Black Sea peril keeps wheat rally thriving

Afternoon report: Corn also jumps higher in Wednesday’s session; soybeans close with mixed results

July 19, 2023

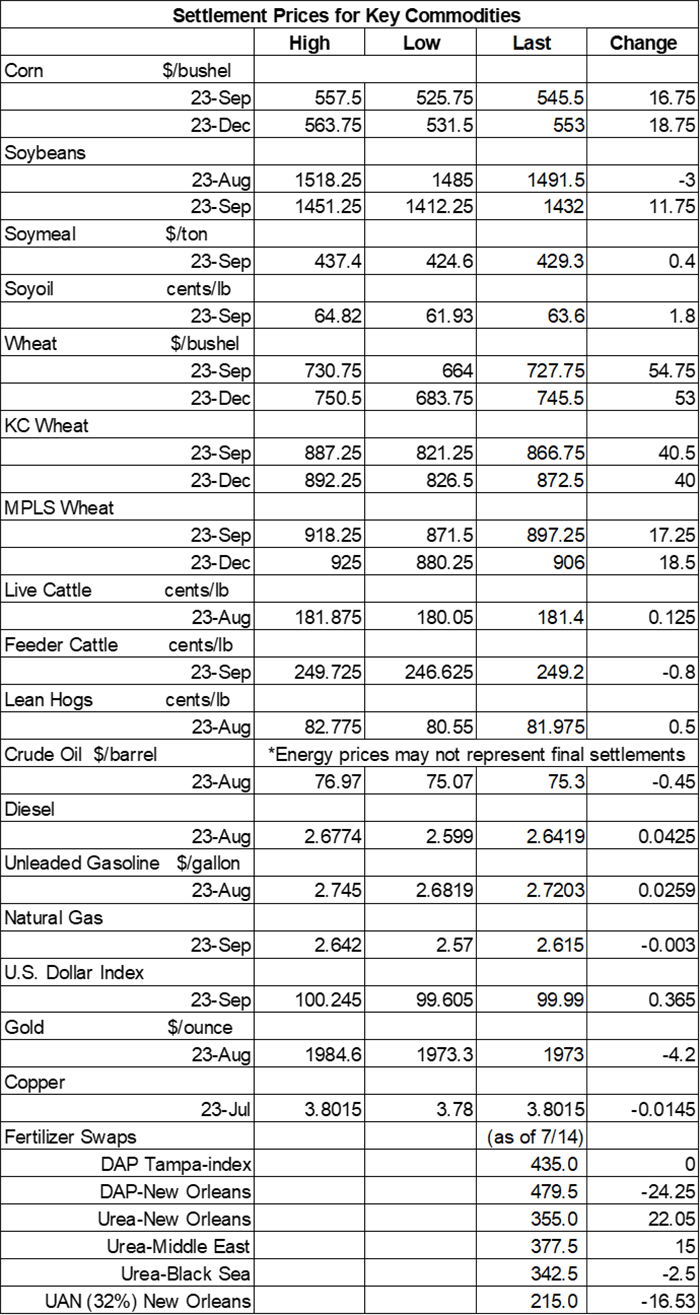

Grain prices continued to push higher on Wednesday after Russia not only let a Black Sea shipping deal expire, they are also actively attacking Ukrainian ports (more on this below). The geopolitical uncertainty in that region led to another round of technical buying that substantially benefited corn and wheat prices. Soybean gains were more muted – August futures eased slightly lower, while September futures trended around 0.75% higher.

The Northern Plains are unlikely to gather any more rain for the rest of the week, while most of the Corn Belt should receive at least some measurable moisture between Thursday and Sunday, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts a return to seasonally wet conditions for the Great Lakes region, while nearly all of the U.S. should experience warmer-than-normal conditions between July 26 and August 1.

On Wall St., the Dow added another 119 points in afternoon trading to 35,071 following another solid round of corporate earnings reports. That’s also the first time since early 2022 that the Dow has crested above 35,000 points. Energy futures were mixed but mostly firm. Crude oil faded 0.7% lower, staying just above $75 per barrel. Diesel trended more than 1.5% higher, with gasoline up around 1%. The U.S. Dollar firmed moderately.

On Tuesday, commodity funds were net buyers of corn (+20,000), soybeans (+9,500), soymeal (+4,000) and CBOT wheat (+5,500) contracts but were net sellers of soyoil (-3,500).

Corn

Corn prices waded through a choppy session on Wednesday but ultimately closed with solid gains of more than 3%. September futures rose 16.75 cents to $5.4550, with December futures up 18.75 cents to $5.5325.

