Grains mixed to start the week

Afternoon report: Some wheat contracts make moderate inroads, while other grains struggle to find forward momentum.

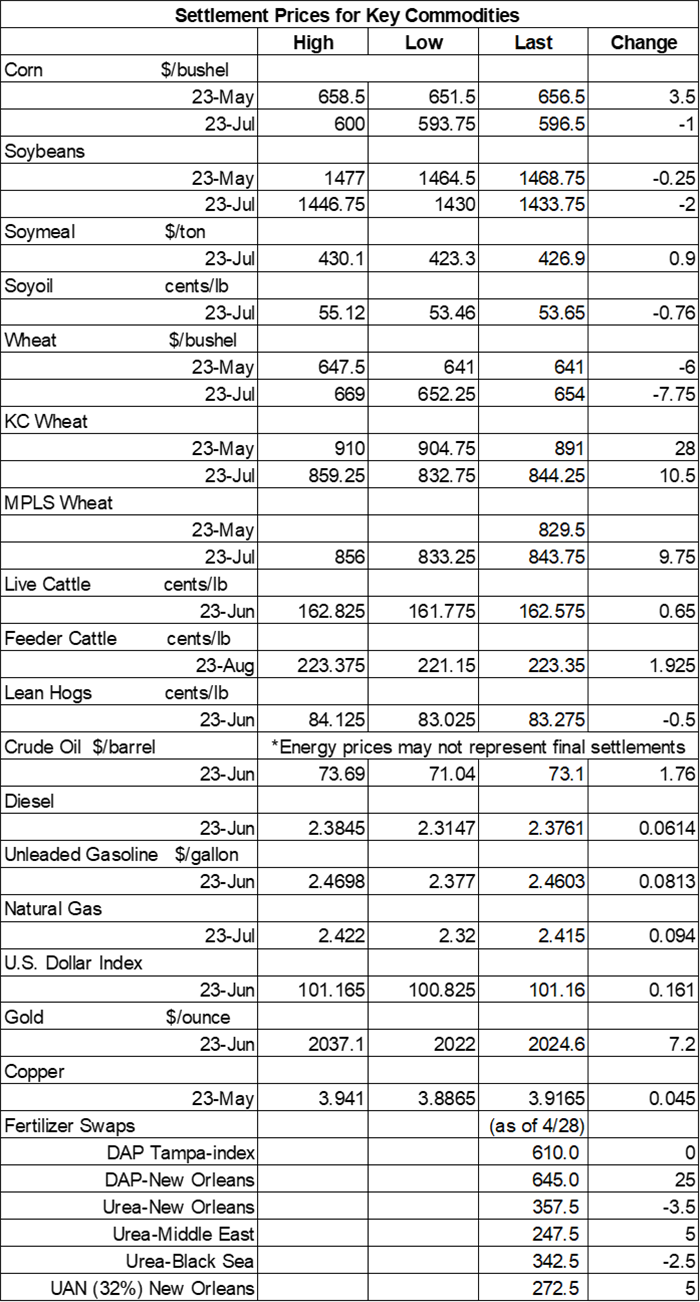

Grains were decidedly mixed on Monday as traders hold for future crop progress updates, along with the May WASDE that comes out Friday morning. Analysts also remain focused on the fate of a key Black Sea shipping deal that could expire on May 18 unless ongoing negotiations bear fruit. Kansas City HRW wheat futures saw the most upside today after capturing double digit gains. On the other side of the ledger, soyoil futures suffered the largest technical setback.

The Northern and Central Plains could get plenty of rain later this week, with large portions of the region likely to see another 1” or more between Tuesday and Friday, per the latest 72-hour cumulative precipitation map from NOAA. Most of the Corn Belt will see at least some moisture during tis time, although a few areas (most notably Illinois) could prove to be the exception. NOAA’s new 8-to-14-day outlook predicts a return to seasonally dry conditions for the central U.S. between May 15 and May 21, with warmer-than-normal weather moving through the Northern Plains into the upper Midwest next week.

On Wall St., the Dow eased 55 points lower in afternoon trading to 33,618 as traders await the next inflation cues when updates to the producer price index is released later this week. Energy futures carved out solid gains, with crude oil up 2.75% this afternoon to $73 per barrel. Diesel rose nearly 3% higher, with gasoline up more than 3.5%. The U.S. Dollar firmed slightly.

On Friday, commodity funds were net buyers of all major grain contracts, including corn (+7,500), soybeans (+7,750), soymeal (+1,500), soyoil (+8,500) and CBOT wheat (+4,250).

Corn

Corn prices were narrowly mixed after some uneven technical maneuvering on Monday. May futures added 3.5 cents to $6.5675, while July futures eased a penny lower to $5.9550.

Corn basis bids shifted 10 cents lower at an Illinois river terminal while holding steady elsewhere across the central U.S. on Monday.

