Dry weather keeps the bulls running

Afternoon report: Corn, soybeans and wheat all trend higher again on Friday.

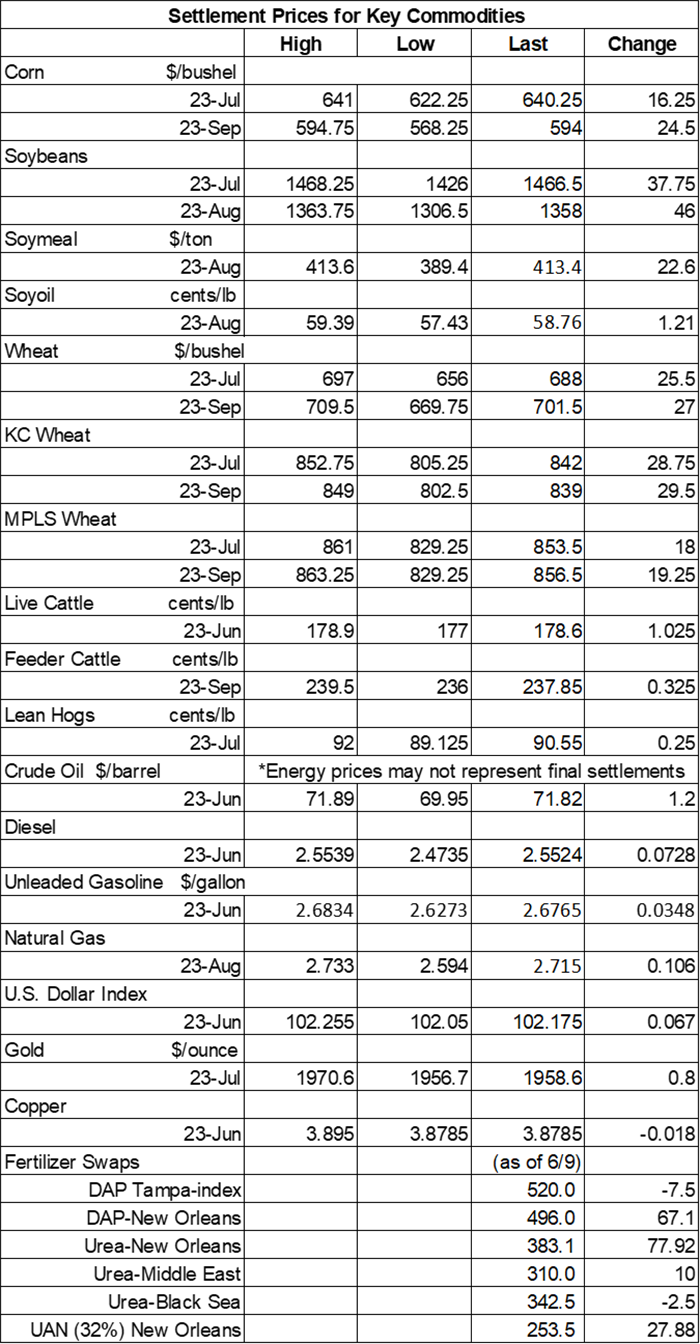

As the weather heats up, leaving crops with already-dry soils even more susceptible to damage, traders handed out big gains again on Friday. Corn, soybeans and wheat all finished with double-digit gains. Notable standouts included September corn and CBOT wheat contracts, which each jumped more than 4% higher by the close.

Some much-needed wet weather will hit parts of the Corn Belt between Saturday and Tuesday, with a few areas set to gather another 0.75” or more during this time, per the latest 72-hour cumulative precipitation map from NOAA. The eastern Corn Belt will remain relatively dry during this time, however. NOAA’s new 8-to-14-day outlook predicts some seasonally wet conditions in the Northern Plains between June 23 and June 29, with warmer-than-normal conditions likely for most of the central U.S.

On Wall St., the Dow eased 17 points lower to 34,390. Total gains for the week totaled roughly 2%, and the Dow has finished higher for three consecutive weeks. Energy futures made solid inroads on Friday, with crude oil rising more than 1.5% to $71 per barrel this afternoon. Diesel jumped more than 2% higher, with gasoline up around 1.75%. The U.S. Dollar firmed slightly.

On Thursday, commodity funds were significant net buyers of all major grain contracts, including corn (+17,500), soybeans (+20,000), soymeal (+4,000), soyoil (+5,500) and CBOT wheat (+12,500).

NOTE: Grain markets will be closed on Monday, June 19 in observance of the Federal Juneteenth holiday. Come back first thing Tuesday for our next round of agricultural news and grain marketing analysis.

Corn

Corn prices moved noticeably higher on a wave of technical buying as the current weather bull market was extended another day. July futures rose 16.25 cents to $6.3950, while September futures climbed 24.5 cents to $5.9450.

Corn basis bids were steady to weak after dropping 1 to 15 cents lower across half a dozen Midwestern locations on Friday.

China is redirecting some resources into improved rural financing in hopes to meet the financing demand of its major grain producers and help them expand their production potential, according to a statement from the People’s Bank of China. Among other things, the moves will help restructure rural banks and step up loan support for its agriculture industry.

