Dry forecasts boost soybean and wheat prices

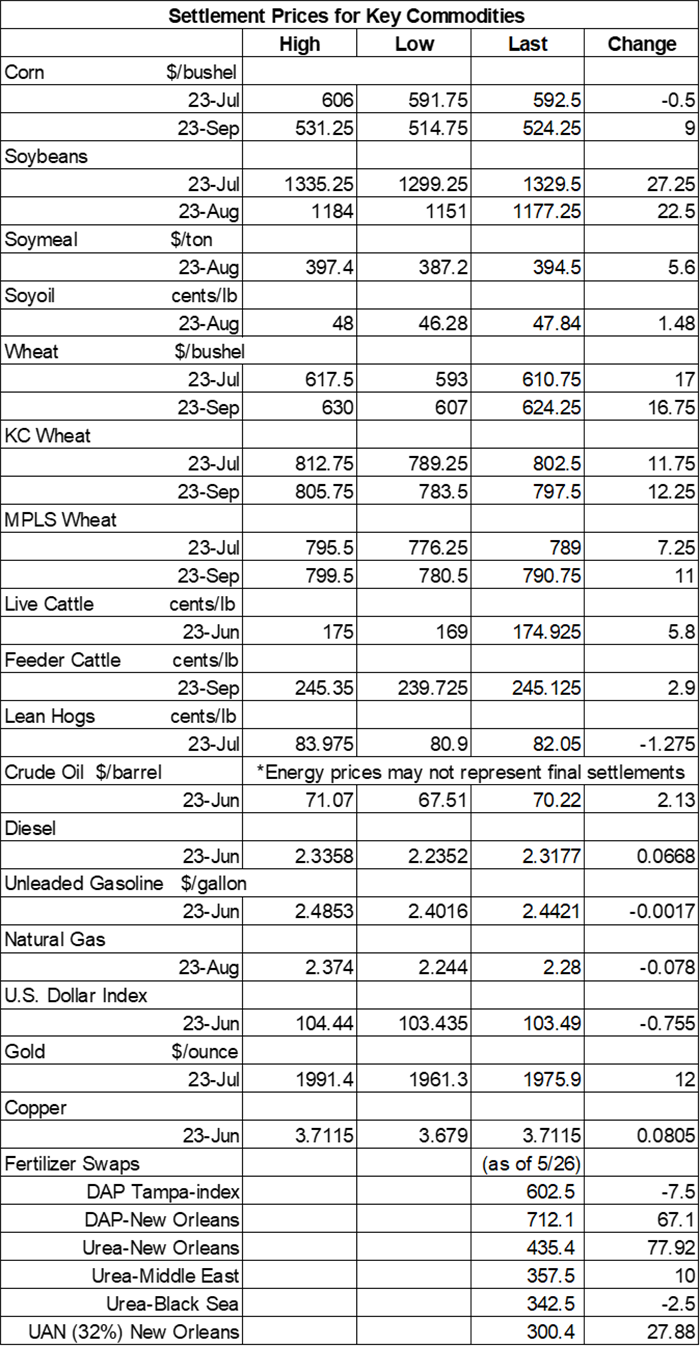

Afternoon report: Nearby corn contracts ease slightly, while September futures jump 1.75% higher.

Grain prices grabbed solid gains on Thursday as traders digested the latest weather forecasts, which show plenty of more dry weather may be in store this month after moving past historically low rainfall for some parts of the Corn Belt in May. Optimism over debt ceiling negotiations added to today’s bullish sentiment. CBOT wheat futures found the biggest boost, moving 2.75% higher. Corn and soybeans were also firm following a round of technical buying for both commodities.

Plenty of rain is expected to fall on parts of the Southern Plains between Friday and Monday, but the Corn Belt is unlikely to see large amounts through the weekend and into early next week, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts some wetter weather reemerging in parts of the Plains and the Ohio River Valley between June 8 and June 14, with warmer-than-normal conditions returning to parts of the Northern Plains and upper Midwest.

On Wall St., the Dow firmed 199 points in afternoon trading to 33,108 after the U.S. House of Representatives passed a debt ceiling bill on Wednesday evening. That bill now goes to the Senate for approval. Energy futures were also in the green today, with crude oil boosting nearly 3% higher this afternoon to $70 per barrel. Diesel rose 2.75%, while gasoline was near-even. The U.S. Dollar softened moderately.

On Wednesday, commodity funds were net sellers of corn (-3,000), soybeans (-3,500) and CBOT wheat (-1,000) contracts. Funds were roughly net even when trading soymeal and soyoil contracts yesterday.

Corn

Corn prices were mixed after July futures eased slightly lower and September futures jumped 1.75% higher. If weather remains dry in June, that may be enough to keep feeding the bulls in coming sessions. Traders also await the next round of export sales data from USDA, out tomorrow morning. July futures eased half a penny lower to $5.9350, while September futures rose 9 cents to $5.2525.

