Retail pork prices may be contributing to weaker carcass value

Lower cutout value in April may be reflecting slowdown in wholesale demand for pork.

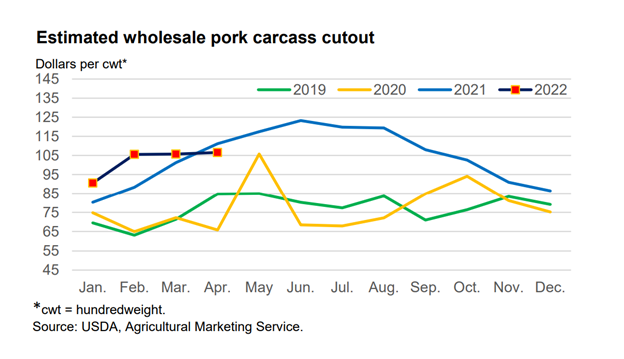

The wholesale value of the pork carcass in April 2022 fell below its year-earlier value for the first time since December 2020, according to the USDA’s latest “Livestock, Dairy and Poultry Outlook.” The cutout averaged $106.56/cwt. last month, compared with $111.17/cwt. a year earlier, a 4.1% decline from its year-earlier value.

The year-over-year difference between the two values—$4.60/cwt.—is disaggregated between component primals using the USDA Agricultural Marketing Service’s (AMS) cutout weighting yields for the composite cutout in the figure below. Positive contributions from butts (61 cents/cwt.) and loins ($1.00/cwt.) are more than offset by value subtractions by picnics (down $1.08/cwt.), ribs (down $1.27/cwt.), hams (down $2.35/cwt.), bellies (down 98 cents/cwt.), and other (down 53 cents/cwt.).

USDA economist Mildred Haley said it is possible that the year-over-year lower cutout value in April is reflecting a slowdown in wholesale demand for pork as retail consumers begin to back away from high-priced retail pork cuts.

“Through 2021 and into 2022, retailers appeared to be able to pass through higher costs of labor, energy and transportation to consumers,” she said. “It could be that as consumers’ household budgets continue to be squeezed by higher living costs—gasoline and food in particular—a smaller share of consumers’ food budget is allocated to animal proteins.”

Within that smaller budget allocation, Haley said consumers may reduce pork volumes purchased, substitute lower-priced meats as prices continue to increase, or some combination of the two. “Such consumer decisions would tend to weaken wholesale pork demand and contribute to lower cutout values,” she explained.

Additionally, persistent year-over-year higher retail prices for bacon, hams, ribs, and picnics may reduce consumer retail demand for those cuts, leading to weaker wholesale pork demand, Haley said.

About the Author(s)

You May Also Like