Bearish sentiment tightens its grip

Afternoon report: Corn, soybeans and wheat all extend losses on Thursday.

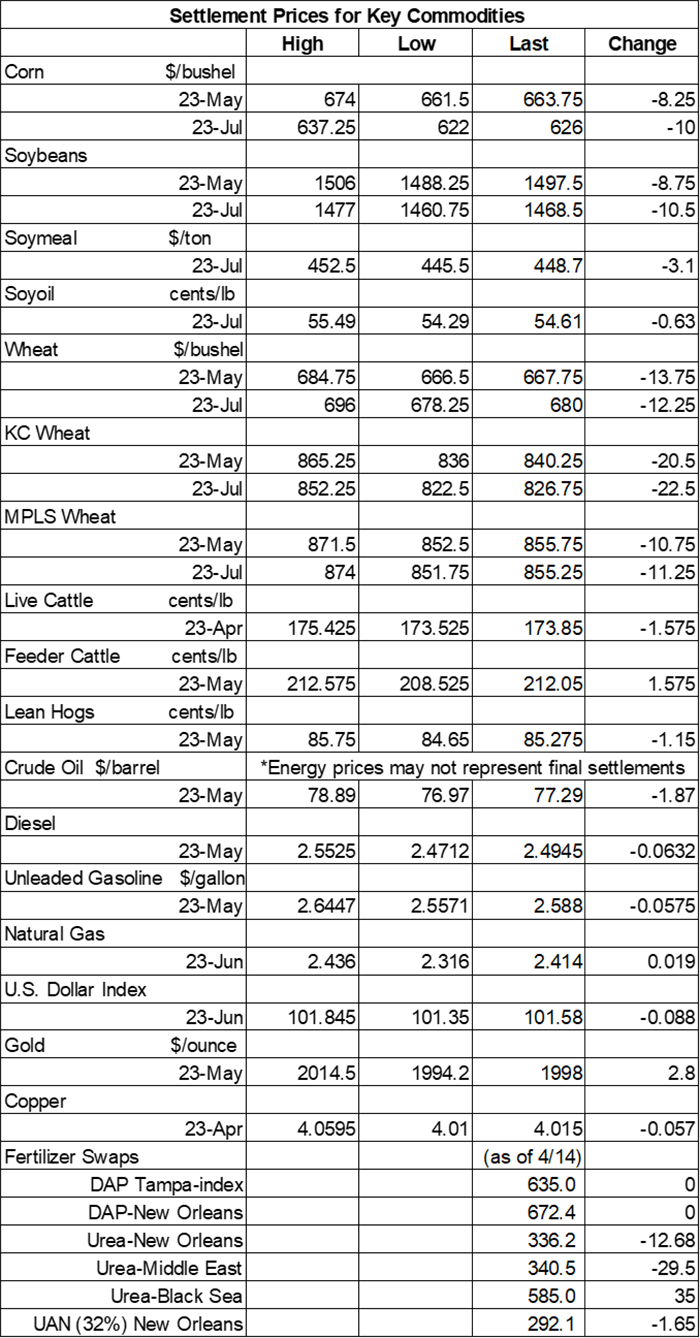

The broad selloff that plagued grain prices on Wednesday continued in earnest today after most contracts finished Thursday’s session with double-digit losses following ample technical selling. Corn prices were down around 1.25%, while soybeans drifted more than 0.5% lower. Wheat losses were much steeper, with some contracts down more than 2.5%.

Rainy weather is still moving eastbound, with the Ohio River Valley now expecting to see the highest totals between Friday and Monday, per the latest 72-hour cumulative precipitation map from NOAA. Further out, the agency’s 8-to-14-day outlook predicts seasonally dry weather developing across much of the western Corn Belt between April 27 and May 3, with widespread colder-than-normal temperatures likely for the Midwest and Plains.

On Wall St., the Dow shifted 74 points lower in afternoon trading to 33,822 following a mixed bag of corporate earnings reports. Tesla grabbed some headlines today after lower-than-expected sales led to 10% losses. Energy futures faced significant cuts again today. Crude oil was down almost 2.5% this afternoon to $77 per barrel, extending losses incurred earlier in the week. Diesel and gasoline each eroded around 2.25% lower. The U.S. Dollar softened slightly.

On Wednesday, commodity funds were net sellers of all major grain contracts, including corn (-4,500), soybeans (-3,500), soymeal (-2,500), soyoil (-1,000) and CBOT wheat (-5,500).

Corn

Corn prices continues to face seasonal bearish planting pressure along with expectations for a record-breaking corn crop in Brazil, which generated plenty of technical selling on Thursday. May futures fell 8.25 cents to $6.64, with July futures down 10 cents to $6.2650.

Corn basis bids tumbled as much as 25 cents lower at an Iowa processor and softened 2 to 3 cents at two other Midwestern locations on Thursday.

