Friday gives silver lining to a sour week

Afternoon report: Corn, soybeans and wheat finally move back into the green on Friday.

Bargain buyers finally came to assist grain prices, which had been pushed substantially lower earlier this week – most notably corn, which tumbled to a nine-month low on Thursday. Soybeans and wheat were also firm on Friday. In fact, Kansas City HRW contracts showed the most upside after May futures jumped more than 4.5% higher.

Parts of the Mid-South and Southeast will see another 1.5” or more rainfall between Saturday and Tuesday, with most areas east of the Mississippi River likely to get at least some measurable moisture during this time, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts a return to drier-than-normal conditions for most of the Corn Belt between May 5 and May 11, with seasonally warm weather building across the Plains and into the western Corn Belt.

On Wall St., the Dow trended another 189 points in afternoon trading to reach 34,015 and is on pace to finish out the month with 2.2% gains. Energy futures also made moderate inroads this afternoon. Crude oil climbed more than 2.75% higher to $76 per barrel on rising domestic demand. Diesel improved 1%, while gasoline rose more than 1.5%. The U.S. Dollar firmed slightly.

On Thursday, commodity funds were net sellers of corn (-18,000), soybeans (-5,000), soyoil (-7,500) and CBOT wheat (-4,000). Funds were roughly even when trading soymeal contracts yesterday.

Corn

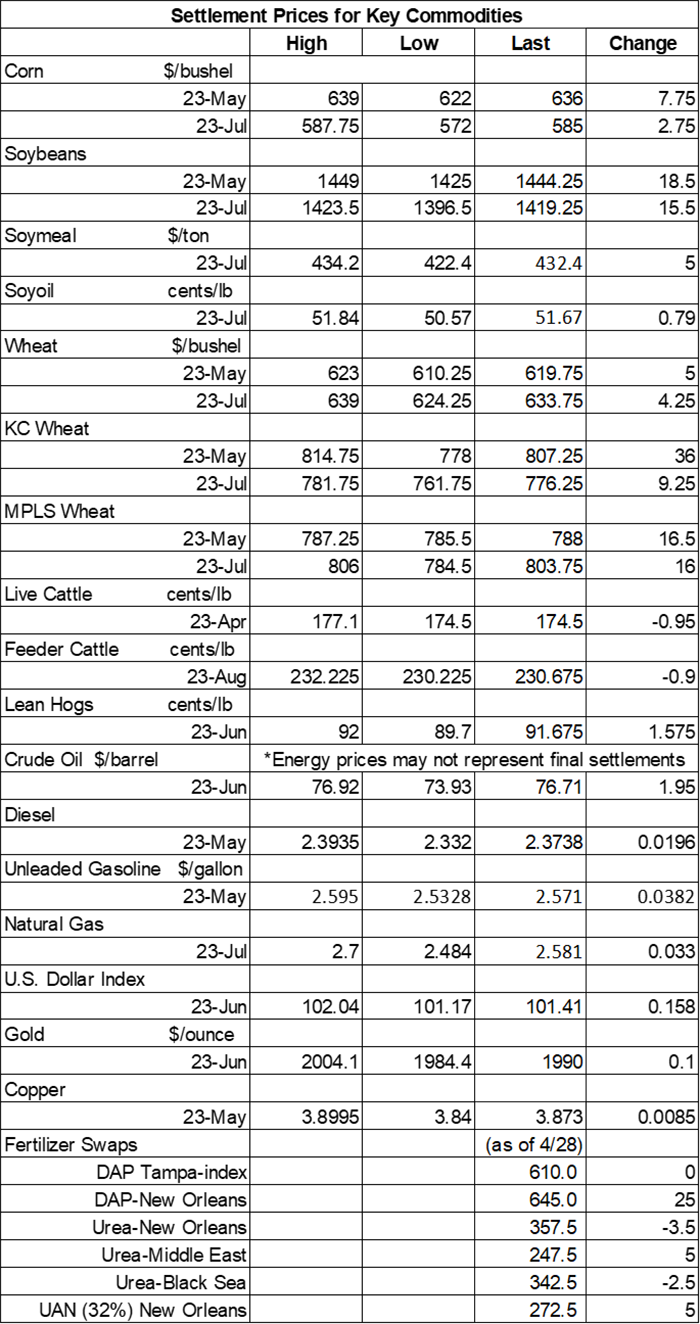

Corn prices attracted some bargain buying after fading to a nine-month low yesterday, although traders remain wary that China could make additional sales cancellations after two sales fell apart earlier this week. May futures added 7.75 cents to $6.3475, with July futures up 2.75 cents to $5.8425.

