Crop quality downgrade props up corn prices

Afternoon report: Soybeans and CBOT wheat also slightly firm in Tuesday’s session.

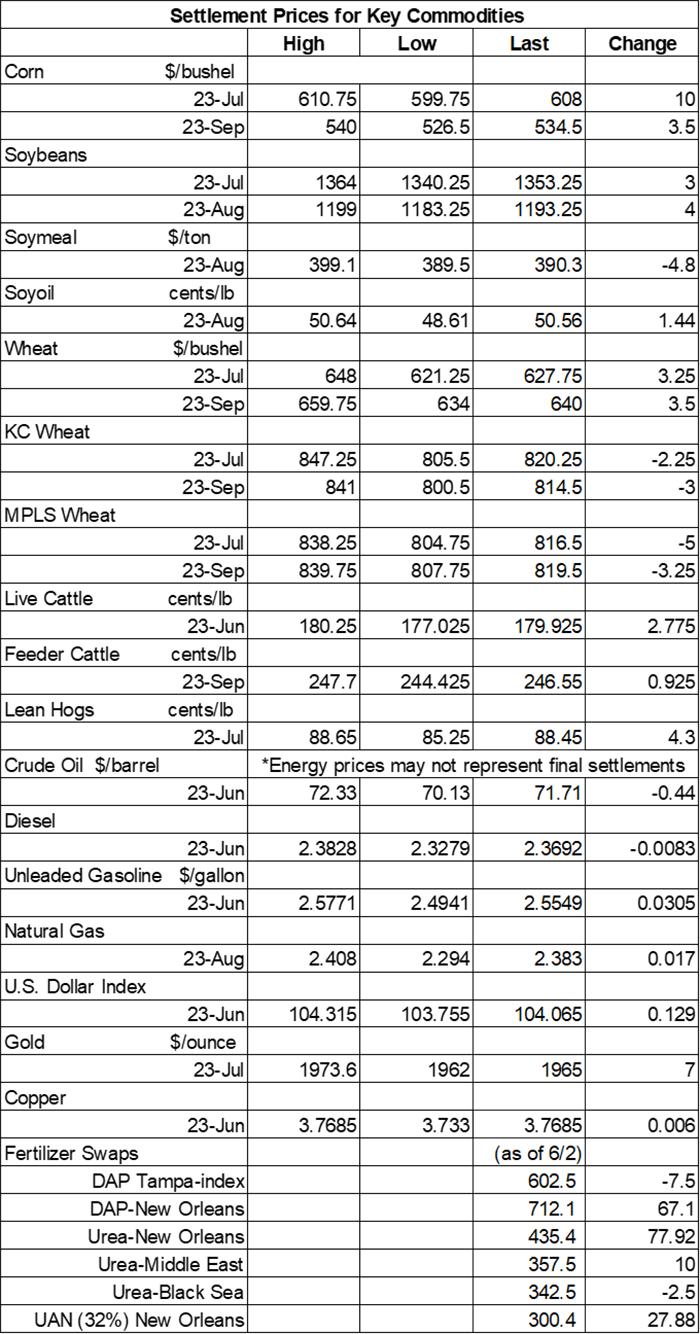

Grain prices were mixed on Tuesday. Corn prices saw the most upside after USDA cut quality ratings more than expected in yesterday’s crop progress report (more on that below). Soybean and CBOT wheat prices were also slightly firm in a somewhat choppy session today. Kansas City HRW and MGEX spring wheat prices failed to follow suit, however, incurring losses of 0.25% to 0.5% by the close.

Variable rains are coming to the central U.S. between Wednesday and Saturday, with most fields likely to get somewhere between trace amounts and 0.75” during this time, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts seasonally wet weather for some of the Plains between June 13 and June 19, with warmer-than-normal conditions likely for most of the central U.S.

On Wall St., the Dow eased 61 points lower in afternoon trading to 33,501 as investors appear to be holding out for the next Federal Reserve policy meeting before making any dramatic moves. Energy futures were mixed but mostly lower. Crude oil and diesel each faded around 0.5% lower, while gasoline climbed more than 1% higher this afternoon. The U.S. Dollar firmed moderately.

On Monday, commodity funds were net buyers of soymeal (+1,500) and CBOT wheat (+1,500) contracts but were net sellers of corn (-7,500), soybeans (-1,000) and soyoil (-1,000).

What motivates the funds to buy or sell commodities? “This year, the global perception is that grain supplies around the world may be building and demand slowing, therefore the funds have been sellers of grain commodities in recent weeks,” notes Naomi Blohm, senior market adviser with Stewart Peterson. “However, there may be a potential third influence in fund trading, and that is the trend of interest rates.” Blohm explores the topic in greater detail in yesterday’s Ag Marketing IQ blog – click here to learn more.