Corn export inspections retreated moderately below the prior week’s total for the week ending May 4, sliding to 37.9 million bushels. Analysts were expecting a bigger haul, offering trade guesses that ranged between 39.4 million and 61.0 million bushels. Mexico was the top destination, with 11.7 million bushels. Cumulative totals for the 2022/23 marketing year remain substantially below last year’s pace so far, with 979.0 million bushels.

Prior to the next crop progress report from USDA, out later this afternoon and covering the week through May 7, analysts expect to see corn plantings move from 26% a week ago up to 48% through Sunday. Individual trade guesses varied widely, ranging between 34% and 64%.

Ukraine’s reconstruction ministry is accusing Russia of effectively stopping a critical deal that allows safe passage in the Black Sea because it is refusing to register incoming vessels. “The Russian Federation once again effectively stopped the Grain Initiative by refusing to register incoming vessels and carry out their inspections. This approach contradicts the terms of the current agreement,” according to a statement issued today. According to the ministry, 90 ships are in Turkey’s territorial waters waiting to return to Ukrainian ports. The deal is set to expire on May 18, although negotiations are in place to get it extended.

Preliminary volume estimates were for 241,518 contracts, which was slightly higher than Friday’s final count of 240,929.

Soybeans

Soybean prices eased slightly lower following a lackluster set of export inspection data from USDA, out this morning. May futures eased 0.25 cents lower to $14.6875, with July futures down 2 cents to $14.3450.

The rest of the soy complex also incurred losses today. Nearby soymeal contracts shifted more than 0.5% lower, with nearby soyoil contracts down almost 1.5%.

Soybean basis bids held steady across the central U.S. on Monday.

Soybean export inspections eased slightly lower week-over-week to 14.5 million bushels. That was on the lower end of trade estimates, which ranged between 11.0 million and 22.0 million bushels. Indonesia was the No. 1 destination, with 3.1 million bushels. Cumulative totals for the 2022/23 marketing year are slightly above last year’s pace so far, with 1.758 billion bushels.

Ahead of the next crop progress report from USDA, analysts think the agency will show soybean plantings at 34% complete as of May 7, up from 19% a week ago. Individual trade estimates ranged between 25% and 41%.

Amid a handful of high-profile bank failures earlier this spring, is it worth worrying about the health of your own lenders? We took a look at potential red flags to watch for, resources from the FDIC and more – click here for details.

Preliminary volume estimates were for 147,364 contracts, trending moderately below Friday’s final count of 166,211.

Wheat

Wheat prices were mixed but mostly higher amid some uneven technical maneuvering as traders attempted to balance the expectations for improving winter wheat crop conditions in the U.S. against worries about ongoing tensions between Russia and Ukraine that could jeopardize a critical Black Sea shipping deal. July Chicago SRW futures fell 7.75 cents to $6.5250, July Kansas City HRW futures rose 10.5 cents to $8.4350, and July MGEX spring wheat futures added 9.75 cents to $8.4575.

Wheat export inspections were lackluster after fading to 7.7 million bushels last week. That was also on the very low end of trade guesses, which ranged between 7.3 million and 18.4 million bushels. Mexico was the No. 1 destination, with 3.1 million bushels. Cumulative totals for the 2022/23 marketing year are slightly behind last year’s pace, with 678.2 million bushels.

Prior to the next USDA crop progress report, analysts expect to see winter wheat quality ratings to improve another two points, with 30% in good-to-excellent condition through May 7. Spring wheat planting progress is expected to move from 12% a week ago up to 28% as of Sunday.

Friday’s World Agricultural Supply and Demand Estimates (WASDE) will offer the agency’s first look into the 2023 crop supply and demand, notes grain market analyst Bryce Knorr. “The May WASDE presents results of the government’s first survey of winter wheat farms to assess yields and harvested acres,” he says. “This year the numbers will be of more than passing interest. With U.S. winter wheat conditions among the worst ever, supplies remain very much in doubt.” Knorr digs into historical data and looks at additional tools such as vegetation maps in today’s Ag Marketing IQ blog – click here to learn more.

Ahead of the next Statistics Canada report, which will be released on Tuesday morning, analysts think the agency will show Canadian wheat stocks at 514.4 million bushels through March 31. That would be a year-over-year increase of nearly 25%, if realized.

Egypt’s supply ministry reported that its strategic wheat reserves are sufficient for the next 4.1 months after procuring another 4.4 million bushels of local grain. Egypt is the world’s top wheat importer.

Algeria issued an international tender to purchase 1.8 million bushels of soft milling wheat (although it often buys much more than the nominal amount listed) from optional origins that closes on Wednesday. The grain is for shipment in June or July, depending on source.

If you like antique tractor shows, the latest edition of Farm Progress America is a can’t miss as broadcaster Max Armstrong talks about which ones he’ll be attending this summer. Click here for details.

Preliminary volume estimates were for 101,884 CBOT contracts, sliding slightly below Friday’s final count of 109,728.

About the Author(s)

You May Also Like