Grain prices continue to shift lower on Thursday

Afternoon report: Corn and soybeans face moderate cuts, while wheat saw much sharper losses.

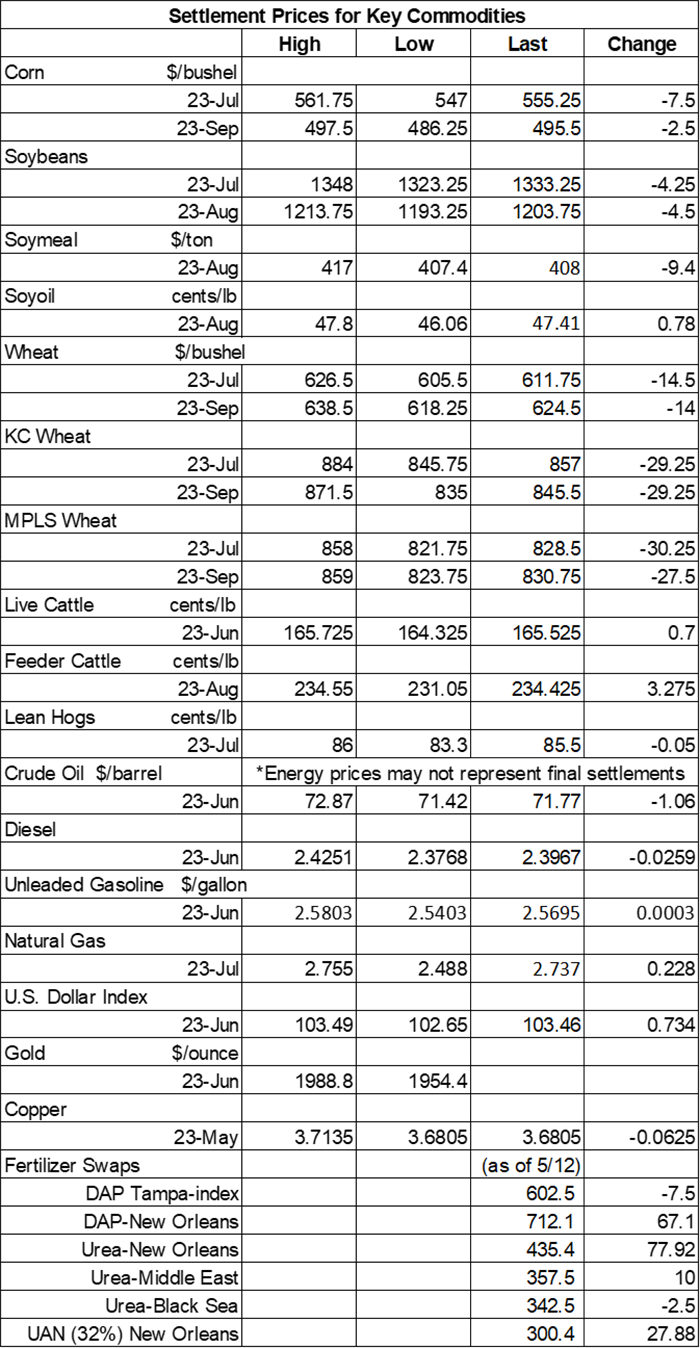

Grain prices trended lower again on Thursday following an unimpressive set of export data from USDA this morning. That issue was compounded by ongoing seasonal planting pressure in the U.S. and seasonal harvest pressure in Brazil, along with a recently inked extension for a deal that allows safe passage of shipping vessels through the Black Sea. Corn and soybean futures each dropped around 0.5% lower. Wheat losses were variable, mostly ranging between 2.25% and 3.5%.

NOAA’s latest 72-hour cumulative precipitation map shows little to no rain in store for the Dakotas and Nebraska between Friday and Monday, but areas farther east and south could see between a light sprinkle and 0.25” during this time. Later on, NOAA’s new 8-to-14-day outlook predicts near-normal to slightly above-normal rainfall likely for much of the Corn Belt between May 25 and May 31, with widespread warmer-than-normal conditions likely throughout the central U.S. as the month draws to a close.

On Wall St., the Dow shifted 78 points lower in afternoon trading to 33,342 as investors remain watchful of ongoing debt ceiling negotiations. House Speaker Kevin McCarthy said today that he’s optimistic a deal will be reached in time to make a House vote sometime next week. Energy futures incurred moderate losses. Crude oil spilled more than 1.5% lower this afternoon to $71 per barrel on a strengthening U.S. Dollar. Diesel dropped 1%, with gasoline down around 0.5%. Volatile natural gas jumped 10% higher today.

On Wednesday, commodity funds were again net sellers of all major grain contracts, including corn (-9,500), soybeans (-12,500), soymeal (-1,500), soyoil (-2,500) and CBOT wheat (-13,000).

