Grain markets begin pricing in rainy forecasts

Afternoon report: Corn, soybeans and wheat all face severe cuts on Tuesday.

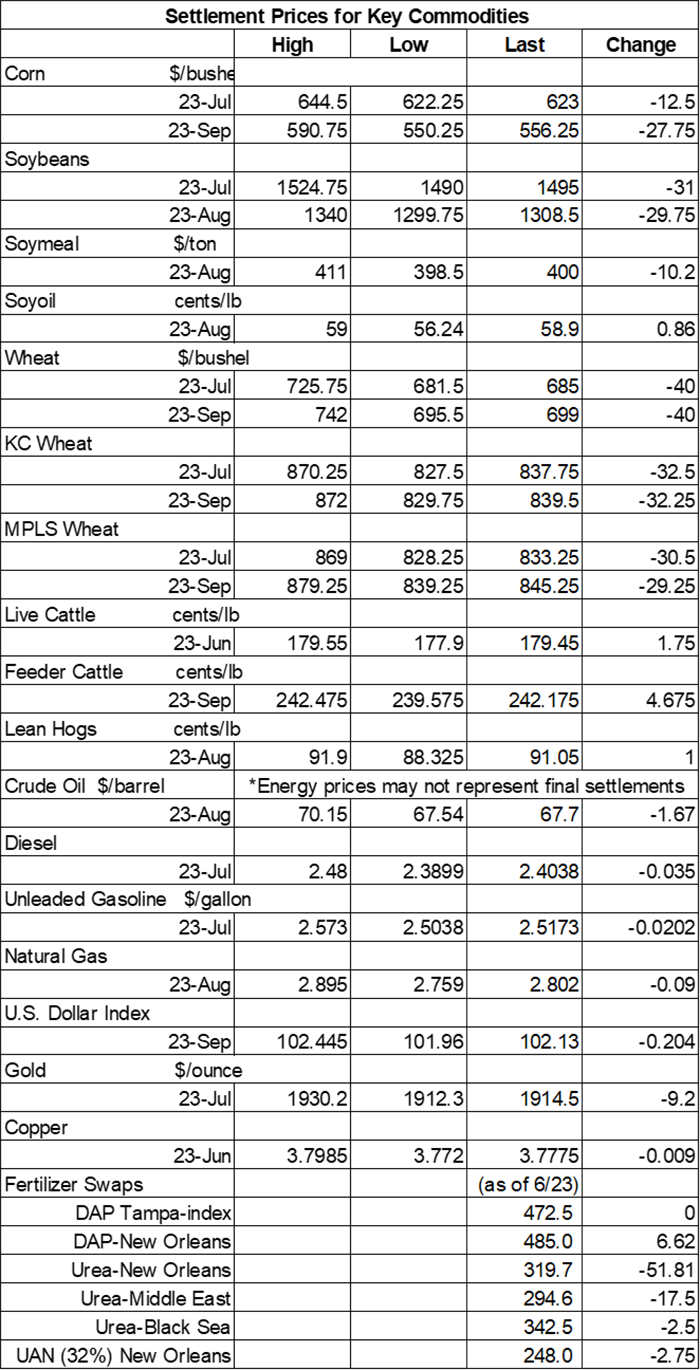

Traders were faced with the reality of sharply lower quality ratings for both corn and soybeans after USDA’s latest crop progress report Monday afternoon. However, the prospect of widespread rains in both the short and mid-range forecasts caught the attention of traders, who in turn engaged in ample technical selling that pushed grain prices noticeably lower on Tuesday. Corn, soybeans and wheat all suffered double-digit losses by the close.

Pretty much all of the central U.S. should receive at least some measurable moisture between Wednesday and Saturday, with some areas set to gather another 0.5” or more during this time, per the latest 72-hour cumulative precipitation map from NOAA. Further out, NOAA’s new 8-to-14-day outlook is anticipating wetter-than-normal conditions likely for the entire central U.S. between July 4 and July 10, with warmer-than-normal temperatures probable for parts of the Midwest and Plains starting on Independence Day.

On Wall St., the Dow is on pace for its first “win” in seven sessions after rising 235 points in afternoon trading to 33,950. Investors remain generally skittish amid high inflation and the potential for additional interest rate hikes from the Federal Reserve later this year. Energy futures eroded lower on interest rate hike concerns, with crude oil down 2.5% this afternoon to $67 per barrel. Diesel dropped more than 1.75%, with gasoline down 1% to 1.5%. The U.S. Dollar softened moderately.

On Monday, commodity funds were net buyers of corn (+1,500), soybeans (+9,500), soymeal (+2,000) and soyoil (+5,500) contracts but were net sellers of CBOT wheat (-4,500).

Corn

Corn prices stumbled majorly on a round of technical selling on Tuesday as traders eyed a series of Midwestern rains that are expected to move through the region over the next two weeks. July futures dropped 12.5 cents to $6.2475, while September futures lost 27.75 cents to $5.5625.

Corn basis bids were steady to weak across the central U.S. after dropping 3 to 5 cents lower at three Midwestern locations on Tuesday.

