LIVESTOCK MARKETS: USDA forecasts 2.3% growth in 2018 beef production

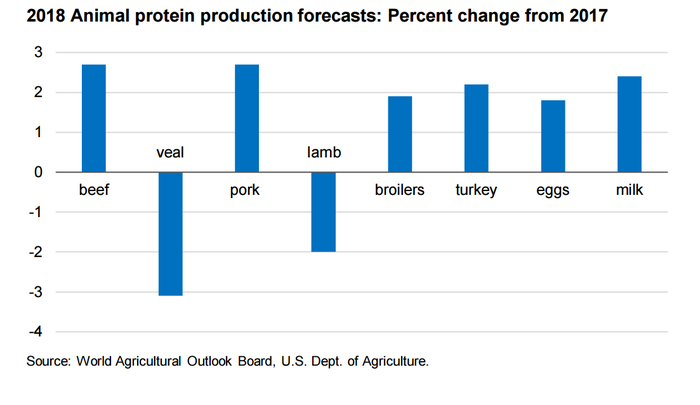

Forecasts for 2018 animal protein production show across-the-board increases.

The U.S. Department of Agriculture forecasts for animal protein production in 2018 show across-the-board increases, with the exception of veal and lamb, according to the latest “Livestock, Dairy & Poultry Outlook.” Total red meat production in 2018 is forecasted to be 54 billion lb., 2.8% more than expected this year. Total poultry production is expected to increase to 49 billion lb., or 1.9% above the 2017 forecast. Total egg production is expected to increase by 1.8% and milk production by 2.4% (Figure).

USDA is forecasting 2.3% growth in U.S. beef production in 2018, based on larger 2016 — and expected 2017 — calf crops that are projected to support increases in cattle placements in late 2017 and early 2018.

Marketings of fed cattle are expected to be higher during 2018, supporting higher slaughter during the year, while carcass weights are also expected to increase, USDA said.

In the current year, USDA reported that commercial beef production during the first quarter of 2017 climbed to 6.3 billion lb., up 6% from the same period in 2016. According to the report, meat packers achieved three consecutive months of year-over-year increases in production, and the increase is reflected in the harvesting of 526,600 more cattle than in 2016.

Despite the increase, USDA said production was restricted by a 10 lb. drop in the average dressed weight as fed cattle were marketed at lighter weights and the slaughter mix contained proportionally more heifers and cows.

“Although the magnitude of the year-over-year decline in weights is expected to moderate during the year, the average carcass weight for the year is expected to be below earlier levels,” the report authors noted. The lower projected carcass weights resulted in USDA reducing the full-year total beef production forecast to 26.3 billion lb.

Cattle prices climb as packers increase slaughter

Fed steer prices showed atypical strength during April and into May, USDA said. The demand for market-ready cattle boosted the five-area direct steer price in April to $131.31/cwt., above the first-quarter estimate of $122.96/cwt., while the second-quarter price is projected to be $127-133/cwt., reflecting strong prices through early May.

“Expectations are that prices will remain relatively strong, despite declining from recent peaks, as packers maintain relatively high rates of cattle slaughter to mitigate the effects of lower carcass weights,” USDA noted.

Feeder steer prices have benefited nicely from increased fed cattle prices, averaging $139.27/cwt. in April. USDA said improved returns for feedlot operators have helped stimulate demand for calves.

“Currently, feedlots have seen returns strengthen on the higher fed cattle prices and relatively cheap feeders purchased two quarters earlier. However, feedlot operators could face declining returns if fed cattle prices decline with increased supplies of cattle in the second half of the year.”

If declining fed cattle prices squeeze feeders’ margins, USDA said feedlot operators may opt to keep cattle on feed longer in an attempt to push bids higher, the result of which would be an increase in average dressed weights.

Looking ahead, USDA forecasts increased marketings in 2018, which are expected to pressure fed cattle prices. The five-area direct price is forecasted to average $116-124/cwt. in the first quarter of 2018 and $113-123/cwt. for the year.

Choice/Select spread widening

University of Wisconsin-River Falls agricultural economist Brenda Boetel recently noted that the Choice/Select spread has widened during the last few weeks. Although this is happening slightly earlier than typical, she said the widening is a seasonally expected occurrence.

“This widening of the Choice/Select spread provides incentives for increased production of Choice beef as compared to Select beef,” she explained.

Over a 12-month period of time, Boetel said the Choice/Select spread is typically narrowest in the January-to-March time frame as the demand for Choice grade middle meats is at its lowest and the supply of Choice grade cattle is typically at its highest. In contrast, the summer months bring an increase in demand for Choice grade middle meats as retailers fill shelves in anticipation of the grilling season, but the supply of Choice cattle is lower as more calf-fed cattle are being harvested, she said.

“What makes the widening of the Choice/Select spread this year interesting is the slightly early occurrence. However, the early widening can still be explained through supply and demand,” Boetel said.

On the supply side, she said the industry is extremely current, and the average weekly year- to-date dressed weights for steers in 2017 is down 17 lb. compared to last year. “Beef production, however, is up almost 4% due to increased slaughter," she noted. "Year to date, the percentage of cattle grading choice is up 2%, but this percentage is starting to slip, and in the last month, the year-over-year weekly increase in percentage is only up 1%.”

On the demand side, Boetel said demand is strong, and retailers are struggling to procure enough product for summer sales. Additionally, demand for Choice-quality beef will increase relative to Select-quality beef in the summer, she said.

“Putting all this together tells us the total tonnage of both Choice and Select graded beef is up this year; and although Choice-quality tonnage is up by more than the Select-quality tonnage, the demand for Choice beef has increased by even more,” she added.

Boetel said one reason for the increased demand for Choice-quality beef is likely the overall decline in retail beef prices. On average, fresh retail beef prices have declined 5% over the same period in 2016.

“This overall decline in beef prices allows consumers to potentially switch from Select-quality beef to Choice-quality beef while not paying substantially more for a better product,” she explained.

Boetel said the Choice/Select spread will likely return to normal by middle to late June.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)