Fast fieldwork slashes corn, soybean prices

Afternoon report: Wheat prices mixed following some uneven technical maneuvering on Tuesday.

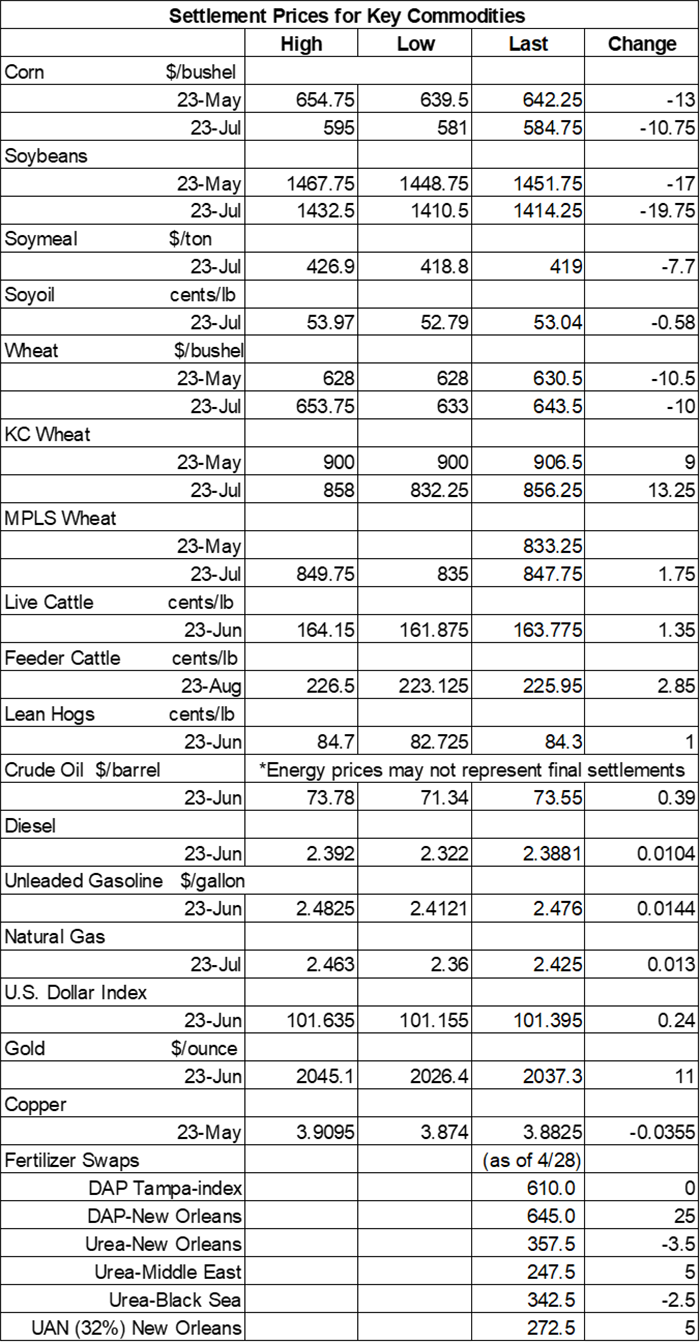

Grain prices were mixed but mostly lower after USDA reported faster-than-expected planting pace for both corn and soybeans in its latest weekly crop progress report. Corn took the largest hit, eroding nearly 2% lower, while soybeans lost more than 1% by the close. Wheat prices were sensitive to the fact that quality ratings are dismal to the west but fairly solid farther east. That left Chicago SRW contracts down 1.5% to 2%, while Kansas City HRW and MGEX spring wheat prices held firm.

Wet weather is likely later this week, with some parts of the Dakotas, Nebraska, Kansas, Missouri and Arkansas likely to gather another 1” or more between Wednesday and Saturday, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts a return to seasonally dry conditions for the Corn Belt between May 16 and May 22, with colder-than-normal conditions likely for the Ohio River Valley and Great Lakes region next week.

On Wall St., the Dow eased 6 points lower to 33,612 as investors hold tight for additional inflation data that will be released later this week. Energy futures made moderate inroads, with crude oil up almost 0.75% in afternoon trading to $73 per barrel. Gasoline and diesel found similar gains today. The U.S. Dollar firmed moderately.

On Monday, commodity funds were net sellers of corn (-2,500), soybeans (-2,000), soyoil (-2,000) and CBOT wheat (-2,000) contracts. Funds were roughly even when trading soymeal contracts yesterday.

Corn

Corn prices faced a significant technical setback after better-than-expected planting progress (more on that below) sent prices spilling nearly 2% lower on Tuesday. May futures dropped 13 cents to $6.4350, with July futures down 10.75 cents to $5.8575.

