Grains stay firm as Black Sea deal nears expiration

Afternoon report: Corn, soybeans and wheat all trend higher to start the week.

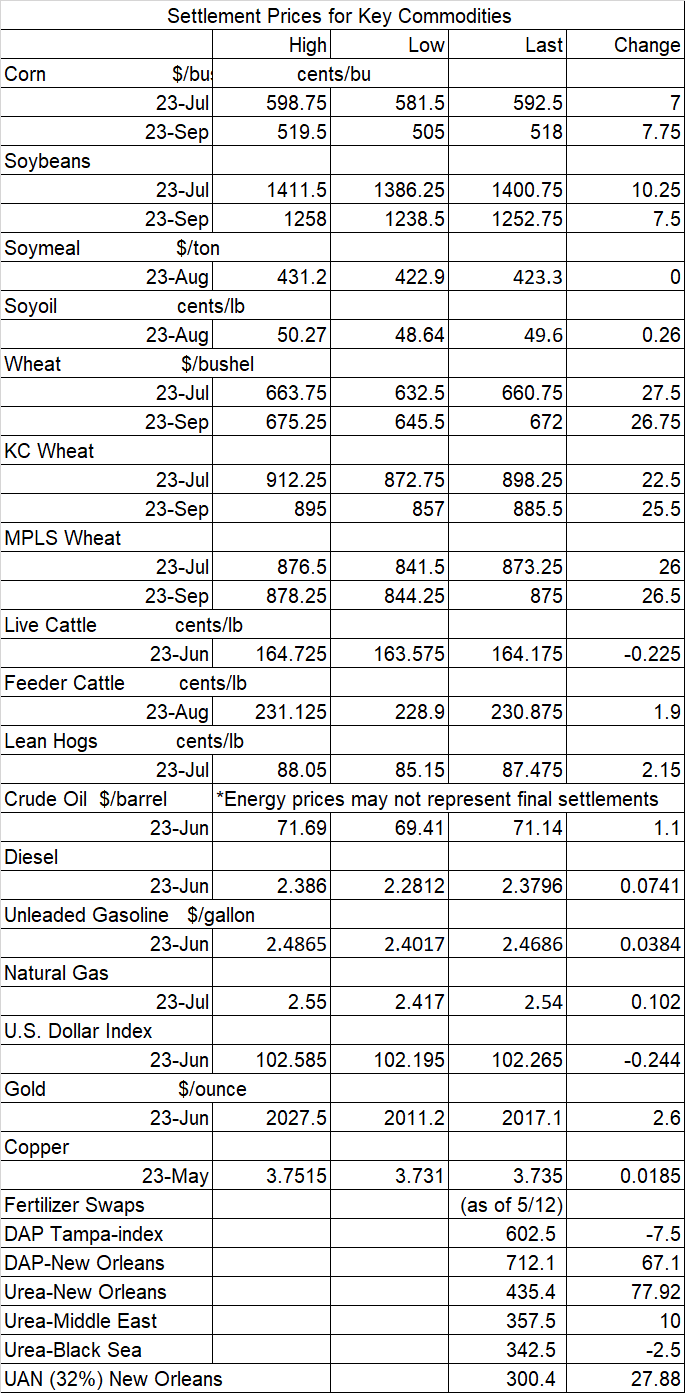

Grain prices started the week with a noticeable boost. Wheat prices saw the most upside on dismal U.S. crop quality, and as a critical Black Sea shipping deal is set to expire on Thursday if it is not extended before then. Some wheat contracts jumped more than 4% higher as a result. Corn prices improved by 1.5%, with soybeans up around 0.75%.

Most of the Midwest and Plains will see at least some measurable rainfall occur between Tuesday and Friday, with the noticeable exceptions of the northern half of Illinois, Indiana and Ohio, per the latest 72-hour cumulative precipitation map from NOAA. Further out, NOAA’s new 8-to-14-day outlook predicts a return to seasonally dry weather for most of the Corn Belt between May 22 and May 28, with warmer-than-normal conditions likely for the Plains and the upper Midwest next week.

On Wall St., the Dow eased 13 points lower to 33,287 as traders await the next round of debt ceiling negotiations, which are expected to occur this week. Energy futures made noticeable inroads, with crude oil up around 1.75% this afternoon to $71 per barrel on bullish demand leading up to the Memorial Day holiday. Gasoline was also up around 1.75%, with diesel rising more than 3% higher. The U.S. Dollar softened moderately.

On Friday, commodity funds were net buyers of soymeal (+1,000) and CBOT wheat (+7,000) contracts but were net sellers of corn (-4,000), soybeans (-10,000) and soyoil (-5,500).

Corn

Corn prices moved moderately higher on a round of technical buying thanks in large part to spillover support from a broad range of other commodities. Worries over a looming deadline for a Black Sea shipping deal also factored into the mix today – and will continue to do so later this week until that deal is extended or otherwise expires on Thursday. July futures added 7 cents to $5.9325, with September futures up 10.25 cents to $5.1850.

