Grains caught in selloff crossfire

Afternoon report: Corn, soybeans and wheat all land in the red on Tuesday’s session.

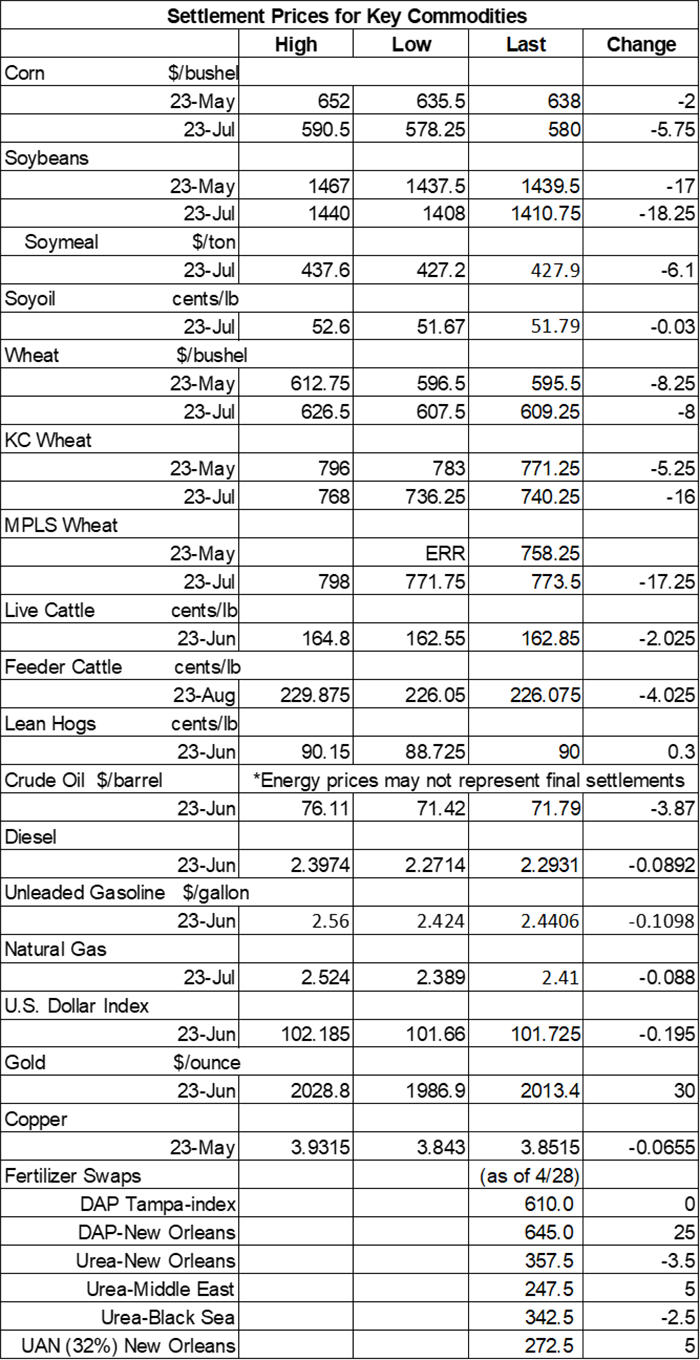

Grain prices slumped lower again on Tuesday amid a broad selloff that also affected cattle prices, energy futures and Wall St. as worries about a potential recession resurfaced. Seasonal planting pressure added to today’s technical setback. July corn futures fell 1%, with July soybean futures down 1.25%. Wheat losses were variable, with some contracts losing more than 2%.

Rains will be variable across the Corn Belt between Wednesday and Saturday. Some areas won’t gather any measurable moisture, while others will see as much as 1.5” or more during this time, per NOAA’s latest 72-hour cumulative precipitation map. The agency’s new 8-to-14-day outlook predicts seasonally wet weather developing across the Plains between May 9 and May 15, with warmer-than-normal conditions likely for the central U.S. next week.

On Wall St., the Dow tumbled 443 points lower to 33,608 in afternoon trading, primarily due to ongoing concerns in the banking sector. Energy futures also took a major hit, with crude oil down more than 5% this afternoon to $71 per barrel on recession concerns. Diesel and gasoline each eroded more than 4% lower.

On Monday, commodity funds were net buyers of soybeans (+3,000), soymeal (+1,000) and soyoil (+1,000) contracts but were net sellers of corn (-2,000) and CBOT wheat (-6,500).

Corn

Corn prices tested modest gains at times in Tuesday’s session but ultimately followed a broad range of other commodities lower. May futures dropped 2 cents to $6.3750, with July futures down 5.75 cents to $5.7875.

