Corn flirts with two-month high on dry extended forecast

Afternoon report: Soybeans close at a one-month high. Dry weather in Europe sends Chicago wheat prices up 5%.

Feedback from the Field! Want to share your fieldwork insights with Farm Futures’ Feedback from the Field series? Just click this link to take the survey and share updates about your farm’s spring progress. I review and upload results daily to the FFTF Google MyMap, so farmers can see others’ responses from across the country – or even across the county!

Corn

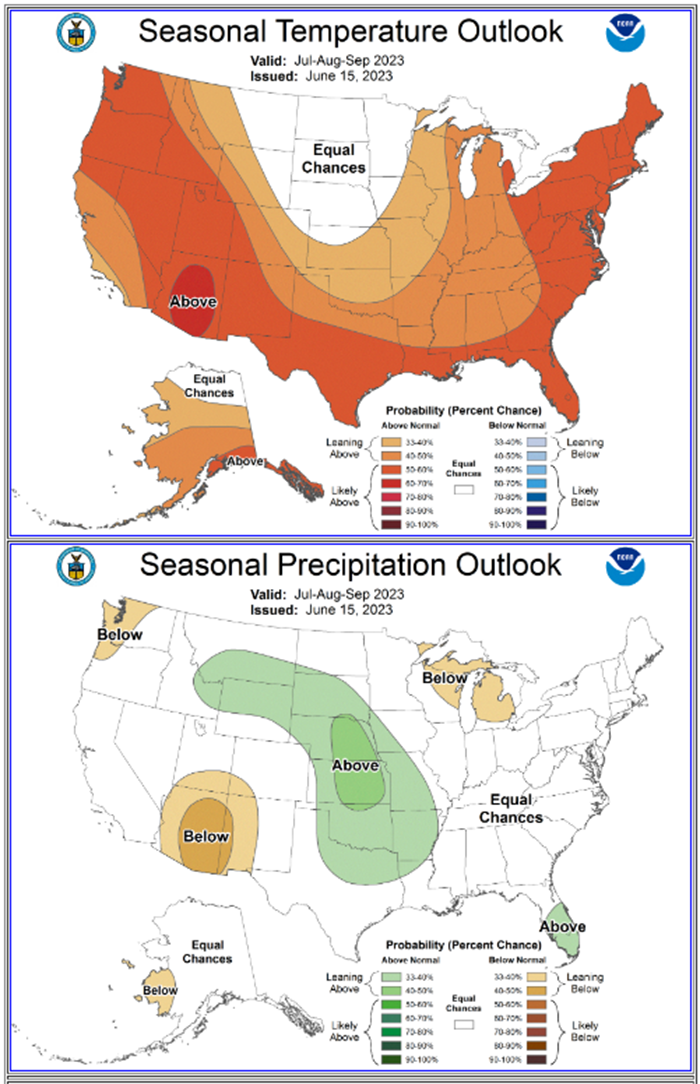

The U.S. Climate Prediction Center updated its three-month outlook today and the results sent corn and soybean futures prices rallying during today’s trading session. Corn prices soared 4% higher – a $0.13-$0.24/bushel daily increase – as the extended forecasts are trending warmer and dryer as the peak pollination period approaches for developing corn crops.

Despite dry weather over the past month or so in the Corn Belt, this outlook is likely the most significant drought news that the corn and soybean markets have seen so far this year because it is so close to the time in the respective crop’s development in which the plants need the most water, nutrition, and moderate growing conditions to produce their kernels and pods.

The good news is that an above-average chance for moisture continues to settle over the Plains over the next few, which have been battered by severe drought conditions over the past several years. But with persistent heat plaguing most of the Upper Midwest, Eastern Corn Belt, and Southern Plains during the peak summer months, crops across the Heartland could face significant struggles to reach yield potential without more moderate temperatures and an abundance of moisture.

Nearby July 2023 corn prices closed at the highest price in almost two months following the weather update, with the contract resting comfortably above the $6/bushel benchmark. Rallying energy markets also provided a boost to corn and soybean rallies today. A weaker dollar added for a trifecta of compounded market factors that kept the bulls running for corn and soybeans in today’s trading session.

"It's all weather. The extended maps keep going drier and drier, every time they come out. A good chunk of the Corn Belt is going to be dry," Sherman Newlin, an analyst with Risk Management Commodities, told Reuters earlier today.

Soybeans

Soybean futures surged $0.34-$0.58/bushel higher on the weather worries, weaker dollar, and higher energy prices today. But the soy complex also gleaned strength from the National Oilseed Processors Association (NOPA)’s monthly report, which showed May 2023 crush volumes for the organization topping 177.9 million bushels.

It marked the highest monthly crush volume for the month of May and marked the fifth consecutive time in 2023 that new monthly highs have been achieved for NOPA’s soy crush volume estimates. Meanwhile, soyoil futures surged a staggering 5% higher as domestic supplies tightened more than the trade was expecting going into this morning’s report.

Wheat

Wheat prices followed the rally in the corn market today, with the weaker dollar and worries about Black Sea supply availability and persistent dryness in Spain and Northern Europe renewing supply availability concerns for the global wheat market. U.S. wheat prices closed today’s trading session $0.23-$0.33/bushel higher on the overarching sentiments.