Corn

Corn prices found some forward momentum after USDA slashed quality ratings by five points, which triggered a round of technical buying on Tuesday. July futures rose 10 cents to $6.0750, while September futures added 3.5 cents to $5.3375.

Corn basis bids were steady to mixed across the central U.S. on Tuesday after trending as much as 5 cents higher at an Iowa processor and as much as 5 cents lower at an Illinois river terminal today.

Corn plantings moved from 92% complete a week ago up to 96% through Sunday. That puts this year’s pace three points ahead of 2022’s mark of 93% and five points ahead of the prior five-year average of 91%. And 85% of the crop is now emerged, up from 72% a week ago and favorable versus the prior five-year average of 77%. Quality ratings retreated significantly last week, spilling five points lower to 64% rated in good-to-excellent condition.

Per the latest data from the European Commission, out earlier today, EU corn exports during the 2022/23 marketing year are still trending 60% above last year’s pace after reaching 968.9 million bushels through June 4. Ukraine, Brazil, Canada, Serbia and Russia were the top five suppliers.

Ukraine’s total grain exports during the 2022/23 marketing year are approximately 3.4% below last year’s pace so far as the Russian invasion has continued in earnest since last February. Sales include corn exports totaling 1.067 billion bushels, plus another 573.2 million bushels of wheat exporters. Ukraine is among the world’s top exporters of both commodities.

Meantime, Russian forces damaged a dam in southern Ukraine that flooded numerous towns and nearby farmland. The reservoir holds more than 4.75 trillion gallons of water and is also a part of the Kakhovka hydroelectric power plant. Fighting between Russia and Ukraine has seemed to intensify in recent days.

Preliminary volume estimates were for 397,077 contracts, tracking moderately above Monday’s final count of 330,159.

Soybeans

Soybean prices made modest inroads as traders began squaring their positions ahead of the next WASDE report from USDA, out Friday morning. Rising corn prices lent some additional technical support. July futures added 3 cents to $13.53, with August futures up 4.25 cents to $12.6525.

The rest of the soy complex was mixed. Soymeal futures eroded nearly 1.25% lower today, while soyoil prices jumped 1.75% higher.

Soybean basis bids were steady to firm across the central U.S. after improving 2 cents at an Ohio elevator and 10 cents at an Illinois processor on Tuesday.

Private exporters announced to USDA the sale of 6.1 million bushels of soybeans for delivery to Spain during the 2022/23 marketing year, which began September 1.

Soybean plantings reached 91% completion through Sunday, up from 83% a week ago. That’s still significantly ahead of the prior five-year average of 76%. Emergence moved from 56% a week ago up to 74% as of Sunday – again, much faster than the prior five-year average of 56%. Quality ratings are off to a decent start, with 61% in good-to-excellent condition so far.

European Union soybean imports during the 2022/23 marketing year are down 11.5% from year-ago totals after reaching 442.0 million bushels through June 4. EU soymeal imports are also down year-over-year, with 14.64 million metric tons over the same period.

Iran issued an international tender to purchase 120,000 metric tons of soymeal, sourced from Brazil, that closes on Wednesday. The grain is for shipment in July and August.

Preliminary volume estimates were for 238,942 contracts, firming moderately above Monday’s final count of 177,243.

Wheat

Wheat prices were mixed but mostly lower following an uneven round of technical maneuvering on Tuesday. September Chicago SRW futures added 3.5 cents to $6.3975 while September Kansas City HRW futures dropped 3 cents to $8.1350 and September MGEX spring wheat futures fell 3.25 cents to $8.19.

Winter wheat quality ratings improved two points, matching analyst expectations. Through Sunday, 36% of the crop is in good-to-excellent condition. Another 30% is rated fair (down one point from last week), with the remaining 34% rated poor or very poor (down one point from last week). Physiologically, 82% of the crop is now headed, up from 72% last week and just ahead of the prior five-year average of 81%. Harvest is just getting started, with nationwide progress of 4%.

Spring wheat plantings moved from 85% a week ago to 93% as of June 4, matching the prior five-year average. Around three-fourths (76%) of the crop is now emerged, up from 57% a week ago and two points ahead of the prior five-year average. Nearly two-thirds (63%) of the crop is rated in good-to-excellent condition at this time.

European Union soft wheat exports during the 2022/23 marketing year are up 11% from year-ago totals after reaching 1.061 billion bushels through June 4. Morocco, Algeria, Nigeria, Egypt and Saudi Arabia were the top five destinations. EU barley exports are down 13% year-over-year, meantime, with 273.7 million bushels.

Japan issued a regular tender to purchase 3.2 million bushels of food-quality wheat from Australia and Canada that closes on Thursday. Nearly two-thirds of that total is expected to be sourced from Canada, with the remainder coming from Australia. It’s also worth noting that the United States is typically a top source of these regular tenders but is absent in this particular one. The grain is for shipment in August.

About the Author(s)

You May Also Like