Feedlot inventory down slightly

Fed cattle backlog expected to continue to plague feedlots and fed cattle markets for many weeks.

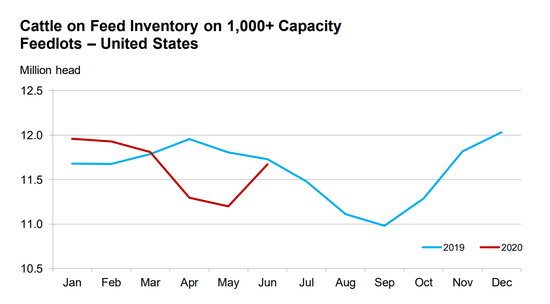

The U.S. Department of Agriculture’s latest “Cattle on Feed” report showed that the feedlot inventory for feedlots with a capacity of 1,000 head or more totaled 11.7 million head on June 1, 2020, fractionally below the same period last year and the second-highest June 1 inventory since the series began in 1996. The number came in near analysts’ pre-report estimates.

According to the report, placements in feedlots during May totaled 2.04 million head, 1% below 2019. Analysts had expected a 2% year-over-year decline. Net placements were 1.97 million head.

During May, placements totaled: 375,000 head for cattle and calves weighing less than 600 lb., 305,000 head for those weighing 600-699 lb., 485,000 head for those weighing 700-799 lb., 532,000 head for those weighing 800-899 lb., 235,000 head for those weighing 900-999 lb. and 105,000 head for those weighing 1,000 lb. and greater.

Marketings of fed cattle during May totaled 1.50 million head, 28% below 2019 and the lowest May marketings since the series began in 1996. The number was larger than the analysts’ pre-report estimates of 26%. However, USDA livestock analyst Shayle Shagam pointed out that there were two fewer slaughter days this May. “As a result, when you factor that in, we were down only about 20% in May,” he said.

Following a challenging May, Shagam said there are signs of improvement for the beef industry's situation as plants are mostly back on line.

“As we sort of worked our way through the month, we began to see more and more plants come on line; we began to see increased line speeds [and] some higher Saturday slaughter,” he said. “There became an increased impetus to pull some of those cattle out of the feedlots.”

USDA also reported that feeder cattle prices in May were $12.00/cwt. below the same period last year. Shagam said those prices have started to rise, “even though they are below a year ago.”

In CME Group’s “Daily Livestock Report,” Steiner Consulting Group (SCG) said decent pasture conditions early in the spring allowed some producers to keep their calves longer and add pounds outside of the feedlot. Further, SCG noted that the current backlog of fed cattle and uncertainty about demand continue to incentivize keeping cattle outside of feedlots.

Oklahoma State University extension livestock marketing specialist Derrell Peel said the backlog of fed cattle will continue to plague feedlots and fed cattle markets for many weeks. However, he did note that feedlot placements and marketings will return to more typical seasonal levels from June through the second half of the year.

With beef supplies increasing in the second half of the year, Peel said beef demand will be critical.

“Retail grocery will transition from limited beef supplies in recent weeks to ample supplies at the same time that foodservice demand is slowly building," he said. “Wholesale boxed beef prices have dropped nearly back to pre-COVID-19 levels and may go lower into midsummer as abundant third-quarter beef production could highlight potential recessionary demand weakness.”

About the Author(s)

You May Also Like