Jan Dieleman, president of Cargill's ocean transportation business, told Reuters that the original Black Sea Grains Initiative is no longer moving the grain volumes it was originally designed to facilitate. Russia continues to slow shipments out of Ukraine to a trickle, while many international companies continue to reduce their activity at ports in Russia amid Western banking sanctions.

"The corridor is definitely not performing as it was at the beginning," Dieleman said. "It’s more focused on the smaller (ship) sizes now ... I do think that with some quite big crops in Brazil, you might also see some of the demand being switched out of the Black Sea into Brazil at some point, on corn, for instance."

This creates opportunities for South America to step in and absorb some of the shipping volumes being forsaken in the Black Sea. The likelihood of this only increases as Moscow continues to issue threats that Russia will pull out of the BSGI.

"The grain market is not the same as it was a year ago,” cautioned Dieleman.

Weather

Spotty showers will provide the Northwestern Plains, Michigan, and the Mississippi Delta with some well-received moisture this morning, according to NOAA’s short-term forecasts. Those showers will intensify by this afternoon/evening, with more rain expected for the entire Western Plains and the Eastern Corn Belt by tonight.

Accumulation could be substantial for all regions mentioned above over the next 24 hours. Central North Dakota could see up to two inches during that time. Southwest Kansas and Oklahoma could receive up to 1.5 inches during the next 24 hours. And parched soils in Michigan (as well as dry soft red winter wheat areas of Ontario) are likely to see up to an inch of accumulation in the next day.

Looking into the end of next week, NOAA’s 6-10-day forecast is still predicting persistent across the Heartland, with below normal temps expected on the East Coast and west of the Rocky Mountains. Dry skies will remain situated over the Great Lakes and Southern Border during that time, while the Pacific Northwest, the entire Plains region, and Southeast could see above average chances for showers.

The heat will persist across Middle America and into the Pacific Northwest through next weekend, according to NOAA’s 8-14-day outlook. Chances for excess showers in the Upper Plains and Upper Midwest will decrease slightly at that time, with dryness easing and moisture chances returning to normal levels in the Great Lakes region.

The reality of the forecasts is this: over the next couple weeks, there are some decent chances dry fields in the Corn Belt will see some meaningful accumulation. But rising temperatures in the extended forecasts could suck out ground moisture and inflict further stress on young crops.

Yield potentials are likely already facing a minor setback due to the current weather conditions in Corn Country, but we aren’t looking at a complete shortfall – yet. If rains this week and over the next don’t recharge soil moisture levels, next week’s heat waves in the Plains and Midwest could trigger moderate price climbs in the futures markets.

Financials

Yesterday, the Federal Reserve announced at the conclusion of its two-day June Federal Open Market Committee (FOMC) meeting that it would leave interest rates unchanged at the 5% to 5.25% level as it reevaluates the economic climate under the current rate levels.

But as inflation rates remain persistently above the Fed’s target rate of 2%, the Fed also announced that another rate hike of 0.5% would likely be in order by the end of 2023. That value was higher than the market had been expecting.

The Fed also projected in its FOMC meeting that by the end of 2024, it expects rates to be set at a 4.5% to 4.75% range. This means that it will not likely lower interest rates anytime soon and that these high rates may stick around for longer than most investors – and farmers – had previously hoped.

“When the Fed has raised rates in the past, it has often hiked them to the point where the job market cracks, plunging the economy into a recession that leads the central bank to quickly reverse course and cut rates sharply,” explains Justin Lahart in this brilliant Wall Street Journal article.

“But although the job market has loosened a bit, it still looks quite healthy, with unemployment low and plenty of job vacancies waiting to be filled,” Lahart continues. “As long as that is true, even if inflation cooled substantially, policy makers wouldn’t see much point in cutting [rates].”

Wall Street futures wobbled violently on the news yesterday, though recovered following Chairman Jerome Powell’s comments to end the day mostly flat. The announcement creates a little more uncertainty in the Fed’s ultimate direction as it pauses for a breather following 15 months of consecutive rate hikes.

But ultimately, Wall Street would not be happy with high interest rates for an extended period of time, as it would limit the inflow of new capital into the market. For farmers, that means that operating capital and the cost of new equipment and land purchases will remain persistently high over at least the next year and a half, which could slow down the dizzying paces at which we’ve seen land prices rise over the past several years.

This will be especially true if the early drought in the Midwest lifts and farmers are able to produce the record-breaking corn and soybean crops projected by USDA this year. That would result in lower commodity prices earned by farmers. The higher interest rate costs would inevitably tighten on-farm profit margins and limit the available capital farmers would need to aggressively pursue new land acquisitions.

Here’s what else I’m reading this morning on FarmFutures.com:

Advance Trading’s Brian Basting has helpful tips for farmers to strengthen their marketing plans in advance of any further drought-driven market volatility.

My latest E-corn-omics column dives into wheat’s yield woes in the U.S. this summer.

Is the current Midwest drought worse than 2012? Bryce Knorr’s history lesson proves that a dry start to June doesn’t guarantee summer corn rallies.

Our team’s coverage of last Friday’s June 2023 WASDE report!

Drought or no drought for corn? Naomi Blohm reminds farmers it doesn’t matter – either way, you still need to be managing risk in these corn markets.

Mike Downey’s latest More than Dirt column explains how a recent Iowa land ownership survey contains valuable takeaways for landowner-tenant relationships.

About the Author(s)

You May Also Like