Higher fertilizer prices not linked to natural gas

New study suggests corn prices, not natural gas prices, driving fertilizer prices higher for corn producers.

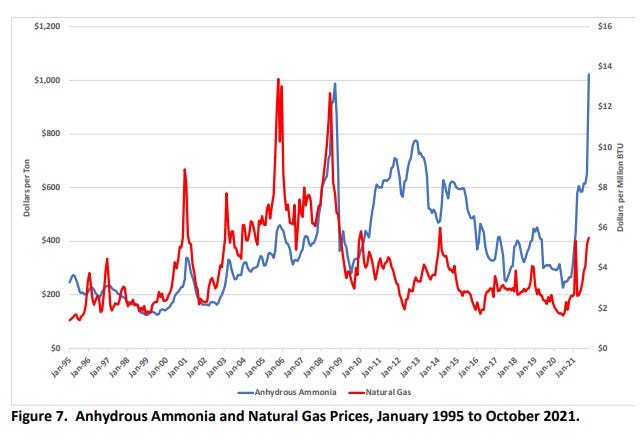

The suggestion that recent increases in the price of natural gas are the primary reason for recent increases in the prices of nitrogen products is “highly suspect,” according to a new study from Texas A&M and released by corn grower groups. Instead, fertilizer prices are tracking closely with the improvement in corn prices, leading producers to question the influence of fertilizer companies.

“Any thought higher natural gas prices are driving fertilizer costs is not valid,” says Joe Outlaw, agricultural economist and co-director of the Agricultural and Food Policy Center at Texas A&M University.

For example, the price of anhydrous ammonia increased $688 per ton from the end of 2020 through the end of October 2021. However, the increase in the value of the embedded natural gas accounts for only $102 (or 15%) of that increase, the report notes.

Before 2010, about 80% of changes in the natural gas price were passed through to the anhydrous ammonia price. Since 2010, however, they find no significant pass through. That is, since 2010, natural gas and AA prices have been decoupled.

Dee Vaughan, who farms in the northern Texas panhandle, says the concentration in recent years of the four major players controlling 75% of nitrogen produced brings into question the power they wield. “It appears the industry uses its market power to set the price of the market,” he says.

In addition, the assumption that higher use on more planted acres is driving prices also fails to reflect actual data which shows that total acres of the major field crops and hay is decreasing domestically over time, while fertilizer costs are increasing.

The three periods of higher than average planted acreage were 2002, 2008, and 2013 to 2015. There were nitrogen price spikes in 2008 and 2013 to 2015. “The planted acres in 2021 are considerably lower than acres that triggered previous nitrogen price increases, even as domestic production of nitrogen products has increased,” the report finds.

Input costs hitting farmers

Over one-third of corn and wheat operating costs are directly attributed to highly volatile fertilizer prices. The results of the Texas A&M study indicate an average increase in nitrogen costs of $52.07 per acre across the 46 farms growing corn evaluated by APAC. This would translate into roughly $0.32/bushel that corn farmers would need from the market or government to offset the higher nitrogen price.

Vaughan has seen his nitrogen costs increase 264% in just a two-year time, with an increase of 241% of his total fertilizer bill over the same period since 2020.

Jay Schutte, a Missouri corn grower from Benton City and Missouri Corn Growers Association president, says the increases in costs are “very detrimental” to his operation. In 2021, anhydrous ammonia cost him $488/ton. What he applied in the fall, the price was $1,282, an increase of 168%. The price for spring application is $1,480.

Tariff relief needed

The study has farmers raising concerns about a petition by CF Industries, one of the country’s major nitrogen producers, with the U.S. International Trade Commission to impose tariffs on nitrogen fertilizers imported from Trinidad & Tobago and Russia. The U.S. Department of Commerce has since released a preliminary finding recommending tariffs, despite strong outcry from farm groups.

“The proposed tariffs will create shortages and drive our costs up even higher,” says Iowa farmer and National Corn Growers Association President Chris Edgington. “They will add insult to injury and impose a financial hardship on family farms.”

Leaders from the National Corn Growers Association and state affiliates have sent letters to executives at Mosaic Co. and CF Industries asking them to drop their requests for the tariffs.

Pending tariffs on nitrogen fertilizers could create shortages and cause prices to increase even more for farmers. Based on prices as of the end of October, a 19% tax on imported anhydrous ammonia would imply an additional increase in prices paid by farmers of $194 per ton.

Schutte says the 244% increase of last year if tariffs are implemented would be “huge.”

“Once that countervailing duty is put in place, that helps garner additional market share and therefore market control, allowing companies to implement price control measures like we are seeing today,” Schutte says.

Despite requests, Edgington says neither of the fertilizer companies are willing to drop the cases.

“We have had some preliminary discussions with Mosaic. CF has indicated they may be interested in talking with us,” he says. But there’s no interest in the NCGA request for the tariffs to be paused, stopped or rescinded, Edgington adds.

“We’re just asking companies to keep us out of trade disputes and keep products available and affordable for U.S. farmers,” Edgington says.

The study was commissioned by state corn organizations in Texas, Missouri, Colorado, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Maryland, Michigan, Minnesota, Nebraska, New York, North Carolina, North Dakota, Ohio, South Carolina, South Dakota, Tennessee and Wisconsin.

About the Author(s)

You May Also Like