Corn prices back off from multiweek highs

Afternoon report: Soybeans also in the red on Monday, while wheat posts moderate gains.

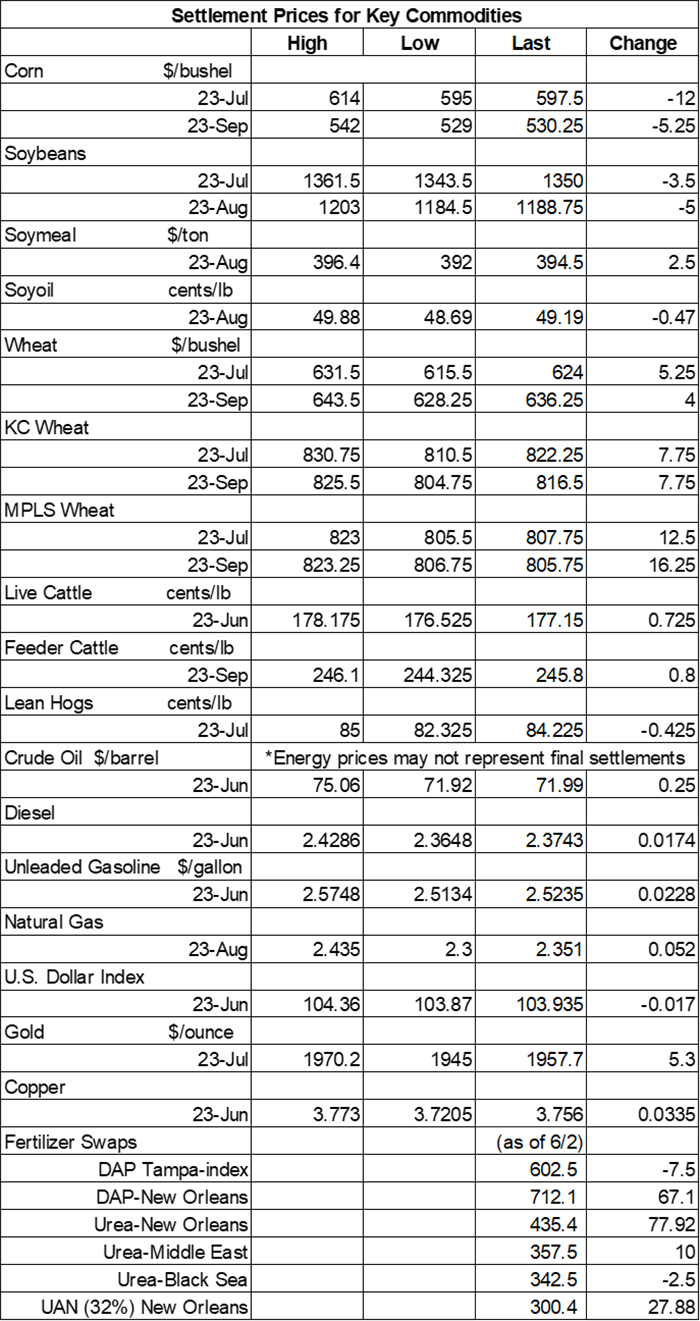

Grain prices were mixed on Monday as traders resumed a full week of trading following last week’s holiday-shortened efforts. Corn prices captured six-week highs late last week, inviting some traders to lock in profits today. Nearby contracts eroded nearly 2% lower as a result. Soybeans were also in the red, but losses were minimal. Wheat prices shifted higher, with some contracts up as much as 2% by the close.

Most of the Corn Belt will receive a bit of measurable moisture between Tuesday and Friday, per the latest 72-hour cumulative precipitation map from NOAA, but very few fields will see more than 0.25” during this time. Further out, NOAA’s new 8-to-14-day outlook predicts seasonally dry weather building across the upper Midwest between June 12 and June 18, with warmer-than-normal conditions also likely in that area next week.

On Wall St., the Dow dipped 150 points lower to 33,612, while the S&P made it to a nine-month high, anchored by gains in Apple, which is now sitting on an all-time high after it gave a sneak peek at its new virtual reality headset. Energy futures made modest inroads, with crude oil up 0.5% to $72 per barrel amid voluntary production cuts from Saudi Arabia. Diesel and gasoline each firmed around 0.75% higher this afternoon. The U.S. Dollar softened fractionally.

On Friday, commodity funds were net buyers of corn (+6,500), soybeans (+6,500), soyoil (+5,000) and CBOT wheat (+3,000) contracts but were net sellers of soymeal (-3,000).