Corn basis bids were steady to mixed across the central U.S. after trending as much as 7 cents higher at an Ohio elevator and as much as 10 cents lower at a Nebraska processor on Wednesday.

Ethanol production found moderate increases for the week ending July 14 after reaching a new daily average of 1.070 million barrels, per the latest data from the U.S. Energy Information Administration. That’s also the best weekly total since early December 2022. Ethanol stocks increased by 2% last week.

Ahead of Thursday morning’s export report from USDA, analysts expect to see combined old and new crop corn sales ranging between 9.8 million and 39.4 million bushels for the week ending July 13.

Grain traveling the nation’s railways totaled another 16,032 carloads last week. That brings cumulative totals for 2023 to 529,654 carloads, a year-over-year decline of 10.7%.

Did you know that wildfire smoke can have some interesting side effects – some negative, and some positive – on corn production? Purdue Extension corn specialist Dan Quinn offered an in-depth look in a recent article for Indiana Prairie Farmer – click here to learn more.

Brazil’s Anec estimates that the country’s corn exports will reach 267.7 million bushels in July, which would be a year-over-year increase of nearly 21%, if realized.

Algeria is thought to have purchased up to 3.1 million bushels of animal feed corn, likely sourced from Argentina or Brazil, in an international tender that closed earlier today. The grain is for shipment starting later this month.

Preliminary volume estimates were for 625,547 contracts, trending well above Tuesday’s final count of 420,125.

Soybeans

Soybean prices attempted to follow other grains higher on Wednesday with mixed results thanks to some uneven technical maneuvering. August futures dropped 3 cents to $14.89, while September futures rose 11.75 cents to $14.3050.

The rest of the soy complex was firm. Soymeal futures picked up modest gains of around 0.25%, while soyoil prices jumped 3% higher.

Soybean basis bids were steady to weak after eroding 5 to 30 cents lower across eight Midwestern locations on Wednesday.

Prior to tomorrow morning’s export report from USDA, analysts think the agency will show soybean sales ranging between 5.5 million and 36.7 million bushels for the week ending July 13. Analysts also expect to see soymeal sales ranging between 125,000 and 500,000 metric tons last week, plus up to 20,000 MT of soyoil sales.

Brazil’s Anec estimates that the country’s soybean exports will reach 323.3 million bushels in July, which would be a monthly increase of nearly 26%, if realized. Anec also expects to see Brazilian soymeal exports reach 2.584 million metric tons this month.

Meantime, Brazilian farmers could plant 109.9 million acres of soybeans in the 2023/24 season, according to the Patria Agronegocios consultancy. That would be an increase of around 0.5% above the prior season’s plantings. The group’s initial production estimate is for 5.725 billion bushels, a yearly increase of around 1.6%.

Can your marketing plan withstand wild weather markets? That’s a question that Luke Williams, ag risk management adviser with Advance Trading, has found himself asking. “In my opinion, managing through a summer weather market is the toughest thing to do the entire year,” he says. “There are so many emotions that get in the way of making good business decisions. You need tools that are flexible and protect – not predict.” Williams serves up a fresh round of advice in today’s Ag Marketing IQ blog – click here to learn more.

Preliminary volume estimates were for 251,944 contracts, moving modestly ahead of Tuesday’s final count of 232,731.

Wheat

Wheat prices captured sizeable gains as the fate of Black Sea exports are as much in doubt right now as perhaps they ever have been. September Chicago SRW futures climbed 54.75 cents to $7.2550, September Kansas City HRW futures rose 40.5 cents to $8.6775, and September MGEX spring wheat futures gained 17.25 cents to $8.9475.

Ahead of Thursday morning’s export report from USDA, analysts expect to see wheat sales ranging between 7.3 million and 18.4 million bushels for the week ending July 13.

Starting tomorrow morning, Russia’s Defense Ministry says it will consider any shipping vessels in the Black Sea heading to Ukrainian ports as possibly carrying military cargo. As such, the Kremlin is warning that portions of the Black Sea’s international waters are now unsafe for navigation. Ukraine typically sends the majority of its grain exports through that corridor.

Meantime, a fresh Russian attack in the southern Ukrainian city of Chornomorsk has damaged port infrastructure and potentially destroyed thousands of tons of grains stored there, according to Ukraine’s agriculture minister, Mykola Solsky, who said the air strike was deliberately aimed at the city’s grain terminal. “This is a terrorist act not against Ukraine, but against the entire world,” Solsky said. “The world's food security is once again in danger.”

Preliminary volume estimates were for 254,125 CBOT contracts, which more than doubled Tuesday’s final count of 87,721.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)