Corn basis bids firmed 3 to 10 cents higher at two interior river terminals and improved 5 cents at an Iowa ethanol plant while holding steady elsewhere across the central U.S. on Tuesday.

Private exporters announced to USDA the cancellation of 10.7 million bushels of corn that was originally bound for China during the 2022/23 marketing year, which began September 1.

Corn plantings moved from 26% completion last week up to 49% through May 7.That was a point above the average trade guess of 48%. It was also more than double 2022’s pace of 21% and seven points faster than the prior five-year average of 42%. Twelve percent of the crop is now emerged, up from 6% a week ago and slightly ahead of the prior five-year average of 11%.

Ahead of Friday’s WASDE report from USDA, analysts expect the agency to offer a 2023 corn production estimate of 15.120 million bushels on average yields of 180.7 bushels per acre. That would be significantly above 2022’s output of 13.730 billion bushels, if realized.

Brazil’s Anec estimates that the country’s corn exports will reach 12.6 million bushels in May, which is slightly below it’s prior forecast from a week ago.

Taiwan is seeking 2.6 million bushels of animal feed corn that can be sourced from the United States, South America or South Africa in an international tender that closes on Wednesday. The grain is for shipment between early July and early August, depending on origin.

Preliminary volume estimates were for 325,024 contracts, tracking moderately above Monday’s final count to 241,518.

Soybeans

Soybean prices lost more than 1% on Tuesday after USDA showed the 2023 planting pace is happening much faster than the historical average. Prices incurred double-digit losses by the close, with May futures down 17 cents to $14.5175 and July futures down 19.75 cents to $14.14.

The rest of the soy complex also trended lower. Soymeal futures faded more than 1.75% lower, with soyoil futures down around 1%.

Soybean basis bids trended 10 cents lower at an Illinois river terminal while holding steady elsewhere across the central U.S. on Tuesday.

Soybean plantings moved from 19% completion a week ago up to 35% through May 7. That was a point better than the average trade guess of 34%. It is also trending significantly above 2022’s pace of 11% and the prior five-year average of 21%. Progress among individual states varies widely, between 0% in North Dakota and 71% in Louisiana. Nine percent of the crop is now emerged.

Prior to Friday’s WASDE report from USDA, analysts think the agency will show 2023 soybean production potential at 4.494 billion bushels, with average yields of 51.8 bushels per acre. That would put this season’s production moderately ahead of last year’s total of 4.276 billion bushels, if realized.

The latest customs data showed China’s soybean imports in April were down 9.8% year-over-year, falling to 267.9 million bushels. However, total volume during the first four months of 2023 are still trending 6.8% above last year’s pace, with 1.113 billion bushels. China is the world’s No. 1 soybean importer.

Brazil’s Anec estimates that the country’s soybean exports will reach 564 million bushels in May, which is moderately above its prior projection last week. Anec also increased its estimates for Brazilian soymeal exports this month, with a new forecast of 2.37 million metric tons.

Preliminary volume estimates were for 173,337 contracts, moving moderately ahead of Monday’s final count of 147,364.

Wheat

Wheat prices were mixed after USDA showed dismal crop ratings in Kansas and Oklahoma and much better quality unfolding for eastern production states such as Illinois and Indiana. As a result, July Chicago SRW futures fell 10 cents to $6.44, while July Kansas City HRW futures rose 13.25 cents to $8.5750. MGEX spring wheat contracts were also firm today, with July futures picking up 1.75 cents to $8.4550.

Winter wheat quality ratings improved by another point last week, with 29% of the crop now rated in good-to-excellent condition. Analysts were expecting to see a two-point bump, however. Another 27% of the crop is rated fair (down three points from last week), with the remaining 44% rated poor or very poor (up two points from last week). Physiologically, 38% of the crop is now headed, up from 25% a week ago. It’s also moderately above last year’s pace of 32% and the prior five-year average of 35%.

Spring wheat plantings moved from 12% complete a week ago to 24% complete through Sunday. That was four points below the average trade guess of 28%. It was also two points behind 2022’s pace of 26% and noticeably below the prior five-year average of 38%.

Statistics Canada reported this morning that the country’s total wheat stocks as of March 31 were up 18.2% from last year’s volume after climbing to 488.7 million bushels. The agency also showed Canadian canola stocks rising 15.3% higher year-over-year, to 260.1 million bushels.

Preliminary volume estimates were for 102,056 CBOT contracts, which was fractionally higher than Monday’s final tally of 101,884.

About the Author(s)

You May Also Like