Corn basis bids were steady to firm after rising 5 cents higher across three Midwestern locations on Friday.

The White House announced today that the United States EPA will allow E15 blends of gasoline to be sold over the summer, exempting it from anti-smog rules that have blocked sales between June 1 and September 15 in the past across most of the country. “Allowing E15 sales during the summer driving season will not only help increase fuel supply, but support American farmers, strengthen U.S. energy security, and provide relief to drivers across the country,” according to a statement from EPA Administrator Michael Regan.

France’s 2023 corn plantings are 44% complete through August 24. That’s a solid improvement from the prior week’s tally of 20% but is still well below the prior five-year average of 56%.

Brazil could surpass the United States as the world’s largest corn exporter – and it might not be a temporary swap. Farm broadcaster Max Armstrong takes a closer look at the latest trends in today’s edition of Farm Progress America – click here to listen.

Mike Downey, co-owner of Iowa-based Next Gen Ag Advocates, has worked with around 300 farming operations over the years. Recently, he sat down and wrote up 10 trends he’s spotted. Click here for his latest observations on the present and future of farming.

As planters continue to roll across Midwestern fields in earnest this week, Farm Futures grain market analyst Jacqueline Holland is bringing back the farmer-led series Feedback from the Field for our readers. Just click this link to take the survey and share updates about your farm’s spring progress. Holland reviews submissions and uploads daily to the interactive FFTF Google MyMap. Weekly recaps of responses will be compiled in a regular column each Tuesday throughout the 2023 season.

Preliminary volume estimates were for 413,159 contracts, sliding moderately below Thursday’s final count of 511,415.

Soybeans

Soybean prices improved more than 1% on Friday following some bargain buying and further assisted by spillover strength from other commodities. May futures rose 18.5 cents to $14.4525, with July futures up 15.5 cents to $14.1925.

The rest of the soy complex was also in the green on Friday, with soymeal and soyoil prices each firming around 1.5% higher today.

Soybean basis bids dropped 5 cents at an Iowa processor while holding steady elsewhere across the central U.S. on Friday.

Prior to the next monthly oilseed report from USDA, out Monday afternoon, analysts expect the agency to show a March soybean crush totaling 197.3 million bushels. That would be the largest crush in more than a year and the second-largest monthly crush on record, if realized. Soyoil stocks through March 31 are expected to rise to 2.414 billion pounds.

Grit is a highly valued commodity in agriculture, according to Davon Cook, family business consultant with Pinion. “We reward those who work long, physically grueling hours in busy seasons,” she notes. “We value mental and physical toughness. But when does that idolization of grit turn into a liability? Any strength gone too far becomes a weakness.” Cook takes a closer look at grit vs. quit and offers advice on how to find the balance between the two – click here to learn more.

Preliminary volume estimates were for 215,044 contracts, which was slightly above Thursday’s final count of 210,904.

Wheat

Wheat prices saw widely variable gains on Friday following a round of technical buying. Some contracts jumped more than 4.5% higher, while others only found gains of around 0.75%. July Chicago SRW futures picked up 4.25 cents to $6.3350, July Kansas City HRW futures added 9.25 cents to $7.7450, and July MGEX spring wheat futures rose 16 cents to $8.01.

French soft wheat crop ratings are at the highest levels on record for this time of year, with 94% in good-to-excellent condition through April 24. That’s a one-point weekly improvement amid ongoing favorable weather for Europe’s No. 1 grain producer.

Negotiations are ongoing to extend a deal that allows for safe passage of shipping vessels in the Black Sea, which would otherwise expire on May 18. However, Russia has been showing some pessimism as it looks to gain advantage for its own grain and fertilizer exports. A statement from the Kremlin issued earlier today indicated that the outlook for the deal is “not very good.”

If it’s been a few days since you’ve visited FarmFutures.com, our Friday feature “7 ag stories you can’t miss” is a great way to quickly catch up on the industry’s top headlines. Today’s batch of stories includes a look at how inflation is affecting cattle profits, an update about an unusual grain theft in Indiana and more. Click here to get started.

Preliminary volume estimates were for 93,864 CBOT contracts, trending moderately below Thursday’s final count of 146,203.

About the Author(s)

You May Also Like