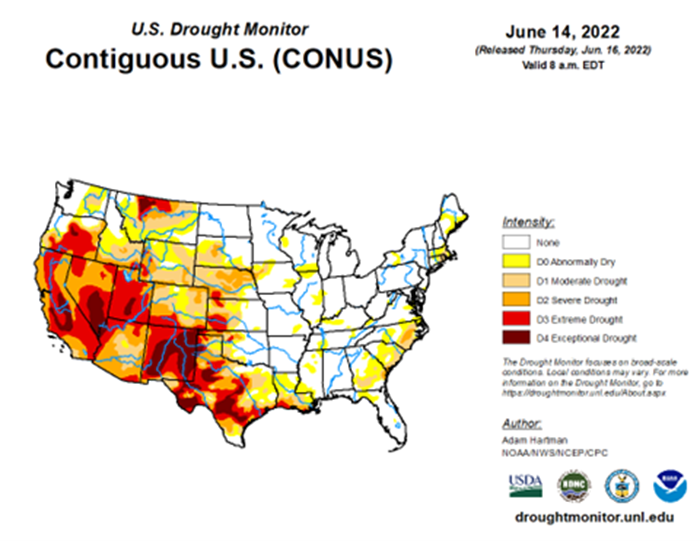

Drought’s footprint looks very different this year versus a year ago. Here’s a look at mid-June in 2022:

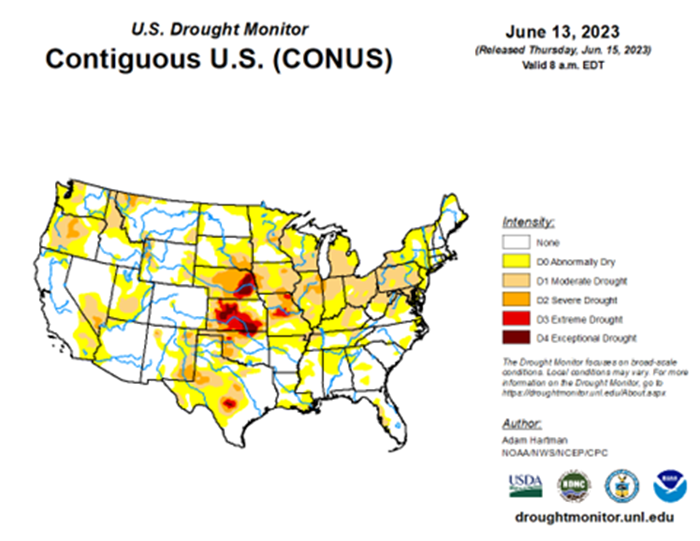

Notice how severe the drought was throughout the Central and Southern Plains extending all the way to the West Coast. The Corn Belt was relatively spared, in contrast. Now take a look at the latest U.S. Drought Monitor map:

Drought remains problematic in the Central Plains but has somewhat cleared farther West. Meantime, almost all of the Corn Belt is at least abnormally dry, with some areas intensifying to moderate or severe drought – making these maps a good visual aid to help explain the most recent grain market rally.

Preliminary volume estimates were for 727,522 contracts, tracking moderately higher than Thursday’s final count of 588,253.

Soybeans

Soybean prices followed other grains higher on weather-related technical buying on Friday and are now back above $14 per bushel. July futures climbed 37.75 cents to $14.66, with August futures up 36.5 cents to $14.05.

Soybean basis bids were mostly steady to soft after eroding 10 to 20 cents lower at five Midwestern locations. An Ohio elevator bucked the overall trend after firming 3 cents higher today.

“Finally, traders realized that we are in fact cutting yield and markets have rallied substantially,” according to Bill Biedermann, hedging strategist with AgMarket.net, in response to the reality of just how dry most the Midwest is right now. “Estimate your yields, and be conservative. Multiply that by price for fall and see if selling here makes you money.” Biedermann offers additional advice and analysis in today’s Ag Marketing IQ blog – click here to learn more.

If it’s been awhile since you’ve been to FarmFutures.com, our Friday feature “7 ag stories you can’t miss” is a great way to quickly catch up on the industry’s top headlines. The latest batch of stories includes a look at cover crop cost trends, a look at a new acquisition from Bunge and more. Click here to get started.

Preliminary volume estimates were for 473,294 contracts, trending moderately higher than Thursday’s final count of 396,027.

Wheat

Wheat prices trended 2.25% to 4% higher following another round of technical buying largely spurred by dry weather in the U.S. along with ongoing geopolitical turmoil in the Black Sea region. September Chicago SRW futures jumped 27 cents to $6.9975, September Kansas City HRW futures climbed 29.5 cents to $8.3825, and September MGEX spring wheat futures rose 19.25 cents to $8.5275.

Russia’s speaker of the country’s upper house of parliament complained that it will be “impossible” to extend a critical deal that allows for safe passage of shipping vessels in the Black Sea under its current parameters, adding that the limits of Russia’s patience “have been exhausted.” Russia has cited frustration in recent weeks that its own food and fertilizer export needs are not being met. Russia is the world’s No. 1 wheat exporter.

French farm office FranceAgriMer downgraded its soft wheat quality ratings once again, moving it from 88% in good-to-excellent condition in the prior week down to 85% through June 12. That’s still well above year-ago ratings of 65%. France is Europe’s top grain producer.

And finally, is there a way for solar panels and row crops to co-exist in the same field? That’s a question that Purdue University researchers are investigating. Farm broadcaster Max Armstrong delivers the details in today’s edition of Farm Progress America – click here to listen.

Preliminary volume estimates were for 241,214 CBOT contracts, moving moderately above Thursday’s final count of 171,065.

About the Author(s)

You May Also Like