Grains rally after rough midweek session

Afternoon report: Corn, soybean and wheat prices all post solid gains on Thursday.

July 14, 2023

Grain prices found a much needed rebound on Thursday after facing steep cuts on Wednesday, thanks to a bevy of unhelpful supply and demand data from USDA. (If you missed that news yesterday, click here for a recap and expert analysis.) Corn prices led the charge after a better-than-expected round of export data was released this morning. Soybeans and wheat also turned in solid efforts. Weather, war in Ukraine and a weakening U.S. Dollar were all factors in today’s successes.

Rainfall in the Midwest will be variable heading into the weekend, with some areas likely to gather 1” or more while others may just see trace amounts between Friday and Monday, per the latest 72-hour cumulative precipitation map from NOAA. Further out, NOAA’s latest 8-to-14-day outlook predicts a return to seasonally dry conditions for the Northern Plains and upper Midwest between July 20 and July 26, with warmer-than-normal conditions also likely in the central U.S. during this time.

On Wall St., the Dow tested modest gains of 37 points in afternoon trading, reaching 34,384, as investors continue to monitor some better-than-expected inflation data. Energy futures were also back in the green today, with crude oil up another 1.5% to $76 per barrel. Diesel and gasoline gains were more modest, hovering around 0.5% higher this afternoon. The U.S. Dollar softened moderately.

On Wednesday, commodity funds were net sellers of all major grain contracts, including corn (-10,500), soybeans (-10,000), soymeal (-4,000), soyoil (-1,000) and CBOT wheat (-9,000).

Corn

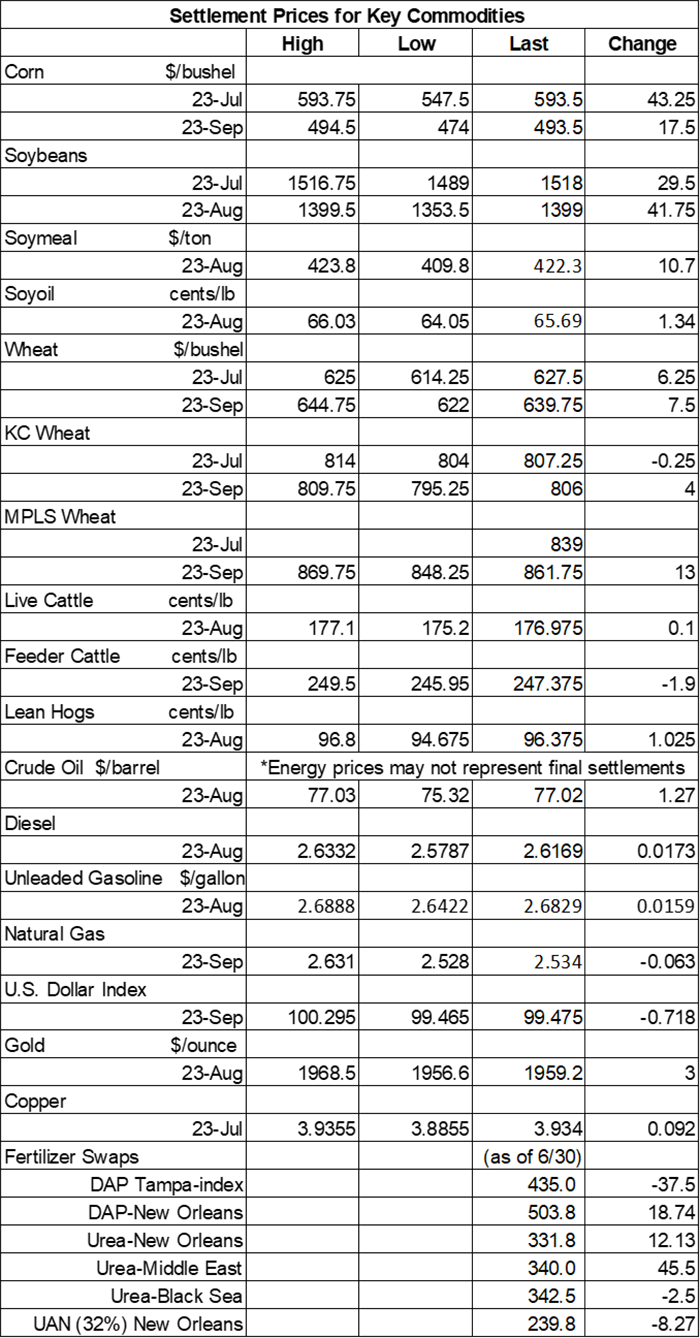

Corn prices jumped substantially higher on a wave of bargain buying after sinking to multiyear lows following Wednesday’s selloff. Spillover strength from a variety of other commodities lent additional support. July futures soared 43.25 cents to $5.93, with September futures up 17.5 cents to $4.9375.

Corn basis bids were mostly steady across the central U.S. but did trend as much as 5 cents higher at an Indiana ethanol plant and as much as 10 cents lower at an Illinois river terminal on Thursday.