What motivates the funds to buy or sell commodities? “This year, the global perception is that grain supplies around the world may be building and demand slowing, therefore the funds have been sellers of grain commodities in recent weeks,” notes Naomi Blohm, senior market adviser with Stewart Peterson. “However, there may be a potential third influence in fund trading, and that is the trend of interest rates.” Blohm explores the topic in greater detail in today’s Ag Marketing IQ blog – click here to learn more.

Corn

Corn prices tilted 1% to 2% lower following a round of technical selling and profit-taking on Monday. July futures dropped 12 cents to $5.97, with September futures down 5.25 cents to $5.3025.

Corn basis bids were mostly steady to soft after dropping 2 to 10 cents across five Midwestern locations on Monday. An Illinois river terminal bucked the overall trend after firming 8 cents today.

Corn export inspections were down from the prior week’s tally after coming in at 46.5 million bushels. That was still toward the higher end of trade estimates, which ranged between 31.5 million and 55.1 million bushels. China was the No. 1 destination, with 15.8 million bushels. Cumulative totals for the 2022/23 marketing year remain significantly below last year’s pace, with 1.177 billion bushels.

Analysts expect corn plantings to be virtually complete when the agency releases its next crop progress later today, moving from 92% a week ago up to 97% through Sunday. Quality ratings are expected to decline two points, with 67% in good-to-excellent condition over the same period.

Are you the employer of choice in your community? Farmers share eight tips that can help you attract and keep talent on your operation – click here to learn more.

Preliminary volume estimates were for 330,159 contracts, tracking moderately lower than Friday’s final count of 396,732.

Soybeans

Soybean prices pushed though a choppy session on Monday, incurring modest losses along the way. July futures dropped 3.5 cents to $13.49, with August futures down 2.75 cents to $12.5975.

The rest of the soy complex was mixed. Soymeal prices trended 0.75% higher, while soyoil prices faded nearly 1% lower.

Soybean basis bids held steady across the central U.S. on Monday.

Soybean export inspections were lackluster, sliding to 7.9 million bushels last week. That was on the lower end of trade estimates, which ranged between 5.5 million and 14.7 million bushels. Germany was the No. 1 destination, with 2.5 million bushels. Cumulative totals for the 2022/23 marketing year are still running slightly below last year’s pace, with 1.788 billion bushels.

Prior to the next USDA crop progress report, analysts think the agency will show soybean plantings move from 83% completion a week ago up to 92% through June 4. Quality ratings will make their debut in today’s report, and analysts expect to see 65% of the crop in good-to-excellent condition through Sunday.

Preliminary volume estimates were for 177,243 contracts, moving moderately below Friday’s final count of 227,826.

Wheat

Wheat prices moved moderately higher after a round of technical buying on Monday amid some growing concerns about production potential in drought stressed parts of Europe and the Black Sea region. September Chicago SRW futures added 4 cents to $6.3625, September Kansas City HRW futures gained 7.75 cents to $8.15, and September MGEX spring wheat futures rose 16.25 cents to $8.22.

Wheat export inspections were pedestrian after only reaching 10.7 million bushels last week. That was also toward the lower end of trade estimates, which ranged between 7.3 million and 16.5 million bushels. Mexico was the No. 1 destination, with 3.2 million bushels. USDA has now begun tracking data for the 2023/24 marketing year, which began June 1, noting sales of 2.1 million bushels so far.

Ahead of the next crop progress report from USDA, out Monday afternoon, analysts think the 2022/23 winter wheat crop will see slightly improved quality ratings, with 35% of the crop in good-to-excellent condition through June 4. USDA should also release its initial spring wheat quality ratings in today’s report, and analysts offered an average estimate of 66% rated in good-to-excellent condition. However, individual trade guesses varied widely, ranging between 57% and 77%.

Russian consultancy Sovecon estimates that the country’s wheat exports reached 150.6 million bushels in May. That’s a month-over-month decline of 4.7%, if realized. Russia is the world’s No. 1 wheat exporter. Sovecon is expecting a modest increase of total wheat exports for the upcoming 2023/24 marketing year, with an estimate of 1.679 billion bushels.

Saudi Arabia purchased 22.9 million bushels of wheat from optional origins in an international tender that recently closed. Most of the grain is expected to be sourced from the Black Sea region. The grain is for shipment in September and October.

About the Author(s)

You May Also Like