.14/head in December, down 6.7% (down $1.33/head) from last year.

With the lower feed costs, the breakeven price declined to $89.32/cwt. in December, which is the first time the breakeven price has been below $90.00/cwt. since February 2022. The selling price was $67.66/cwt., much lower than the breakeven price and 17.1% below last year.

In 2023, the average annual estimated return was a loss of $24.10/head, which was a $39.76/head decrease from the average annual profit of $15.66/head in 2022. In a National Hog Farmer article last week, Ron Plain, University of Missouri professor said this was the biggest annual loss since 2009 when losses averaged $26.04/head. Producers lost money on hogs sold in every month of 2023 except for July and August, he added.

Total costs in 2023 averaged $197.05/head, an increase of 2.2% (up $4.24/head) from last year. The rise in total feed costs was due to a $10.16/head increase in nonfeed costs over 2022 to an average of $70.45/head in 2023.

Annual average total feed costs declined 3.2% (up $4.02/head) to $120.36/head in 2023. Noticeably, the average selling price in 2023 was $81.72/cwt., compared to $97.47/cwt. in 2022, a decrease of 16.2% (down $15.75/cwt). The average breakeven price increased $2.10/cwt (2.2%) to $97.31/cwt., much higher than the average selling price.

As 2023 ended, feed costs were declining, a trend that LMIC said is likely to continue into 2024 due mainly to corn prices being below $5.00/bushel to start the year. This will help keep total feed costs closer to $100.00/head at the beginning of 2024.

“Even with expected lower feed costs, profitability will likely be limited in 2024 given a breakeven selling price around $90.00/cwt. Last week, only the June, July, and August futures contracts were above $90.00/cwt., highlighting the limited opportunities for profitability,” LMIC noted.

Barring an unexpected shortfall in hog slaughter, Plain said 2024 hog prices are likely to be even with or below last year’s average. “For hog producers, 2024 financial losses should be less than last year, but hog prices are not likely to turn red ink into black.”

About the Author(s)

You May Also Like