Better weather weakens wheat prices

Afternoon report: Soybeans stand firm on Monday, while corn closes with mixed results.

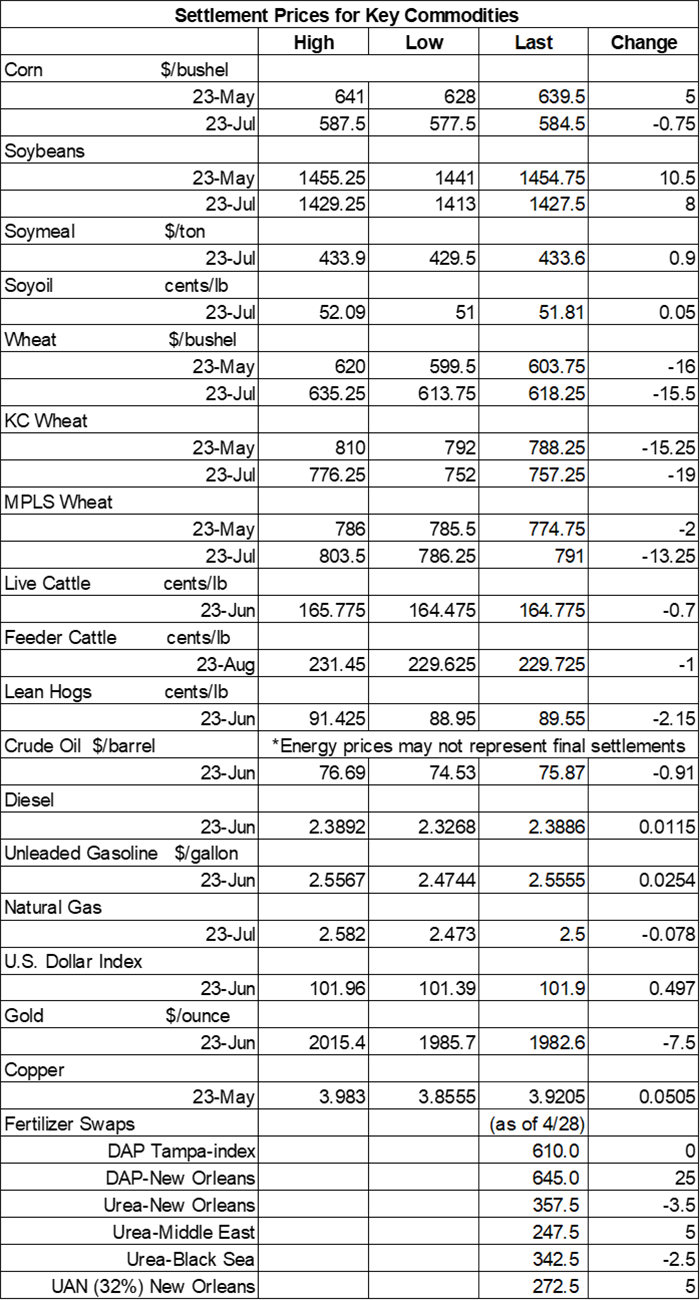

Grain prices were mixed but mostly lower to start the week. Soybeans sat on the positive end of the ledger, moving more than 0.5% higher following some short covering today. Wheat prices were unable to follow suit, suffering a technical blowback that pushed some contracts as much as 2.5% lower. Corn prices were narrowly mixed.

A large portion of the Corn Belt will remain completely dry between Tuesday and Friday, although some areas will receive 0.25” or more during this time, per the latest 72-hour cumulative precipitation map from NOAA. Further out, NOAA’s 8-to-14-day outlook hints that seasonally wet weather could return to the Plains between May 8 and May 14, with warmer-than-normal temperatures likely for most of the central U.S. next week.

On Wall St., the Dow eased slightly lower, shedding 30 points in afternoon trading to 34,067 as investors absorbed the news of the First Republic bank takeover by JPMorgan Chase over the weekend. Energy futures were mixed. Crude oil shifted 1.5% lower to $75 per barrel, with diesel up 0.25% and gasoline trending more than 0.75% higher. The U.S. Dollar firmed moderately.

On Friday, commodity funds were net buyers of all major contracts, including corn (+1,000), soybeans (+5,500), soymeal (+3,000), soyoil (+3,500) and CBOT wheat (+2,000).

Corn

Corn prices were narrowly mixed amid some uneven technical maneuvering as traders mostly brushed off a better-than-expected round of export inspection data from USDA on Monday. May futures added 5 cents to $6.41, while July futures eased 0.75 cents lower to $5.8425.