Corn basis bids were mostly steady across the central U.S. on Tuesday but did trend 5 cents higher at an Indiana ethanol plant while sliding 3 cents lower at an Illinois ethanol plant today.

Corn plantings are 26% complete through April 30, per USDA’s latest crop progress report, out Monday afternoon. That’s up from 14% a week ago and one point below the average trade guess of 27%. This spring’s progress has doubled 2021’s effort so far while matching the prior five-year average. Six percent of the crop is now emerged.

Per the latest data from the European Commission, EU corn imports during the 2022/23 marketing year are substantially higher than last year’s pace after reaching 905.1 million bushels through April 30.

As Ukraine continues to deal with ample logistical problems due to Russia’s ongoing invasion, the country’s agriculture ministry anticipates a sharp reduction in grain exports for the upcoming 2023/24 marketing year. That includes an estimated “exportable surplus” of 590.5 million bushels of corn, plus another 440.9 million bushels of wheat. Ukraine is among the world’s top exporters of both commodities.

Meantime, the European Commission reported today that it is imposing restrictions on Ukrainian imports of corn, wheat, canola and sunflower seed into Bulgaria, Hungary, Poland, Romania and Slovakia to ease excess grain coming into those countries, which is cratering local prices. The restrictions will last until June 5 and will presumably be reviewed at that time for possible extensions. The Commission also developed a support package worth $100 million euros to subsidize farmers in those countries.

Preliminary volume estimates were for 310,874 contracts, moving slightly above Monday’s final count of 283,767.

Soybeans

Soybean prices eroded steadily throughout Tuesday’s session following a round of technical selling due to a variety of factors, including U.S. planting progress, record-breaking Brazilian production and tumbling oil prices. May futures lost 17 cents to $14.3775, with July futures down 18.25 cents to $14.0925.

The rest of the soy complex also trended lower today. Soyoil losses were modest, easing 0.25% lower, while soymeal futures dropped more than 1%.

Soybean basis bids were steady across most Midwestern locations on Tuesday but did tilt 5 cents higher at an Indiana processor today.

Soybean plantings moved from 9% a week ago up to 19% through Sunday. Analysts were expecting to see progress reach 17%. It was also well above both 2021’s pace of 7% and the prior five-year average of 11%.

Governmental data from Brazil shows the country’s soybean exports in April reached 526.9 million bushels. That was slightly lower than year-ago results of 531.8 million bushels. Brazil also exported 18.5 million bushels of corn last month.

European Union soybean imports during the 2022/23 marketing year are trending moderately below last year’s pace so far after reaching 378.1 million bushels through April 30. EU soymeal imports are also trending lower year-over-year, with 13.05 million metric tons over the same period.

“Soybeans ended April on their back foot, losing more than 75 cents of gains made on a late March bounce,” according to grain market analyst Bryce Knorr. “Still, though November futures hover just above nine-month lows, the news isn’t all bad.” Knorr explains why in Monday’s Ag Marketing IQ blog – click here to learn more.

Preliminary volume estimates were for 183,284 contracts, shifting moderately above Monday’s final count of 122,551.

Wheat

Wheat prices followed other commodities lower on Tuesday, with improving quality conditions for the embattled U.S. winter wheat crop generating additional downward pressure today. July Chicago SRW futures dropped 8 cents to $6.1025, July Kansas City HRW futures fell 16 cents to $7.4125, and July MGEX spring wheat futures lost 17.25 cents to $7.7375.

Winter wheat quality ratings improved two points last week, with 28% of the crop in good-to-excellent condition through April 30, matching analyst expectations. Another 30% of the crop is rated fair (down three points from last week), with the remaining 41% rated poor or very poor (up one point from last week). Physiologically, 25% of the crop is now headed, up from 18% a week ago.

European Union soft wheat exports during the 2022/23 marketing year are trending 9.4% higher year-over-year after reaching 943.2 million bushels through April 30. EU barley exports are moderately below last year’s pace, meantime, with 242.0 million bushels.

Russian consultancy Sovecon are still predicting the country’s April wheat exports came in at 154.3 million bushels, which is down 6.7% from March. Russia is the world’s No. 1 wheat exporter, and Sovecon expects the country to ship out 1.631 billion bushels during the current marketing year.

Jordan purchased 2.2 million bushels of hard milling wheat from optional origins in an international tender that closed earlier today. The grain is for shipment during the first half of October.

Preliminary volume estimates were for 104,960 CBOT contracts, tracking slightly above Monday’s final count of 92,291.

About the Author(s)

You May Also Like