Corn quality ratings once again suffered a larger-than-expected setback as the central U.S. slugged through another week of hot-dry weather. Only half of the crop is now rated in good-to-excellent condition through June 25, versus 55% a week ago and two points lower than the average trade guess of 52%. It’s also the lowest-rated crop in late June since the late 1980s.

Physiologically, 4% of the crop is now silking, which mirror’s 2022’s pace as well as the prior five-year average. Progress in this category is largely relegated to southern states so far.

Are analysts expecting any big surprises in the highly anticipated June 30 acreage and stocks report from USDA? “Big changes in these June reports are the exception, but they do occur,” notes grain market analyst Bryce Knorr. “The granddaddy of these adjustments came in 1983, the year farmers idled millions of acres to participate in in the government’s PIK program, only to watch as corn fields withered when a blast of hot, dry weather baked fields at pollination.” Knorr offers his best guess at corn acres and looks at the latest weather trends in yesterday’s Ag Marketing IQ blog – click here to learn more.

Per the latest data from the European Commission, EU corn imports during the 2022/23 marketing year are still substantially above last year’s pace after reaching 1.005 billion bushels through June 25. Ukraine, Brazil, Canada, Serbia and Russia are the top five suppliers so far.

South Africa is the continent’s top corn producer and tends to be a net exporter of this commodity. The country’s Crop Estimates Committee reported today that the 2022/23 harvest should come in 5.7% higher from a year ago, with an estimated total of 643.7 million bushels. A little over half of that total is white corn for human consumption, with the remainder in yellow corn for animal feed.

Preliminary volume estimates were for 503,319 contracts, trending moderately above Monday’s final count of 452,217.

Soybeans

Soybean prices followed other grains lower, although losses were not as steep following a choppy session on Tuesday. Still, July futures eroded 31 cents lower to $14.90, with August futures down 31.25 cents to $13.93.

The rest of the soy complex was mixed. Soymeal futures fell 2% to 2.5%, while soyoil futures shot up nearly 1.75% today.

Soybean basis bids were mostly steady across the central U.S. on Tuesday but did tilt 10 cents lower at an Indiana processor today.

As expected, USDA slashed quality ratings by another three points last week, with 51% of the crop now rated in good-to-excellent condition through June 25. Another 35% is rated fair (up a point from last week), with the remaining 14% rated poor or very poor (up two points from last week).

Physiologically, 96% of the crop is now emerged, versus 2022’s pace of 90% and the prior five-year average of 89%. And 10% of the crop is now blooming, which is modestly faster than the prior five-year average of 9%.

Brazil’s Abiove modestly raised its estimates for the country’s 2022/23 soybean production, which is expected to carve out a new record of 5.732 billion bushels. Brazilian soybean exports are also likely to reach record levels this season, with Abiove currently estimating that total will reach 3.564 billion bushels.

Iran issued an international tender to purchase 120,000 metric tons of soymeal, sourced from Argentina, that closes on Wednesday. The grain is for shipment in July and August.

Preliminary volume estimates were for 263,751 contracts, firming slightly above Monday’s final count of 251,730.

Wheat

Wheat prices navigated rough waters that featured plenty of technical selling on Tuesday that pushed some contracts down more than 5% by the close. September Chicago SRW futures tumbled 40 cents to $6.9825, September Kansas City HRW futures lost 32.25 cents to $8.36, and September MGEX spring wheat futures fell 29.25 cents to $8.4325.

Winter wheat quality ratings bucked expectations after rising two points last week, with 40% now rated in good-to-excellent condition. Analysts were expecting USDA to leave ratings unchanged. Another 32% is rated fair (down one point from last week), with the remaining 28% rated poor or very poor (down one point from last week).

Most of this season’s crop (97%) is now headed, with harvest trending from 15% a week ago to 24% through June 25. Analysts were expecting to see more progress after offering an average trade guess of 29%.

Sprung wheat quality ratings eased slightly, with 50% now rated in good-to-excellent condition. Another 38% is rated fair (up one point from last week), with the remaining 12% rated poor or very poor (unchanged from last week). Physiologically, 31% of the crop is now headed, which is far above 2022’s pace of 7% and moderately faster than the prior five-year average of 25%.

European Union soft wheat exports during the 2022/23 marketing year have reached 1.131 billion bushels through June 25, which is a year-over-year increase of 11.3% so far. Morocco, Algeria, Nigeria, Egypt and Saudi Arabia are the top five destinations. EU barley exports are modestly below last year’s pace, meantime, reaching 291.2 million bushels over the same period.

“Nobody expects a 25,000-strong private army to leave the frontlines of a war and march hundreds of miles toward the Kremlin,” says Advance Trading risk advisor Ryan Fogel, referencing a near-coup last weekend that ultimately fizzled before those troops reached Moscow. “What does this have to do with grain markets? Volatility.” Fogel expands on how geopolitical threats can intersect a farmer’s grain marketing strategy in today’s Ag Marketing IQ blog – click here to learn more.

Preliminary volume estimates were for 129,351 CBOT contracts, spilling moderately below Monday’s final count of 183,757.

About the Author(s)

You May Also Like