Corn basis bids were steady to mixed across the central U.S. on Monday after trending as much as 5 cents higher at an Iowa ethanol plant and as much as 6 cents lower at an Ohio elevator today.

Corn export inspections came in at 46.2 million bushels last week, firming moderately above the prior week’s total of 38.4 million bushels. It was also on the higher end of trade estimates, which ranged between 27.6 million and 47.2 million bushels. China was the No. 1 destination, with 18.6 million bushels. Cumulative totals for the 2022/23 marketing year are still significantly behind last year’s pace so far, however, with 1.026 billion bushels.

Prior to the next USDA crop progress report, out Monday afternoon, analysts expect the agency to show corn plantings move from 49% a week ago to 68% through May 14. Individual trade guesses ranged between 60% and 75%.

Ukraine’s total grain exports during the 2022/23 marketing year are trending 5.8% below last year’s pace so far as the country continues to face logistical struggles amid the ongoing Russian invasion. That includes corn sales totaling 1.012 billion bushels, plus another 551.2 million bushels of wheat sales. Ukraine is among the world’s top exporters of both commodities.

On occasion, it is important to intentionally take stock of where your farm is at now and weigh that against how you want it to look in the future, according to Darren Frye, CEO of Water Street Solutions. “That place in the middle – where the farm is not yet where you want it to be – is the place where you as the leader have the opportunity to make the greatest impact,” he notes. “That’s where your new ideas for your farm business come in.” Frye offers some advice around what to do when you get a big idea in his latest column – click here to learn more.

Preliminary volume estimates were for 317,919 contracts, which was moderately below Friday’s final count of 347,478.

Soybeans

Soybean prices followed other commodities higher on a round of technical buying that lifted prices around 0.75% higher by the close. July futures rose 10.25 cents to $14.0025, with August futures up 9.5 cents to $13.2775.

The rest of the soy complex was lightly mixed. Soymeal futures faded 0.5% lower, while soyoil futures trended 0.5% higher on Monday.

Soybean basis bids were mostly steady across the central U.S. on Monday but did slide 2 cents lower at an Ohio elevator today.

Private exporters announced to USDA the sale of 100,000 metric tons of soymeal for delivery to Poland during the 2022/23 marketing year, which began September 1.

Soybean export inspections were tepid last week, reaching just 5.4 million bushels. That was below the entire range of trade guesses, which came in between 5.5 million and 18.4 million bushels. Mexico topped all destinations, with 2.1 million bushels. Cumulative totals for the 2022/23 marketing year are slightly below last year’s pace so far, with 1.764 billion bushels.

Ahead of this afternoon’s crop progress report from USDA, analysts think the agency will show soybean planting pace move from 35% a week ago up to 51% through Sunday. Individual trade guesses ranged between 46% and 55%.

The National Oilseed Processors Association (NOPA) reported a U.S. soybean crush in April totaling 173.232 million bushels. That was below both March’s total of 185.810 million bushels and an average trade guess of 174.173 million bushels, but it was still the largest April total on record. Soyoil stocks moved to a 14-month high of 1.957 billion pounds through April 30.

Preliminary volume estimates were for 177,692 contracts, fading moderately below Friday’s final count of 222,852.

Wheat

Wheat prices jumped substantially higher on an ample round of technical buying as traders await news on whether a deal that allows for safe passage of shipping vessels in the Black Sea will be extended again. July Chicago SRW futures climbed 27.5 cents to $6.6250, July Kansas City HRW futures gained 22.5 cents to $8.9950, and July MGEX spring wheat futures rose 26 cents to $8.72.

Wheat export inspections found modest week-over-week improvements after reaching 8.9 million bushels. That was near the middle of trade estimates, which ranged between 4.6 million and 12.9 million bushels. Mexico was the No. 1 destination, with 1.8 million bushels. Cumulative totals for the 2022/23 marketing year are slightly lower than last year’s pace, with 687.6 million bushels.

Prior to Monday afternoon’s crop progress report from USDA, analysts expect to see winter wheat quality ratings trend another point higher, although that would still mean only 30% of the crop would be rated in good-to-excellent condition through May 14. Spring wheat planting progress could move from 24% complete a week ago up to 39% through Sunday.

Russian consultancy Sovecon estimates that the country’s wheat exports will reach 139.6 million bushels in May, which would be 12% below April’s tally, if realized. Russia is the world’s top wheat exporter.

Egypt, which is one of the world’s top wheat importers, has strategic reserves that are sufficient for the next five months per the country’s supply minister. Egypt’s government has purchased 73.5 million bushels of local wheat since the beginning of harvest and may double that amount by the end of the season.

Preliminary volume estimates were for 99,202 CBOT contracts, sliding slightly below Friday’s final count of 114,869.

About the Author(s)

You May Also Like