Corn exports were lackluster in the week ending April 13, per the latest data from USDA on Thursday morning. Combined old and new crop sales only reached 28.9 million bushels, with old crop sales trailing the prior four-week average by 79%. Total sales were on the very low end of trade estimates, which ranged between 28.0 million and 49.2 million bushels. Cumulative totals for the 2022/23 marketing year are still well below last year’s pace so far, reaching 889.5 million bushels.

Corn export shipments tracked 42% above the prior four-week average, meantime, with 51.1 million bushels. Mexico, Japan, Colombia, Peru and China were the top five destinations.

In recent travels, Bill Biedermann, hedging strategist with AgMarket.net, has seen planted fields stretching from Tennessee all the way up to I-80 in Illinois. “It wasn’t every county, but it was more than I expected to see. I can’t say with accuracy what percent, but if I go by the fields I counted it would be a strong 20-25% compared with a more normal 10% in Illinois and 25% in Kentucky for this time of year.” Figuring out where total acres will land over the next few weeks could be the top component to setting the tone of the market for the rest of the marketing-year, he adds. Click here for additional analysis.

Meantime, if you’re still holding onto some old crop corn and are looking for some sales strategies, Naomi Blohm, senior market adviser with Stewart Peterson, has some advice. “If you have old crop corn and are looking to sell, you will notice that the May 2023 futures contract price is inverted over the July 2023 futures contract by approximately 35 cents,” she offers for starters. “The market is saying it wants your corn now.” Blohm takes a closer look at what happened the last time we saw inverted markets in today’s Ag Marketing IQ blog – click here to learn more.

The EPA reported today that the United States generated 1.22 billion ethanol blending credits in March, which was slightly above February’s tally of 1.13 billion. The U.S. generated an additional 619 million biodiesel blending credits last month, which was moderately above February’s tally of 514 million.

Importers in the Philippines purchased almost 2.0 million bushels of feed corn, likely sourced from South America, in an international tender that recently closed. The grain is for shipment in July.

Preliminary volume estimates were for 365,600 contracts, moving moderately above Wednesday’s final count of 307,179.

Soybeans

Soybean prices followed a broad set of other commodities lower on Thursday, closing more than 0.5% lower. May futures dropped 8.75 cents to $14.9775, with July futures down 10.5 cents to $14.6825.

The rest of the soy complex also faced significant reductions today. Soymeal futures also fell more than 0.5%, while soyoil lost almost 1.25%.

Soybean basis bids were steady to mixed across the central U.S. after dropping 3 cents at an Ohio elevator while firming 5 to 8 cents at two other Midwestern locations on Thursday.

Soybean exports only gathered 3.8 million bushels in combined old and new crop sales last week. Old crop sales slumped 58% below the prior four-week average. Total sales were below the entire set of trade guesses, which ranged between 9.2 million and 22.0 million bushels. Cumulative totals for the 2022/23 marketing year are still slightly above last year’s pace so far, with 1.702 billion bushels.

Soybean export shipments faded 20% below the prior four-week average to 21.4 million bushels. China, the Netherlands, Mexico, Canada and Indonesia were the top five destinations.

China’s soybean production jumped around 24% higher in 2022, reaching 745.9 million bushels. However, 2023 is not expected to see a large repeat increase, according to Pan Wenbo, director general with the country’s agriculture ministry. “Frankly speaking, due to the low soybean market price and low comparative benefit, the enthusiasm and willingness of farmers to plant soybeans has declined compared with this time last year,” he said in a recent press briefing. China is by far the world’s No. 1 soybean importer.

Preliminary volume estimates were for 262,914 contracts, which was modestly above Wednesday’s final count of 245,290.

Wheat

Wheat prices were hammered again by a round of technical selling on Thursday after some rains landed on the U.S. Plains earlier this week and as shipping vessels continue to move through the Black Sea. May Chicago SRW futures fell 13.75 cents to $6.68, May Kansas City HRW futures lost 20.5 cents to $8.4125, and May MGEX spring wheat futures dropped 10.75 cents to $8.5625.

Wheat exports found another 11.2 million bushels in combined sales last week, with old crop sales jumping 93% above the prior four-week average. That was a bit towards the higher end of trade estimates, which ranged between zero and 17.5 million bushels. Cumulative sales for the 2022/23 marketing year are slightly behind last year’s pace so far, with 583.9 million bushels.

Wheat export shipments slid 29% below the prior four-week average to 7.5 million bushels. Mexico, Thailand, Panama, Nigeria and Colombia were the top five destinations.

As expected, Japan purchased 2.4 million bushels from the United States and Australia in a regular tender that closed earlier today. Of the total, 53% was sourced from the U.S. The grain is for shipment in June.

The Philippines purchased 2.2 million bushels of animal feed wheat, likely sourced from Australia, in an international tender that recently closed. That grain is for shipment in July.

About the Author(s)

You May Also Like