Corn basis bids were steady to mixed on Thursday after rising 5 to 8 cents higher at two Midwestern ethanol plants while sinking 5 to 10 cents lower at three other central U.S. locations today.

Ethanol production for the week ending May 26 improved to 1.004 million barrels per day per the latest data from the U.S. Energy Information Administration, out Thursday morning. It was also the first time since mid-April that the daily average surpassed the 1-million-barrel benchmark. Ethanol stocks firmed 1% last week.

Prior to Friday morning’s export report from USDA, analysts expect the agency to show corn sales ranging between net reductions totaling 3.9 million bushels and net sales totaling 27.6 million bushels for the week ending May 25.

A critical deal between Russia and Ukraine that allows for safe passage of shipping vessels through the Black Sea recently received a 60-day extension. However, Ukrainian officials are accusing Russia of blocking registration of ships to all of its ports, adding that 50 vessels are awaiting inspections in Turkish territorial waters. Russia did not immediately respond to these complaints. Ukraine has exported more than 1 billion bushels of corn so far during the 2022/23 marketing year and is also one of the world’s top wheat exporters.

Hoping for a “weather market”? The eastern Corn Belt is coming off one of the driest Mays on record, notes Jim McCormick, hedging strategist with AgMarket.net. “Unlike last week, temperatures this week are expected to exceed normal, exasperating the dry situation and putting the crop under continued stress,” he says. “With trading funds carrying uncommon short fund positions this time of year, the lack of weather pattern change could lead to ‘a rush to the exits’ resulting in a short covering rally. The trade will watch to see if the pattern change comes to fruition over the next two weeks.” McCormick offers additional analysis in today’s Ag Marketing IQ blog – click here to learn more.

Preliminary volume estimates were for 315,652 contracts, which was slightly above Wednesday’s final count of 311,522.

Soybeans

Soybean prices found improvements of around 2% following a round of technical buying on Thursday. July futures climbed 27.25 cents to $13.27, with August futures up 23.25 cents to $12.41. The rest of the soy complex was also firm today. Soymeal futures rose 1.75%, while soyoil futures jumped more than 3.25% higher.

Soybean basis bids were largely steady across the central U.S. on Thursday but did tilt 5 cents higher at two Midwestern processors while sliding 2 cents lower at an Iowa river terminal today.

Ahead of the next USDA export report, out tomorrow morning and covering the week through May 25, analysts think the agency will show soybean sales ranging between net reductions of 3.7 million bushels and net exports of 27.6 million bushels. Analysts also anticipating soymeal sales ranging between 175,000 and 625,000 metric tons, plus up to 30,000 MT in soyoil sales.

It’s not unheard of, but Brazilian soybean sales to the United States are relatively rare. However, the U.S. did recently purchase 6.6 million bushels of the oilseed, which will ship out next week. The buyers include Perdue Farms and Archer-Daniels-Midland. “As recent soybean crush rates in the U.S. are at a record high, we look to several countries, primarily in South America, to fill the gap in what’s grown domestically.” According to president of Perdue AgriBusiness Scott Fredericksen.

Meantime, Agresource is projecting Brazil’s 2022/23 soybean production at 5.701 billion bushels – one of the more bullish estimates at this time. That would also easily be a new record production, if realized. Agresource is also anticipating that Brazil’s total corn production will reach 5.017 billion bushels this season.

Financial decisions often prove to be tough to make, admits Darren Frye, CEO of Water Street Solutions. “Whether that’s creating a financial plan for your operation, getting a marketing plan in place and making decisions about grain sales, or considering major asset purchases for the operation – these are often the types of decisions that can keep a farm leader up at night.” But Frye has three tips in particular that can help you make major decisions on your operation – click here to learn more.

Preliminary volume estimates were for 262,244 contracts, tracking slightly above Wednesday’s final count of 256,615.

Wheat

Wheat prices jumped higher after a wave of technical buying lifted some contracts as much as 2.75% on Thursday. September Chicago SRW futures rose 16.75 cents to $6.2475, September Kansas City HRW futures gained 12.25 cents to $7.9750, and September MGEX spring wheat futures added 11 cents to $7.9350.

Prior to Friday morning’s export report from USDA, analysts expect to see wheat sales ranging between 3.7 million and 20.2 million bushels for the week ending May 25.

Saudi Arabia issued an international tender to purchase 17.6 million bushels of hard milling wheat from optional origins that closes on Friday. The grain is for shipment starting in mid-September, depending on where it is sourced.

South Korea purchased 2.4 million bushels of animal feed wheat from optional origins in an international tender that closed earlier today. The grain is for arrival in mid-October.

About the Author(s)

You May Also Like