Ag outlook shows demand for meat remains strong

Outlook for livestock and dairy is for another year of record total meat and dairy production.

Demand for meat is quite strong, and even with strong production and supplies, that is likely to continue, according to Shayle Shagam, livestock analyst at the U.S. Department of Agriculture and the World Agricultural Outlook Board.

Shagam, speaking at USDA’s annual Agricultural Outlook Forum on Feb. 22, said unemployment is projected to continue to decline, and consumer prices are expected to increase less rapidly than in 2018. Both of these factors tend to be support for meat demand.

“We like meat; we’ve always seemed to have a soft spot for beef,” Shagam said. “Even though exports are taking up an increased proportion of production, the U.S. consumer remains willing to pay for meat.”

He said the economic growth tends to support consumption of meat both at home and away from home. Real U.S. gross domestic product (GDP) is expected to grow by more than 2% in 2019, somewhat lower than last year’s growth.

USDA chief economist Robert Johansson projected that with low and stable feed costs over the past few years and projected going forward, the outlook is for another year of record total meat and dairy production.

Total red met and poultry production in 2018 increased for the fourth consecutive year, growing just over 2% to a record 102.4 billion lb. In 2019, red meat and poultry production is forecasted to increase about 2% to reach a further record 104.7 billion lb. Production records are expected for beef, pork and broilers, based on USDA's projections.

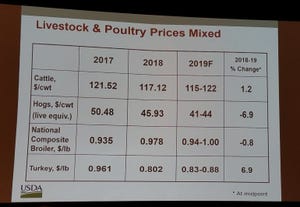

The large production levels weighed on prices during 2018, Shagam said. Prices for cattle, hogs and turkey were lower, but demand strength in the first half of the year supported broiler prices. Broiler prices did, however, come under pressure later in the year. For 2019, prices for cattle and turkey are expected to rise, but hog and broiler prices are expected to be lower.

The five-area steer price for 2019 is expected to average $115-122/cwt., up slightly from the 2018 average of $117, Shagam reported. “Despite increased production, beef demand is expected to remain strong, and the willingness of feedlot operators to hold cattle in feedlots longer may help support prices during much of the year,” he added.

Cow/calf operators and backgrounders will likely see lower prices during 2019 based on a combination of higher feed prices, expected large supplies of cattle in feedlots and adequate supplies of calves available for placement. Feeder steer prices in 2019 are forecasted to average $141-148/cwt., compared to $147 in 2018.

“Hog prices saw marked volatility in 2018, falling by over 20% from highs following the tariff retaliation and stronger supply and then some signs of recovery amid [African swine fever] outbreaks and uncertain prospects for China demand,” Johansson explained.

Commercial pork production for 2019 is expected to be a record 27.34 billion lb., 4% higher than in 2018. Although the increase will be primarily driven by higher slaughter hog numbers, carcass weights are forecasted to increase slightly in 2019. Despite facing record-high slaughter numbers, especially in the fourth quarter, recent expansion of slaughter capacity should be able to absorb the expected availability of slaughter hogs. U.S. hog prices (national base, 51-52% lean, live equivalent) are projected to average $41-44/cwt. for 2019, down from $46 last year, USDA reported.

In the face of relatively weak margins expected during 2019, the broiler sector is likely to remain cautious in flock expansion plans in the coming months. However, slaughter capacity is expected to expand in the later part of 2019, which will support demand for broilers.

Shagam said egg prices are more stable but will remain below 2018, more in the range of $1.22-1.29/doz. Following the big jump in prices after highly pathogenic avian influenza hit in 2015 and the volatility in recent years, eggs are returning to “more normal seasonal price patterns,” he said.

Exports

Exports for 2019 are expected to increase for all major commodities, although pork export growth is likely to be dampened by ongoing trade disputes.

Shagam said pork exports saw growth through November, but there was a shift in the buyers. He explained that prices helped push product to markets, even though exports to China and Hong Kong have been down since midyear 2018, when tariffs took effect. Meanwhile, pork exports to South Korea are up nearly 40%.

Beef exports in 2018 are expected to have increased about 11%, as U.S. beef prices remained competitive and global demand was firm. U.S. exports in 2019 will face the prospects of higher prices, but recent drought and flooding events in Australia may limit competing supplies. Beef exports for 2019 are expected to be 3.26 billion lb., just over 2% higher than 2018.

U.S. broiler meat exports for 2019 are projected to increase to 7.15 billion lb., up 1% from 2018 but still below the 2013 record level of 7.35 billion lb. “Competitive prices or export products in a number of price-sensitive markets will help support sales. Supplies of leg quarters, which supply a large share of U.S. exports, are expected to be ample with increased U.S. broiler production, and leg quarter prices thus far in 2019 remain below 2018,” Shagam said.

About the Author(s)

You May Also Like