Corn basis bids were mostly steady to firm on Monday after rising 3 to 5 cents higher across four Midwestern locations. An Indiana ethanol plant bucked the overall trend after fading 5 cents lower today.

Corn export inspections improved 62% from the prior week’s tally, reaching 59.8 million bushels in the week ending April 27. That was above the entire range of trade estimates, which came in between 27.6 million and 53.1 million bushels. Japan was the No. 1 destination, with 21.0 million bushels. Cumulative totals for the 2022/23 marketing year are still trending well below last year’s pace, however, with 941.0 million bushels.

Ahead of USDA’s next crop progress report, out Monday afternoon and covering the week through April 30, analysts are expecting corn plantings to jump from 14% a week ago up to 27% through Sunday. Individual trade guesses ranged between 22% and 35%.

As planters continue to roll across Midwestern fields in earnest this week, Farm Futures grain market analyst Jacqueline Holland is bringing back the farmer-led series Feedback from the Field for our readers. Just click this link to take the survey and share updates about your farm’s spring progress. Holland reviews submissions and uploads daily to the interactive FFTF Google MyMap. Weekly recaps of responses will be compiled in a regular column each Tuesday throughout the 2023 season.

Ukraine’s total grain exports during the 2022/23 marketing year are down around 9.4% from year-ago totals as the country continues to struggle with logistical challenges surrounding the ongoing Russian invasion. That includes corn sales totaling 960.6 million bushels, plus another 529.1 million bushels in wheat sales. Ukraine is among the world’s top exporters of both commodities.

Large speculators increased their net short position in corn by another 71,000 contracts to 89,330 for the week ending April 25.

Preliminary volume estimates were for 283,767 contracts, sliding 31% below Friday’s final count of 413,159.

Soybeans

Soybean prices shifted moderately higher as traders engaged in some short covering opportunities on Monday. Planting progress kept prices from moving even higher, however. May futures rose 10.5 cents to $14.5475, with July futures up 8 cents to $14.2725.

The rest of the soy complex captured modest gains – July soymeal futures added 0.2%, while July soyoil futures picked up 0.1% gains.

Soybean basis bids were mostly steady across the central U.S. on Monday but did trend 8 cents higher at an Illinois river terminal today.

Soybean export inspections slightly firmed above last week’s total after reaching 14.8 million bushels. That was near the middle of analyst estimates, which ranged between 7.3 million and 25.7 million bushels. China topped all destinations, with 7.2 million bushels. Cumulative totals for the 2022/23 marketing year are still tracking slightly ahead of last year’s pace, with 1.744 billion bushels.

Prior to this afternoon’s crop progress report from USDA, analysts expect soybean plantings to move from 9% a week ago to 17% through Sunday. Individual trade guesses ranged between 15% and 22%.

The European Union doesn’t produce a substantial amount of soybeans, but consultancy Strategie Grains is estimating that 2023/24 EU production will rise 27.1% higher year-over-year to 116.8 million bushels. EU sunflower production is expected to rise 22.4% this season, with EU canola production likely to increase 3.1% above last season’s total.

Large speculators trimmed their net short position for soybeans by 52,373 contracts to 58,883 for the week ending April 25.

Preliminary volume estimates were for 122,551 contracts, which was moderately below Friday’s final count of 215,044.

Wheat

Wheat prices made solid inroads last Friday but were unable to enjoy a repeat performance today, with traders falling back into a pattern of technical selling. July Chicago SRW futures fell 15.5 cents to $6.1825, July Kansas City HRW futures lost 19 cents to $7.5725, and July MGEX spring wheat futures dropped 13.25 cents to $7.9050.

Wheat export inspections made it to 13.2 million bushels last week, which was slightly lower than the prior week’s tally of 13.4 million bushels. That was also toward the higher end of trade estimates, which came in between 7.3 million and 14.7 million bushels. Egypt was the No. 1 destination, with 2.0 million bushels. Cumulative totals for the 2022/23 marketing year are slightly below last year’s pace so far, with 670.5 million bushels.

Ahead of this afternoon’s crop progress report from USDA, analysts expect to see winter wheat quality ratings improve two points from last week, with 28% of the crop in good-to-excellent condition through April 30. Individual trade guesses ranged between 25% and 31%. For spring wheat, analysts think planting progress will move from 5% a week ago up to 14% through Sunday.

Large speculators increased their net short position for wheat by 10,940 contracts to 100,362 for the week ending April 25.

Preliminary volume estimates were for 92,291 CBOT contracts, easing slightly below Friday’s final count of 93,864.

About the Author(s)

You May Also Like