Brazil’s emergence as top competitor rooted in currency depreciation

Brazilian ag production and exports could grow even faster under accelerated currency depreciation in coming years.

Extended periods of currency depreciation, low energy costs and interest rates, rising demand for biofuel feedstocks and macroeconomic fluctuations have aided Brazil’s emergence as a top competitor with the U.S. in global agricultural markets, according to a U.S. Department of Agriculture report. Brazil is now the world’s third-largest exporter of agricultural products, after the European Union and the U.S.

The report authors noted that Brazilian value-added agricultural has grown an average of 3.4% annually over the past two decades, with agricultural output doubling and livestock production increasing. At the same time, Brazil emerged as an important exporter to international grain, oilseed and meat export markets and a competitor of the U.S.

“Brazil’s agricultural exports, including processed products, have grown 12% per year since 2000 and account for 37% of Brazil’s total exports. Consequently, Brazil is now the world’s largest global exporter of soybeans, poultry meat, beef, coffee, sugar and orange juice and is the world’s third-largest exporter of agricultural products, behind the European Union and the United States,” the report said.

Currency devaluation, in particular, has played an important role in its position, the report suggested, explaining, “Because exported Brazilian commodities are priced in dollars, depreciation of Brazil’s local currency, the real (BRL), has meant that Brazilian farmers have received more BRL for each dollar of export revenues.”

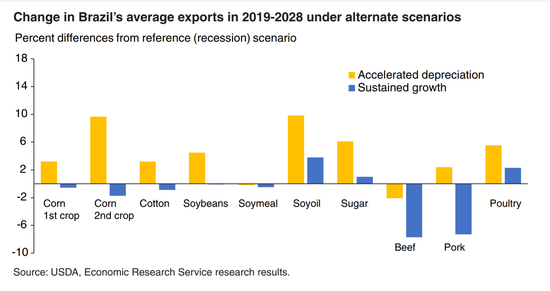

As such, export sales have become more profitable, encouraging expansion of cropland and adoption of techniques to increase productivity. USDA said Brazilian agricultural production and exports, which are poised to continue flourishing over the next decade, could grow even faster under accelerated currency depreciation.

USDA simulations show that if the BRL weakens more than previously expected, exports of major commodities could be an aggregate 5.6% greater than previously projected, with Brazil’s exports increasing for each major commodity except beef and soybean meal.

About the Author(s)

You May Also Like