Corn exports found 37.0 million bushels in combined old and new crop sales last week. Old crop sales jumped 86% higher week-over-week. Total sales were better than all analyst estimates, which ranged between 3.9 million and 31.5 million bushels. Cumulative totals for the 2022/23 marketing year are still far below last year’s pace, however, after reaching 1.396 billion bushels.

Corn export shipments reached 19.4 million bushels, which was 30% below the prior week’s tally and 38% below the prior four-week average. Mexico, Japan, Costa Rica, Canada and Colombia were the top five destinations.

Brazil’s Conab is expecting the country’s total corn production to improve 13% year-over-year, thanks in large part to a record safrinha (second) corn crop. The agency currently estimates that total Brazilian corn production will come in around 5.039 billion bushels.

South Korea purchased 2.7 million bushels of animal feed corn, likely sourced from South America, in an international tender that closed earlier today. The grain is for arrival in late November.

Preliminary volume estimates were for 275,064 contracts, which was noticeably lower than Wednesday’s final count of 441,368.

Soybeans

Soybean prices found solid footing following a round of technical buying on Thursday as traders expressed doubts over this season’s true production potential. July futures rose 29.5 cents to $15.18, with August futures up 39 cents to $14.8325.

The rest of the soy complex was also firm today. Soymeal futures gained more than 2.5%, with soyoil futures up around 2%.

Soybean basis bids were mostly steady to weak after dropping 5 to 25 cents lower across five Midwestern locations on Thursday. One noticeable exception was a Nebraska processor that jumped 30 cents higher today.

Private exporters announced to USDA the sale of 11.6 million bushels of soybeans for delivery to Mexico during the 2022/23 marketing year, which began September 1.

Soybean exports found 10.6 million bushels in combined old and new crop sales last week. That was toward the lower end of analyst estimates, which ranged between 3.7 million and 33.1 million bushels. Cumulative totals for the 2022/23 marketing year are still trending slightly below last year’s pace so far, with 1.826 billion bushels.

Soybean export shipments were up 27% week-over-week and 37% above the prior four-week average, with 12.4 million bushels. Spain, the Netherlands, Japan, Mexico and Taiwan were the top five destinations.

China’s soybean purchased in June climbed nearly 25% above year-ago volume, reaching 404.3 million bushels. This has been largely fueled by massive purchases from Brazil, although China has also been buying U.S. grain. Total soybean imports for the first half of 2023 are trending 13.6% higher year-over-year, with 1.932 billion bushels. China is by far the world’s top soybean importer and has primarily been buying from Brazil in recent months (the U.S. is a distant second).

Brazil’s Conab is expecting the country’s soybean production will carve out a new record of 5.677 billion bushels, which the agency attributes to a 16% improvement in per-acre yields and a 6% increase in plantings this season.

Preliminary volume estimates were for 194,449 contracts, tracking moderately lower than Wednesday’s final count of 279,638.

Wheat

Wheat prices fought through a choppy session on Thursday to close with moderate gains. September Chicago SRW futures gained 7.5 cents to $6.4025, September Kansas City HRW futures added 4 cents to $8.07, and September MGEX spring wheat futures rose 13 cents to $8.6650.

Wheat export sales reached 14.5 million bushels last week. That was toward the higher end of trade estimates, which ranged between 1.8 million and 20.2 million bushels. Cumulative totals for the 2022/23 marketing year are slightly behind last year’s pace so far, with 53.1 million bushels since the beginning of June.

Wheat export shipments reached 14.1 million bushels. The Philippines, Ecuador, Chile, Indonesia and the Dominican Republic were the top five destinations.

Russian President Vladimir Putin is once again threatening to let a critical Black Sea shipping deal expire if his country’s own feed and fertilizer export needs are not more thoroughly addressed. “We can suspend our participation in the deal, and if everyone once again says that all the promises made to us will be fulfilled, then let them fulfil this promise,” he said. The deal was forged a year ago and has received several extensions so far. It is set to expire early next week if ongoing negotiations fail.

The geopolitical mess in the Black Sea region puts two major wheat exporters – Russia and Ukraine – at an elevated risk to safely move their grain to end users. So why have wheat prices struggled to find much positive forward momentum in recent months? Naomi Blohm, senior market adviser with Stewart Peterson, explored some ongoing trends that include global production and global ending stocks in today’s Ag Marketing IQ blog – click here to learn more.

French farm office FranceAgriMer slightly lowered its ratings for the current soft wheat crop, which is now 80% in good-to-excellent condition through July 10. Harvest moved from 10% completion a week ago up to 33% as of Monday. France is Europe’s No. 1 wheat producer.

As expected, Japan purchased 4.5 million bushels of food-quality wheat from the United States, Canada and Australia in a regular tender that closed earlier today. Of the total, 24% was sourced from the U.S. The grain is for shipment in September.

Preliminary volume estimates were for 90,973 CBOT contracts, shifting 18% below Wednesday’s final count of 111,323.

You May Also Like