Corn

Corn prices slumped to a 19-month low on Thursday after yet another round of technical selling caused moderate losses. July futures fell 7.5 cents to $5.54, with September futures down 2.5 cents to $4.9450.

Corn basis bids were largely steady across the central U.S. on Thursday but did trend 5 cents higher at an Illinois while dropping 3 to 5 cents at two other Midwestern locations today.

Corn exports saw old crop net sales reductions of 13.3 million bushels. New crop sales added 2.9 million bushels, leaving a total net reduction of 10.4 million bushels. That was on the low end of trade guesses, which ranged between net reductions of 17.7 million bushels and net sales of 23.6 million bushels. Cumulative sales for the 2022/23 marketing year are roughly 600 million bushels below last year’s pace so far after reaching 1.087 billion bushels last week.

Corn export shipments were more robust, with 42.8 million bushels. Mexico, China, Japan, the Dominican Republic and Costa Rica were the top five destinations.

The U.S. Environmental Protection Agency (EPA) reported that the U.S. generated around 1.16 billion ethanol blending credits in April, which was down from March’s tally of 1.22 billion. EPA also indicated that 603 million biodiesel blending credits were generated last month, versus 619 million in April.

South Korea issued an international tender to purchase 2.8 million bushels of animal feed corn from optional origins that closes today. The grain is for arrival around October 20.

Preliminary volume estimates were for 385,203 contracts, moving moderately below Wednesday’s final count of 510,799.

Soybeans

Soybean prices followed other grains lower on Thursday, but a better-than-expected round of export sales data kept losses somewhat in check. July futures fell 4.25 cents to $13.3275, with August futures down 6.5 cents to $12.6825.

The rest of the soy complex was mixed. Soymeal futures tumbled nearly 2.75% lower, while soyoil futures found a boost of around 1.75%.

Soybean basis bids were mostly steady across the central U.S. on Thursday but did tilt 5 cents higher at an Iowa river terminal today.

Soybean exports saw just 625,000 bushels in old crop sales last week, but thanks to a healthy dose of new crop sales that reached 24.4 million bushels, total sales came in at 25.0 million bushels. That was better than the entire set of trade guesses, which ranged between zero and 22.0 million bushels. Cumulative totals for the 2022/23 marketing year are just below last year’s pace so far, with 1.752 billion bushels.

Soybean export shipments eroded 60% below the prior four-week average to 6.9 million bushels. Mexico, Egypt, the Philippines, Indonesia and Venezuela were the top five destinations.

In Argentina, the Buenos Aires grains exchange again trimmed its estimates for the country’s 2022/23 soybean production by another 6.7% to 771.6 million bushels after suffering through widespread drought earlier in the season.

Preliminary volume estimates were for 223,909 contracts, sliding 12% below Wednesday’s final count of 253,891.

Wheat

Wheat prices tumbled even lower on Thursday as traders still worry that current prices are making U.S. grain uncompetitive in some key overseas markets. A pedestrian round of export sales data added to today’s woes. September Chicago SRW futures dropped 14 cents to $6.2375, September Kansas City HRW futures lost 29.25 cents to $8.44, and September MGEX spring wheat futures fell 27.5 cents to $8.3225.

A critical Black Sea deal that allows safe passage of Ukrainian shipping vessels received a much-needed 60-day extension on Wednesday, but Russia is already warning that more progress advancing its own interests needs to occur in the coming weeks before it considers additional extensions moving forward. “It is very important to understand that the fate of the deal is still in the hands of those with whom the UN must agree on the Russian part of the deal,” according to Kremlin spokesperson Dmitry Peskov. That will include easing international payment transfer restrictions on Russia’s state agricultural bank.

Wheat saw net old crop sales reductions of 1.5 million bushels, but an influx of new crop sales led to a total tally of 10.8 million bushels. That was on the very low end of analyst estimates, which ranged between 9.2 million and 20.2 million bushels. Cumulative sales for the 2022/23 marketing year are trending slightly behind last year’s pace, with 621.1 million bushels.

Wheat export shipments were 13% below the prior four-week average, with 8.0 million bushels. Japan, the Philippines, Mexico, Nigeria and Algeria were the top five destinations.

As expected, Japan purchased 4.2 million bushels of food-quality wheat from the United States, Canada and Australia in a regular tender that closed earlier today. Of the total, 19% was sourced from the U.S. The grain is for shipment in July.

Iraq’s commerce ministry reports that the country has strategic reserves sufficient for the next six months, and the country hopes to boost reserves that are sufficient for an entire year by the end of the current procurement period.

Preliminary volume estimates were for 92,541 CBOT contracts, falling moderately short of Wednesday’s final count of 159,307.

About the Author(s)

You May Also Like